S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 9 Dec, 2021

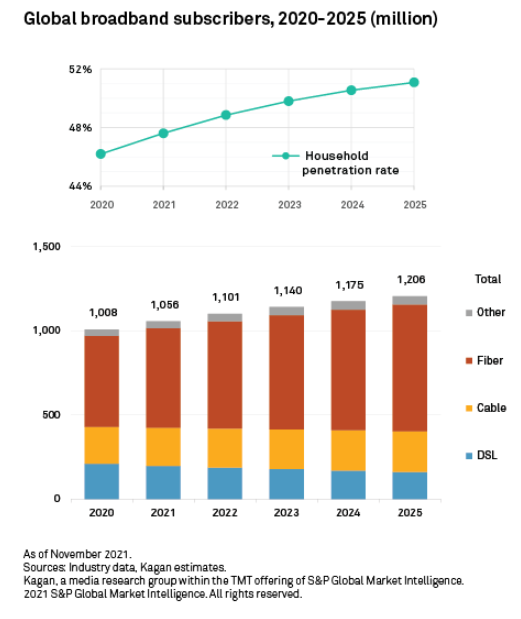

With fiber-optic broadband driving internet service adoption worldwide, Kagan's survey of global fixed broadband trends indicates that 1.06 billion homes will have a fixed broadband subscription by the end of 2021. Fiber-to-the-premises, or FTTP, will account for 56.0% of the total by year-end, with just 18.7% of fixed broadband homes still relying on xDSL, while cable will hold an estimated 21.4% market share. Still, an estimated 11.9 million homes will drop xDSL in 2021. At the same time, fixed broadband penetration is expected to reach 47.6% of occupied households worldwide by end-2021, breaching the 50% threshold by year-end 2024, as subscriptions rise to 1.18 billion, and past 1.2 billion by 2025, equating to a 3.7% CAGR across 2020-25.

North America lags the world in fiber-optic broadband

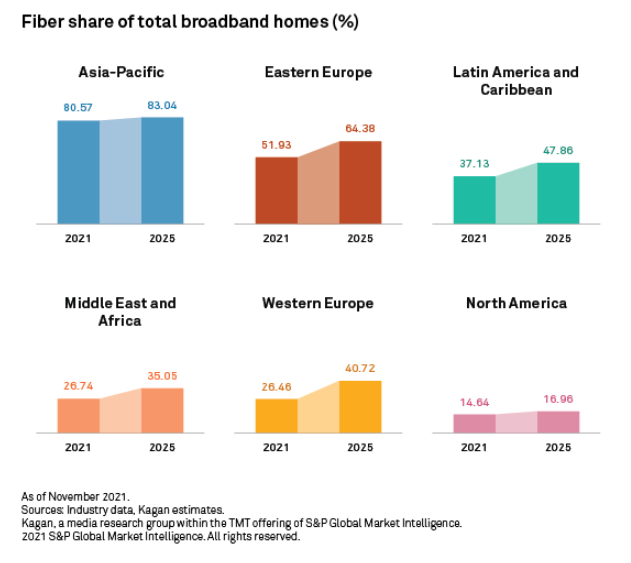

While fiber dominates globally, its availability and service take-up differ greatly across regions and individual markets. Nevertheless, Kagan’s 2021 global telco survey of 101 broadband investment decision-makers indicates a likely worldwide increase in fiber-optic network expansions in 2022 and 2023 after slowdowns due to the COVID-19 pandemic. We forecast that by 2025, fiber will become the dominant fixed broadband platform in all regions but North America and Middle East and Africa. As of 2021, the technology dominates only in Asia-Pacific and Eastern Europe.

Asia-Pacific is the largest market for fixed broadband and full fiber, the latter forecast to represent more than 80% of the region's subscribers by year-end 2021. The world's largest broadband market, mainland China, will account for 53.1% of global fiber homes by year-end. Fiber is the dominant platform in Asia including in the less developed markets of Indonesia, Malaysia, Thailand and Vietnam. The affordability of broadband services has helped drive fiber adoption, evidenced by our affordability index, which shows a relatively low threshold of 1% to 1.3% as of end-2020. The Philippines — one of the exceptions, with some of the highest-priced broadband services globally — had an affordability index of 2.1% as of end-2020. Thanks to the archipelago's challenging geography, fixed wireless dominates the market, and fiber's share is estimated to lag behind the Asia-Pacific average, being 38.8% at end-2021. Asia will also account for 74.2% of the world's FTTH subscribers by year-end.

Eastern Europe — where both telcos and cable operators in most markets deployed FTTP — trails Asia, with nearly 52% of fixed broadband subscribers using fiber by the end of 2021. In Western Europe, xDSL platforms still dominate, as many telcos initially opted for the quicker and less costly upgrades via fiber-to-the-cabinet, or FTTC, and VDSL technologies, giving FTTP only a 26.5% share of total broadband homes by end-2021. Nevertheless, migration to fiber is accelerating in the region, with fiber projected to overtake xDSL by 2025 with a 40.7% market share. The European Union's ambitious Digital Agenda goals, along with increased demand for broadband speed and bandwidth due to COVID-19 pandemic lockdowns, have accelerated FTTP network deployments and service take-up. Telco partnerships with private equity firms and infrastructure specialists have also made large-scale fiber network rollouts faster and more affordable. Notably, in Portugal, Spain and the United Kingdom, key cablers have opted to decommission their HFC networks in favor of FTTP in the coming years.

In terms of FTTP adoption, North America lags all other regions, with just 14.6% of fixed broadband subscribers by end-2021. In the USA, slow telco fiber deployments and an initial focus on FTTC, cable's strong grip on the market with rapid network upgrades to DOCSIS 3.1, enabling speeds of up to 1 Gbps, and attractive double/triple-play bundles, have all contributed to relatively low availability and take-up of FTTP. In fact, cable serves more than two-thirds of U.S. wireline broadband subscribers. Although the lack of government-set fiber deployment targets and investment have historically limited telco fiber deployments to major urban areas, the status quo is likely to change in the near-to-medium term. Kagan analysis indicates that 10 U.S. internet service providers, including market-leaders Verizon Communications Inc. and AT&T Inc. and cableco Altice USA Inc., should add nearly 23 million more FTTP addresses by 2023.

Blog

Blog