Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 12 Dec, 2022

By Erik Keith

Highlights

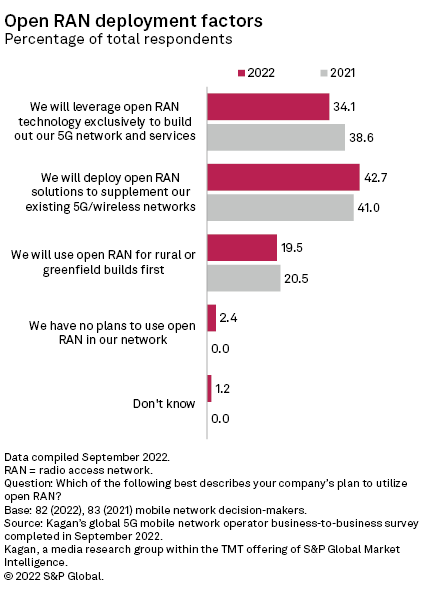

Mobile network operator interest in deploying open RAN technology has declined notably year over year, evidenced by a 5-percentage-point drop (from 39% to 34%) in respondents planning to leverage Open RAN exclusively for their 5G network deployments.

67% of survey respondents plan to leverage Open RAN technology in 2023 or after. This may reflect MNO experiences or perceptions that Open RAN cost savings and network efficiencies are slow to materialize.

Open radio access network, or open RAN, technology, which leverages cloud- and software-based solutions to enable 5G service deployment, is still viewed with some caution by wireless operators, according to Kagan's 2022 global survey of 82 mobile network decision-makers.

In fact, year over year, the number of respondents claiming they will use open RAN exclusively to build their 5G networks has dropped by 5 percentage points, from 39% in 2021 to 34% in 2022.

Respondents planning to deploy Open RAN technology to supplement existing 5G build-outs — as opposed to using it exclusively — grew slightly year over year, from 41% to 43%. Meanwhile, operators planning to use Open RAN for rural or greenfield 5G network and service implementations stayed roughly the same at 20%.

A small but notable change was also registered by the number of MNOs indicating they had no plans to utilize Open RAN technology in the 5G builds, at 2.4% (up from zero percent in 2021).

Open RAN defined

An extension of software-defined networking, or SDN, and virtualization technology, Open RAN technology provides operators with a more flexible path to 5G service implementations, by allowing mobile network operators to avoid being "locked in" or overly dependent on traditional RAN hardware vendors and systems. Open RAN systems are built on commercial-off-the-shelf, or COTS, hardware, leveraging Open interface standards.

Deployment timeline

Another notable change in MNO plans for 5G network deployment became apparent with the following question: When will your company leverage open RAN technology?

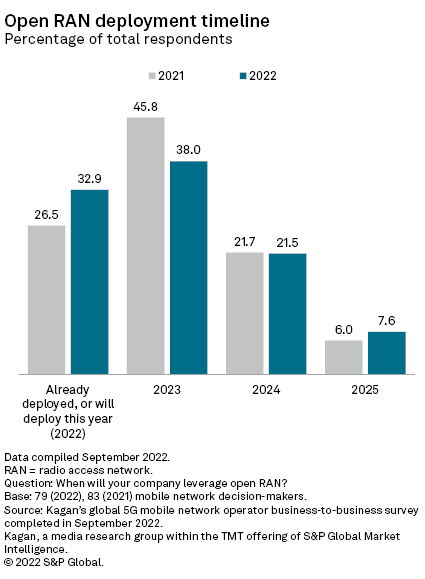

While the number of respondents that indicated they had already deployed open RAN — or planned to deploy the technology in 2022 — grew from 26.5% in 2021 to 33% in the recent survey, the remaining two-thirds of respondents indicated that open RAN technology would be pushed out by a year or two, compared to the responses from 2021. For example, in the 2021 survey, 46% of respondents claimed they would deploy open RAN in 2022, 22% in 2023 and the remaining 6% in 2024, at the latest.

The 2022 survey data shows MNO plans for open RAN-enabled 5G networks and services being moved out a year or more, with 38% claiming open RAN utilization in 2023 (up from 22%), 22% in 2024 (up from 6%) and 8% in 2025 (up from zero percent year over year).

In terms of sheer operator numbers, 68 of the 79 operators that indicated they will use open RAN technology also claimed they would do so in 2023 or later.

As such it appears that MNOs have decided to take a less aggressive, more cautious approach with open RAN technology. So, why the drop in operator enthusiasm for open RAN?

Virtualization: Not so fast?

The answer may be simply that operators of all types have decided to slow the pace of their investment in virtualization technology. While moving the "universe of functionalities" from traditional hardware-based systems to software- and cloud-based solutions can provide operators with an array of initial capital expenditure savings and operational efficiency gains, these savings and efficiencies may be less apparent as networks and subscriber bases are scaled to mass market implementations. Add in the cost of software licensing and upgrades and the proclaimed cost savings enabled by virtualized, software-based solutions effectively evaporate over time, vis-à-vis hardware-based solutions.

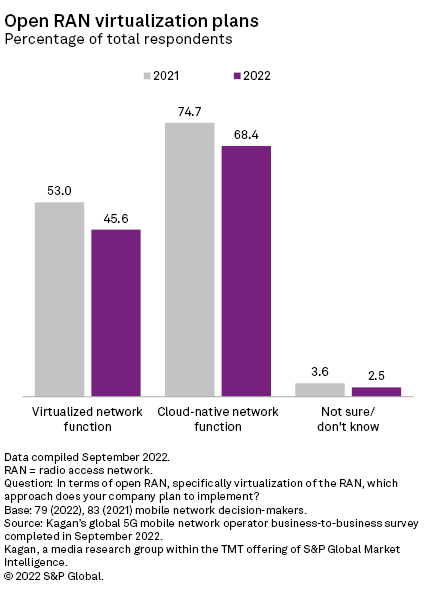

To this end, the percentage of respondents planning to leverage specific functionalities enabled by RAN virtualization showed a year-over-year decline. For example, 68% of 2022 survey respondents indicated they planned to utilize RAN virtualization to implement cloud-native network function(s) compared to 75% in 2021.

There was also a corresponding drop in the percentage of respondents that indicated plans for implementing virtualized network function(s) year over year, with 46% claiming they would leverage virtualized RAN technology to do so, another drop of 7 percentage points from the 2021 survey, where 53% planned to do so.

Vendor short lists

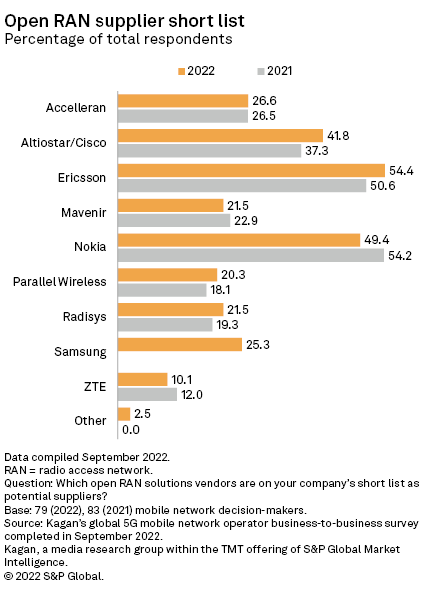

Respondents were also asked to provide insight into their potential choices for open RAN solutions suppliers. Once again, the top two vendors were Ericsson and Nokia, both of which were short-listed by about 50% of the respondents, followed by Altiostar/Cisco and Accelleran. For 2022, however, Samsung garnered 25% of the vote. This is not surprising given that Samsung has generated increasing traction worldwide with its virtualized RAN, or vRAN solution set, evidenced by its recently revealed partnership with semiconductor supplier Marvell Technology Inc. and pan-European MNO Vodafone Group PLC.

Vodafone launched the first open RAN sites in the U.K. back in January 2022, leveraging Samsung's vRAN solution set, and has also recently announced the launch of an open RAN commercial pilot in Germany, which is Vodafone's largest single market in Europe. The open RAN pilot in Germany uses both radio equipment and vRAN solutions from Samsung.

Data presented in this article is from Kagan's September 2022 business-to-business global 5G survey. A total of 82 carrier decision-makers that are well versed in 5G deployment plans were queried online or by phone. Of the respondents, 10 operators were from North America, 28 were from Europe, 11 were from the Middle East/Africa, 14 were from Latin America, and 19 were from Asia-Pacific.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research