Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 18, 2025

By Zain Tariq and Nathan Stovall

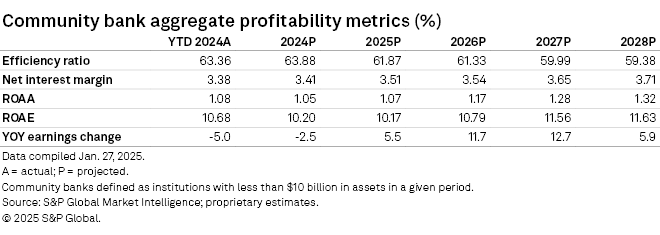

US community bank margins are set to expand over the next few years, supporting stronger earnings growth in 2025 and 2026.

US community bank earnings are set to rise in 2025 and 2026 as higher net interest margins will trump increases in credit costs. Modest decreases in interest rates will allow community banks to decrease their deposit costs. The funding relief will come as fixed-rate assets purchased or originated when rates were low move off institutions' books and are replaced with higher-yielding assets, resulting in margin expansion. Credit costs should also rise but are not expected to rise to levels that would limit earnings growth over the next few years. Community banks will operate in a more favorable fundamental environment, which, coupled with increased investor interest in the sector, should create greater optionality to raise capital or pursue acquisitions.

Click here to access data exhibits and the US community bank projections template.

Banks lowering deposit rates, but pace unlikely to accelerate much

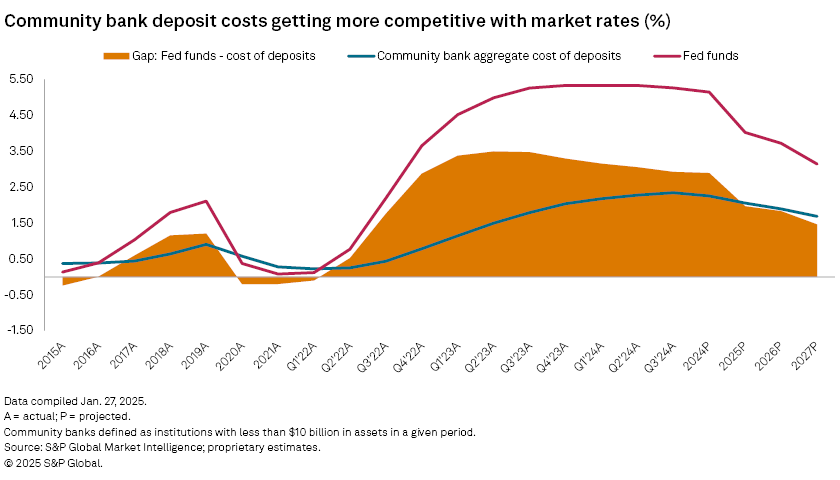

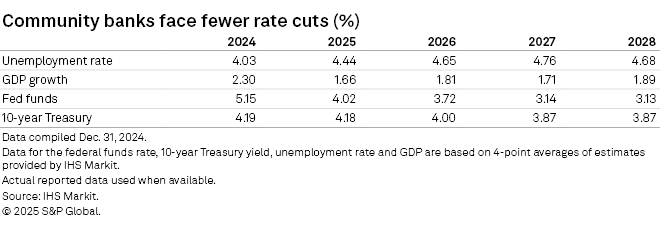

Deposit costs continued to grind higher in the third quarter of 2024, even with interest rates declining, but banks began to feel funding cost relief in the fourth quarter of 2024 as the central bank eased rates further. Community banks could find it challenging to decrease rates more quickly in the coming quarters as short-term rates stabilize and customers still find alternatives with attractive yields in the Treasury and money markets.

Community banks will balance growing deposits and lowering rates on their products and will likely need to remain somewhat competitive with the institutional markets. The proxy for that competition can be seen by looking at the difference between the average fed funds rate and community banks' cost of deposits, which narrowed further in the third quarter of 2024. That gap should continue to decline in 2025 as the fed funds rate moves lower.

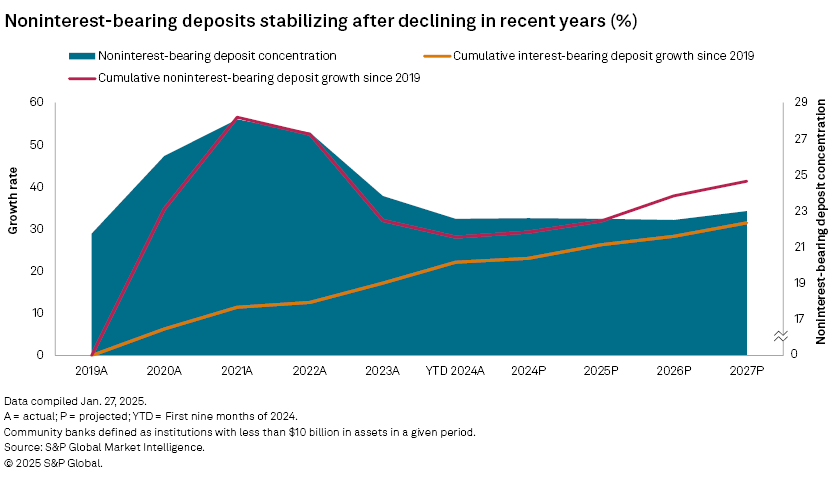

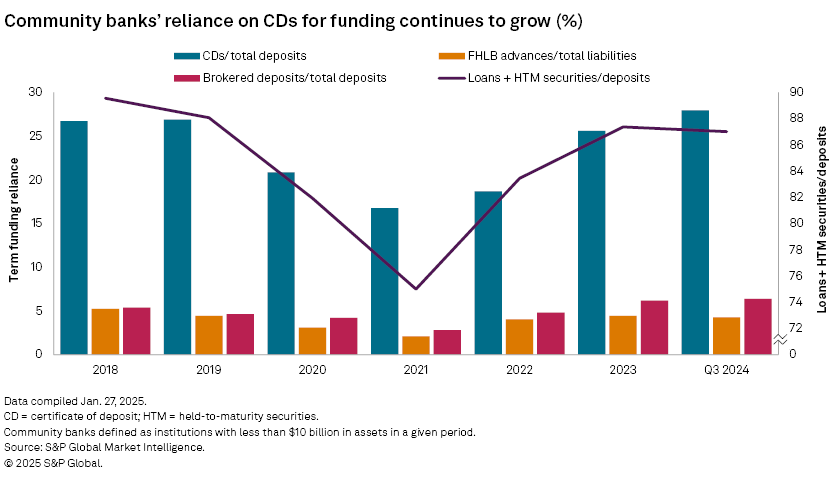

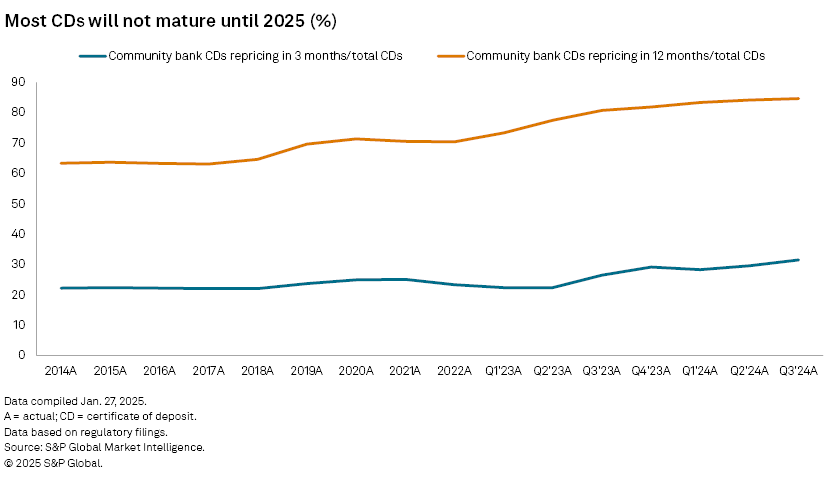

Deposit costs will remain somewhat sticky for many banks, however, because customers have woken up to higher rates available in the marketplace. Most institutions have attracted depositors by growing interest-bearing deposits, particularly certificates of deposit (CDs), over the last three years as interest rates have moved materially higher. CDs represented nearly 28% of community bank deposits at the end of the third quarter of 2024, up slightly from the second quarter but notably from 18.7% at year-end 2022 and 16.8% at year-end 2021.

Many of those products carry one-year terms, meaning that institutions might not feel significant pricing relief until CDs originated before the Fed pivot in September 2024 mature. At the end of the third quarter of 2024, the bulk of CDs were set to mature in the next year, with 31.5% of all CDs maturing or repricing in the next three months, while 84.6% of CDs were set to mature in the next 12 months. At the end of the third quarter of 2024, CDs maturing in the next three months equated to 8.8% of community banks' deposits, while CDs maturing in the next 12 months equated to 23.7% of community banks' deposits.

When those CDs mature, most banks will have to meet market rates to retain the deposits. While the market has waited for lower rates for some time, CD rates only began declining late in the third quarter of 2024.

The number of banks marketing one-year CDs with yields over 4% stood at 906 as of Sept. 6, 2024, down only slightly from 928 institutions as of June 28. That number began to fall more notably in the last week of the quarter, however, declining to 788 institutions as of Sept. 27. Since the end of the third quarter of 2024, the Fed has cut short-term rates by another 50 basis points, while the number of banks marketing one-year CDs over 4% has dropped dramatically to 397 institutions as of Jan. 31, 2025.

Despite those rate cuts, there has been less movement in the number of banks marketing one-year CDs over 3.5%. As of Jan. 31, 2025, 1,090 institutions were in that group, down from 1,266 as of Sept. 27 and 1,289 as of Sept. 6.

Even though community banks should experience more funding relief, institutions should be mindful that the last few years have served as a reminder that deposits are the true value of a franchise.

Credit quality normalizing, not headed in a downward spiral

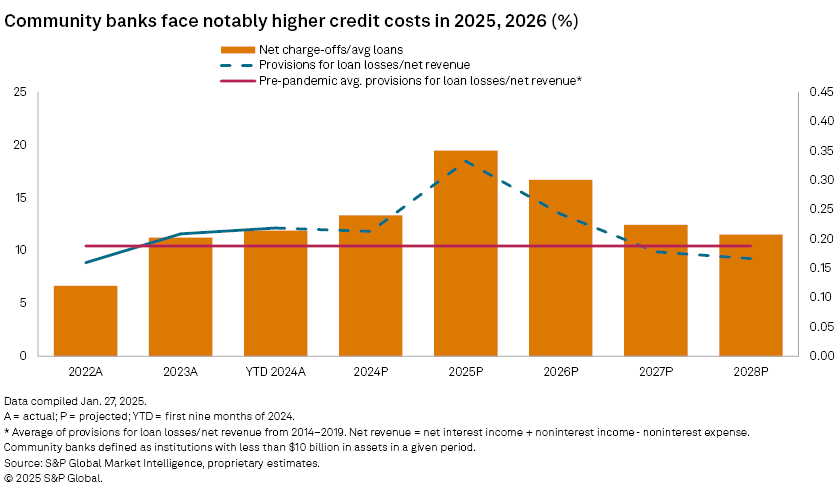

Credit costs migrated higher in 2024 and should continue to rise into 2025 as consumers become more stretched and higher borrowing costs begin to create challenges.

The worst fears regarding a potential deterioration in bank credit quality have eased, and valuations have recovered across the bank group. We maintain that community banks will record higher delinquencies and charge-offs in the future but will avoid a severe credit downturn. We also expect community banks to further strengthen reserves to prepare for potential difficulties ahead.

Consumer delinquencies have continued to rise off historical lows achieved during the pandemic but remain below the long-term average. Consumer savings rates jumped during the pandemic due to stimulus payments and expanded unemployment benefits that allowed consumers to accumulate more than $2 trillion in excess savings. Those savings lasted longer than many economists expected but were finally exhausted in late summer 2024.

While those savings were a buffer against the impact of rate hikes, their absence appears to have already been felt with debt levels rising. US consumer credit card, mortgage, auto loan and home equity loan credit debt all increased in 2024 from year-ago levels, according to Experian, fueling higher consumer spending.

More attention has been paid to the potential risk associated with commercial real estate (CRE) loans. CRE delinquencies at community banks have risen off historically low bases as well, increasing for seven straight quarters. However, unlike their larger counterparts, the growth in problem credits has been driven by delinquencies in owner-occupied CRE loans —effectively business loans collateralized by CRE — as opposed to nonowner-occupied credits, which are loans to landlords. Nonowner-occupied CRE loan delinquencies have risen to 0.90% of loans in the third quarter of 2024 from 0.48% two years ago, while delinquencies on owner-occupied credits increased to 1.01% in the third quarter, up from 0.69% two years earlier.

Even with the uptick in delinquencies, credit quality remains optimistic for community banks. We expect further deterioration, including in institutions' commercial real estate books, as borrowers seeking to refinance maturing credits find it harder to access credit or at least face a significantly higher debt service given the increase in interest rates. But CRE losses are likely to be spread out over time.

Capital is also coming back into the sector and could facilitate sales of distressed loans, particularly in conjunction with M&A activity, which the advisory community feels confident will materially increase in 2025.

Rates are not expected to decline enough to leave borrowers with the same debt servicing costs as before the Fed's tightening cycle. Intermediate rates fell heading into the Fed's pivot in September but have since increased back to the levels in the spring of 2024, leaving borrowers with little relief on their debt service. Some of the properties associated with those credits are also producing weaker cash flows, given the shift to hybrid work.

We expect related refinancing challenges to result in defaults and higher loss content in 2025, with net charge-offs continuing to rise off benign levels. We expect loss content to linger as banks provide borrowers with extensions in the face of some maturity walls. While net charge-offs are expected to build as credit normalizes, losses and the reserves required to fund them should serve as a headwind to earnings as opposed to the headwind that would occur during a severe downturn.

We expect provisions to rise to 18.4% of net revenue in 2025, up from 11.8% 2024 and 11.6% in 2023. From 2014 to 2019, banks' provisions equated to 10.4% of net revenue on average.

Scope and methodology

The outlook discussed in this article is based on a proprietary S&P Global Market Intelligence model that utilizes the actual results of nearly 10,000 active and historical commercial and savings banks and savings and loan associations. The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.