Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 16 Dec, 2022

Despite aggressive plans to deploy fiber to residential and commercial premises across the U.S., macroeconomic challenges such as inflation, supply chain and labor pressures have slowed buildouts this year and will remain headwinds for the top fiber operators through 2024.

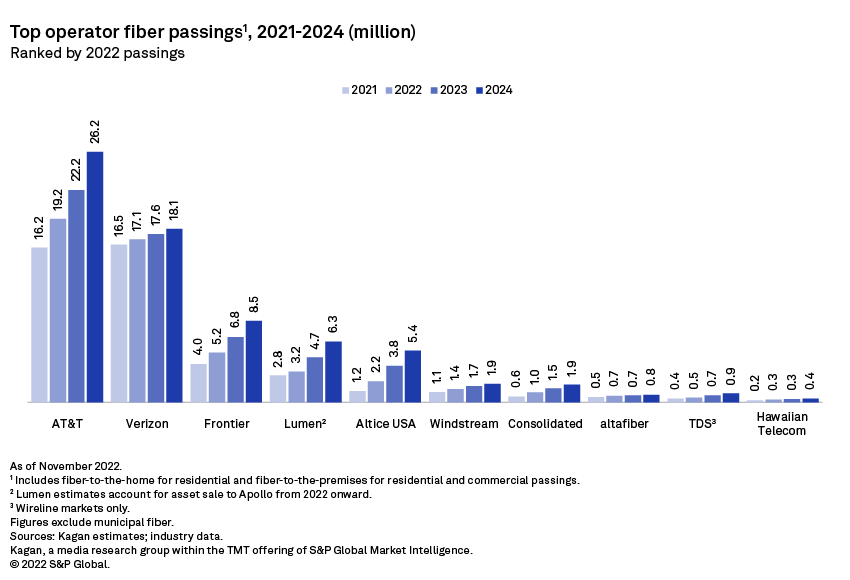

By the end of 2022, we anticipate that the top fiber operators will pass over 50 million homes and businesses with fiber. In that time, we estimate 7.2 million new locations will be passed with fiber, with AT&T Inc. (3 million) and Frontier Communications Parent Inc. (1.2 million) driving the bulk of additions. We estimate commercial and residential passings could grow to more than 70 million by 2024.

This analysis does not include cable conglomerates Comcast Corp. and Charter Communications Inc. but includes Altice USA Inc., which is focused on fiber expansions in some of its markets. While fiber lines make up a substantial portion of several cable operator networks' backbones, top MSOs are still largely banking on the launch of DOCSIS 4.0, which is expected to enable multi-gigabit symmetrical speeds.

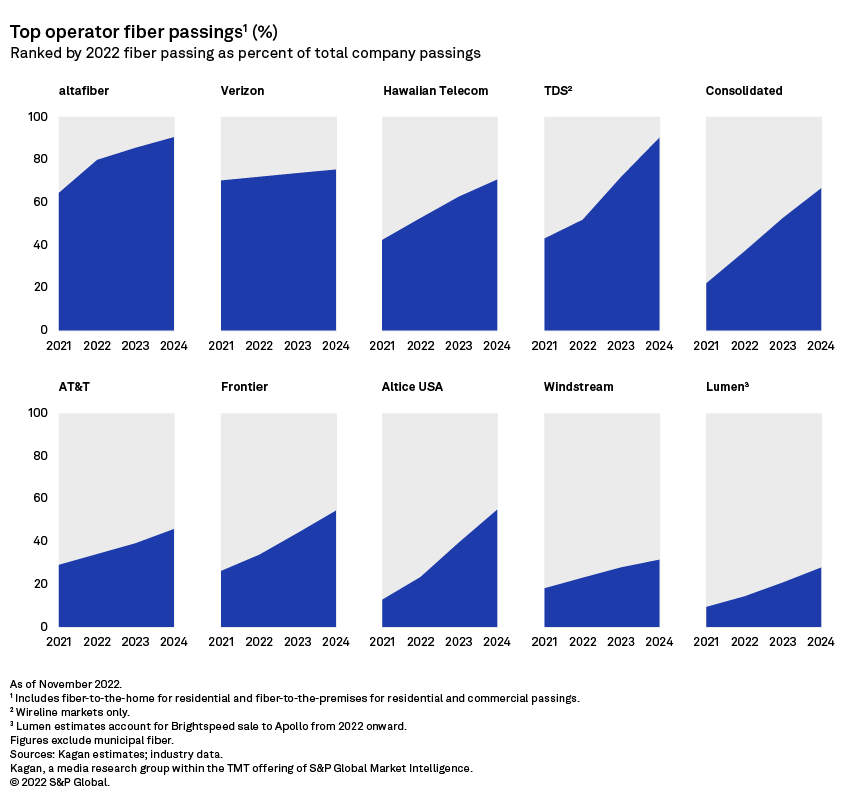

Fiber leader AT&T is estimated to make up 37% of the combined fiber footprint of the top operators in our list by 2024, followed by Verizon at 26% and Frontier at 12%.

As of its third-quarter earnings report, AT&T added nearly 2.3 million fiber locations to its footprint in 2022. Previously, CEO John Stankey confirmed that they had planned to build in the 3 million to 4 million range for the year, with a target of more than 30 million fiber passings by 2025. Fiber buildouts certainly help increase the chances of acquiring fiber subscribers, according to AT&T executives. Stankey also mentioned that he would rather acquire more subscribers to fiber than fixed wireless.

AT&T and Verizon are both careful about their fixed wireless expansions, especially compared to T-Mobile, which has a massive and relatively empty swath of mid-band spectrum to use for the service. Ultimately, mobile service uptime (and margins) is probably more important for AT&T and Verizon to defend compared to adding new fixed wireless customers which can impact mobile network quality.

Verizon Communications Inc., with its mostly fiber-covered wireline business, is estimated to be responsible for 34% of fiber homes passed by the end of 2022. The operator guided to 550,000 locations for 2022, with the next few years in the range of 500,000. Meanwhile, Frontier was the sole operator on our list to increase its guidance this year, from 1.1 million to 1.2 million fiber passings.

Blog

Blog