Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 Apr, 2022

Delivery times lengthened significantly in 2021, and January 2022 began with many companies reporting severely constrained output, input costs rising faster than at any point in the decade prior to the pandemic, and Omicron causing fresh uncertainty.

Our newest global manufacturing PMI survey released on 5 January shows signs of a sector that is still very much under strain from supply bottlenecks and COVID-19- related uncertainty, albeit with some signs that the situation is starting to improve. The incidence of worldwide supplier delivery delays was the lowest since March, allowing global factory output growth to accelerate to the fastest pace since July. Importantly, whereas in recent prior months production growth had lagged demand growth to an unprecedented degree as shortages of staff and materials meant factories simply could not produce everything being demanded by their customers, production and demand growth have come broadly back into line.

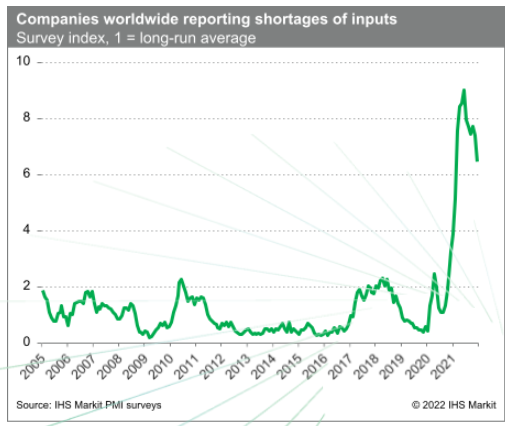

However, these improving data must be viewed in the context of a year of unprecedented supply disruption. IHS Markit has been conducting surveys of purchasing managers for 30 years, and we have not seen supplier delivery times lengthen to anything similar to the degree witnessed in 2021. Going into 2022, companies reporting that output was constrained by shortages was running 3.5 times the long-run average—lower than October, but still much higher than ever before recorded. Also, the average lengthening of supplier delivery times, although easing somewhat, remained at a level far in excess of anything seen before the pandemic.

These shortages have created a seller’s market. While December saw some welcome cooling of industrial price pressures as supply bottlenecks eased, the manufacturing sector is still seeing its input costs rise at rate exceeding anything seen in the decade prior to the pandemic.

Furthermore, these latest PMI survey data come at a time when COVID-19 case numbers continue to rise due to the Omicron variant, raising the possibility of further global production and supply disruptions as we head into 2022, potentially amplified by lockdown policies in some countries.

As a result of these pressures, we have been nudging our global economic growth forecast down and our inflation forecast up. The longer the pandemic keeps affecting supply chains, the weaker the growth outlook. Back in mid-2021, we were forecasting 4.5% global GDP growth for 2022. That’s now down to 4.2%, largely because inflation has become more pervasive than anticipated.

Meanwhile, our business outlook survey for 2022 of 12,000 companies showed profit expectations to be the weakest in the pandemic so far. There are widespread fears about price hikes, supply shortages, customer resistance to high prices, and an inability to pass costs on to customers after a year of sharply rising prices, damaging profit margins.