Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — April 17, 2025

By Tim Zawacki and Husain Rupawala

The investment portfolios of US property and casualty insurers currently stand to take a hit from the recent global sell-off in equities, but the magnitude of the impact on the vast majority of the companies in the sector is significantly inflated by one group's uniquely large allocation to common stocks.

Holdings in unaffiliated publicly traded common stocks among US P&C insurers hit $440.35 billion as of year-end 2024, according to an S&P Global Market Intelligence analysis of disclosures on Schedule D, Part 2, Section 2 of annual statutory filings, an amount that accounted for 17.7% of net admitted cash and invested assets.

The majority of the industry's exposure to publicly traded stocks sits within the subsidiaries of a single group, however, as the P&C subsidiaries of Berkshire Hathaway Inc. reported holding $249.61 billion. While that value declined substantially from $323.13 billion a year earlier, reflecting the company's much-discussed shift to cash and short-term investments, it still was more than twice as large as any other US P&C group's position. Berkshire and the group led by State Farm Mutual Automobile Insurance Co. had 47.6% and 39.6% of their net admitted cash and invested assets allocated to unaffiliated publicly traded common equities. The rest of the industry's combined position amounted to just 5.1% of cash and invested assets, though there were several outliers with outsized concentrations in common equities.

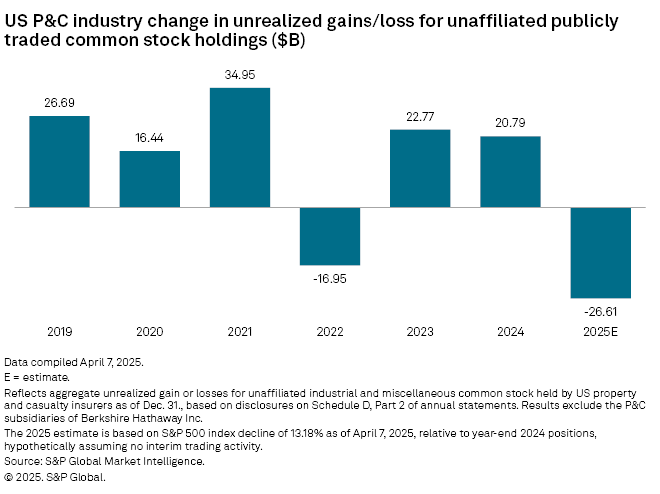

If we were to hypothetically assume a drop in valuations in the holdings of P&C insurers excluding Berkshire equivalent to the S&P 500 Index's year-to-date decline of 13.2% through the April 7 market close, this would suggest a reduction in aggregate policyholders' surplus through a corresponding negative change in unrealized capital gains and losses of approximately $26.61 billion, or about 2.4% of the industry's Dec. 31, 2024, total.

With much of the market sell-off transpiring after the start of the second quarter, it will be months before any effects would manifest themselves in the form of hits to insurer balance sheets and capital-and-surplus accounts. But the underlying factors behind the market woes, including an elevated potential for an economic downturn, fears of significant inflation in consumer and producer prices, and diminished prospects for earnings-per-share growth, may present more of a clear and present threat to the industry.

Most P&C insurers traditionally concentrate a majority of their investments in investment-grade corporate bonds with significant allocations to securities issued by government agencies and the US federal government. Combined, those three asset classes accounted for nearly 52.9% of the industry's net admitted cash and invested assets at year-end 2024 when excluding Berkshire. Of the 1,132 US P&C groups and stand-alone P&C entities with data available as of April 7, there were 616 that showed no investment in unaffiliated, publicly traded common stocks whatsoever as of Dec. 31, 2024. Another 301 held some investments in publicly traded equities but at an amount that constituted less than 10% of their net admitted cash and invested assets.

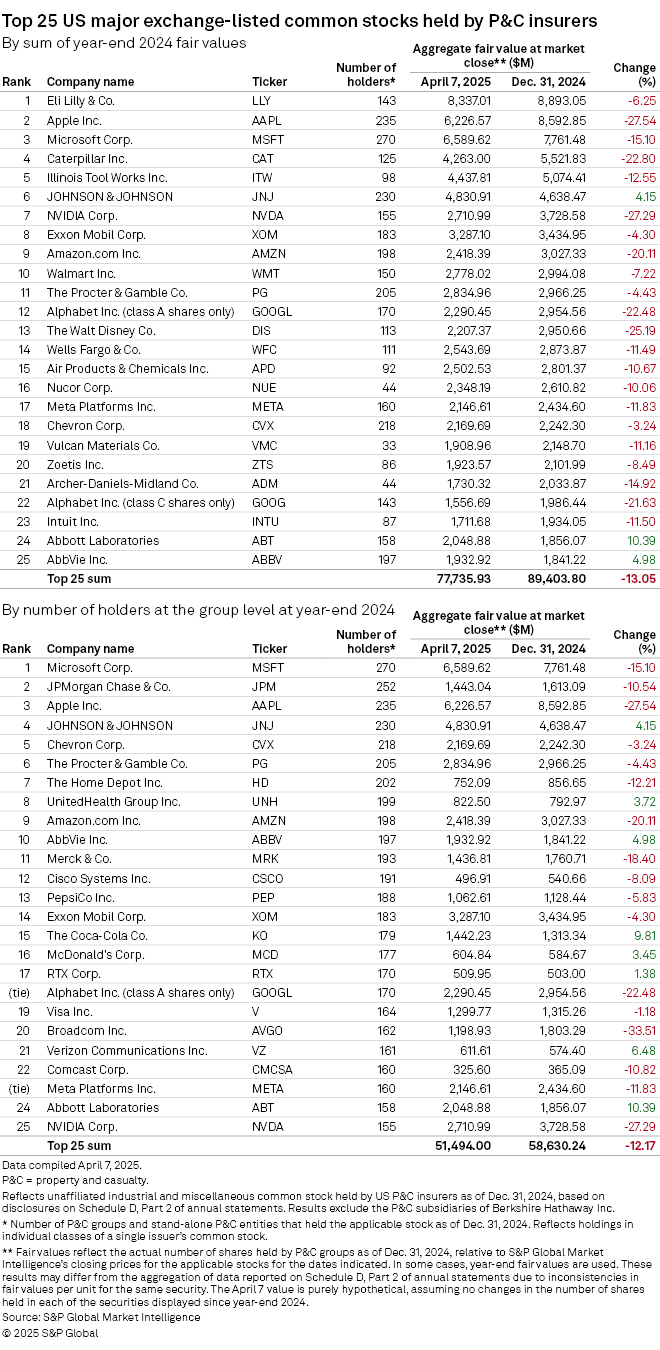

We examined the top 25 unaffiliated, publicly traded common stocks held by P&C insurers other than Berkshire as of year-end 2024 by both the aggregate carrying value of the industry's positions and the number of P&C groups and stand-alone entities that held individual stocks. In both lists, the number of stocks that declined on a year-to-date basis, not surprisingly, far exceeded the count of those that appreciated in value though performances varied widely.

Shares of Eli Lilly and Co., the industry's largest investment in an unaffiliated, publicly traded common stock by carrying value, fell by nearly 6.3% through the April 7 close, outperforming the S&P 500. But shares of Microsoft Corp., the industry's most widely owned name by number of holders, tumbled by 15.1% over the same timeframe. Apple Inc.'s shares, which would have easily topped the list of industry holdings by carrying value had Berkshire's mammoth position been incorporated in our analysis, plunged by 27.5% on a year-to-date basis through April 7.

The top-performing stock on each of the top lists was Abbott Laboratories, though its year-to-date gain of 10.4% through the April 7 close had marked a significant retreat from an early March peak. The industry's largest Abbott Labs investors as of Dec. 31, 2024, were State Farm and Cincinnati Financial Corp.

At the other end of the spectrum, Broadcom Inc.'s 33.5% year-to-date decline was the largest among stocks with the broadest and deepest US P&C industry investment. State Farm along with the group led by Factory Mutual Insurance Co. and The Cincinnati held the largest positions by carrying value in the semiconductor developer's stock. Common stocks accounted for 46.7% and 30.5%, respectively, of the year-end 2024 unaffiliated investments held by FM Global, the name by which Factory Mutual conducts business, and The Cincinnati. Other notable P&C insurers overweight equities relative to the industry as a whole include Auto Club Exchange Group, Markel Group Inc. and the respective groups led by Palisades Safety & Insurance Association and Merrimack Mutual Fire Insurance Co.

The latter of those entities, which operate in combination with an affiliate and subsidiary as the Andover Companies, said in its 2024 annual statement that it has focused its portfolio on dividend-paying common stocks due to their track record of providing "significant cash flow over the last 10 years in a historically low interest rate environment." The company added that it maintains a "high quality" bond portfolio and conservative cash balances to avoid being put in a position where it might have to unload common stock during "inopportune periods" when equity prices are under pressure.

P&C insurers held relatively low levels of exposure to the S&P 500 constituents with the largest month-to-date share price declines through April 7. Among the 17 issues with drops of 20% or more in the first seven days of April, the combined Dec. 31, 2024, carrying value of the industry's holdings was less than $71.4 million. Positions in Zebra Technologies Corp., which has plunged by 42.1% for the year and 20.9% for the month to date, accounted for $18.9 million of that tally.

These prospectively temporary declines in valuations are unlikely to have a significant impact on insurance company holders with large investment portfolios that are diversified across asset classes and strategies. But there are several smaller P&C insurers with outsized exposure to common equities.

Merchants Property Insurance Co. of Indiana, whose investments in unaffiliated, publicly traded common equities amounted to 102.3% of its year-end 2023 policyholders' surplus, might have the most interesting perspective on the situation.

A former homeowners and commercial package policy insurer that has been in run-off for more than 20 years, Indianapolis-based Merchants Property Insurance held 94 publicly traded common equities, including four positions that date back to 1937 and nine others that it originally acquired between 1949 and 1953. The latter investments, the company said in its 2024 annual statement, had been purchased as a hedge against post-World War II inflation. The strategy, it added, "has proven rewarding in the ensuing decades."

While Merchants Property Insurance indicated that it had taken some capital gains on its common stock positions in 2024 to "take advantage of a low tax climate," if we were to assume that its share counts in all 94 equities held steady on a year-to-date basis through April 7, the corresponding fair value decline would amount to an estimated $10.9 million, or 8.7% from the year-end total.

For most P&C insurers, the recent market declines could make a small dent in relatively large unrealized gain positions they had amassed. The aggregate carrying value of unaffiliated publicly traded common shares held by P&C insurers excluding Berkshire exceeded actual cost by $125.57 billion as of Dec. 31, 2024, up from $114.09 billion a year earlier. Of the groups and stand-alone entities that held unaffiliated, publicly traded common stocks as of year-end 2024, 85.6% showed carrying values that were higher than the actual cost of those investments.

The P&C industry, with and without Berkshire, produced a new high in realized capital gains on investments in unaffiliated common stock of $106.05 billion and $11.82 billion, respectively. In theory, this could provide dry powder for insurers to take advantage of buying opportunities left in the wake of the recent sell-off, though in some cases, more than a quarter of the way into 2025, the beneficiaries have already reinvested those proceeds elsewhere.

Our forthcoming 2025 US Insurance Investments Market Report will provide deeper insights into results and trends across asset classes across both the P&C and life sectors.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.