Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 6 Dec, 2021

By Erik Keith

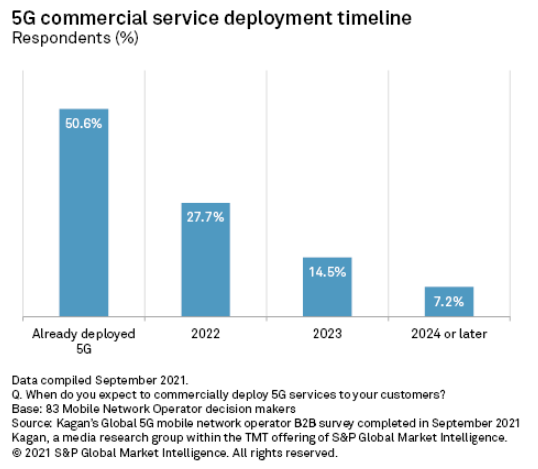

While the COVID-19 pandemic prompted delays to 5G infrastructure buildouts and associated service deployments, mobile network operators, or MNOs, remained firmly committed to 5G network upgrades, according to Kagan's 2021 global 5G survey of 83 wireless operator decision-makers. The annual survey, completed in September 2021, revealed key data points from respondents, including the 51% of the surveyed MNOs that claim to offer 5G services, up from 38% of respondents in our 2020 5G survey. An additional 28% of respondents plan to offer 5G service in 2022, with a further 15% expecting to deploy 5G in 2023.

As with most early deployments of new networking technology, initial 5G network upgrades and service activations will be focused in areas where subscriber density is the highest (i.e., major metropolitan areas). There are some exceptions to this, such as T-Mobile USA Inc.'s plan to deliver "nationwide" 5G using low-band (and therefore lower throughput) 600 MHz technology.

COVID-19 impact

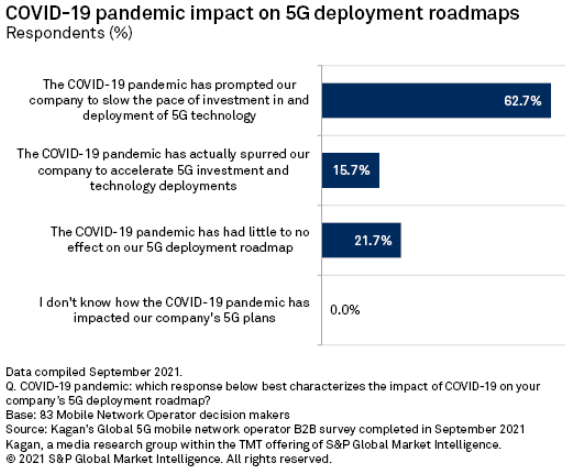

Impacts of the COVID-19 pandemic have certainly slowed the rollout of 5G network upgrades and service implementations. The results of the 2021 5G survey both mirrored and validated the question asked of respondents regarding COVID-19 in the 2020 survey. Specifically, 63% of the 2021 respondents said COVID-19 caused them to delay 5G buildouts, the same percentage as last year. Meanwhile, 22% of the 2021 survey respondents claimed that the pandemic had little to no effect on their 5G network upgrades, and 16% indicated that the pandemic spurred them to accelerate their 5G builds.

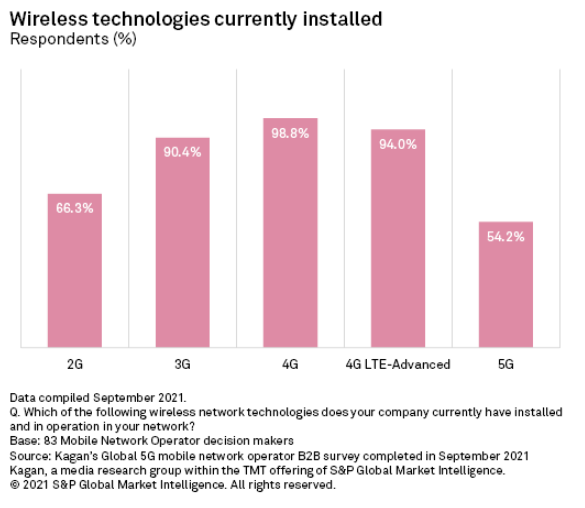

Current network technologies

In terms of technology operational today, 4G was the most popular radio access network generation, selected by nearly 99% of respondents. 4G LTE-Advanced was the second most popular technology currently deployed, with 94% of respondents leveraging this generation. While the 2020 survey had 4G LTE and 3G tied at 95% apiece, this year's survey saw 3G drop to 90%. While this appears to be a notable drop in 3G technology utilization, it is worth noting that 3G is still utilized by 93% of European wireless operators and 95% of Asia-Pacific, or APAC MNOs.

2G technology dropped off more significantly, from 73% in 2020 down to 66% in 2021. This reflects an inherent dichotomy regarding 2G technology. While 2G is undoubtedly on the way out as 4G and 5G solutions become increasingly pervasive, 2G services are still useful for lightly populated or rural areas where greater signal reach and cellular connectivity for voice and basic data services are more important than network throughput speed.

Finally, 54% of the 2021 survey respondents claimed that 5G technologies are currently deployed in their respective networks; this is only slightly ahead of the 51% of respondents shown above that indicated they now offer 5G services. The 3 percentage point discrepancy highlights the lag time between new technology deployments and actual service implementations. This is a notable gain from the 2020 data, where 37% of respondents claimed to have deployed 5G technology.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Read More