Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Apr, 2023

By Milan Ringol

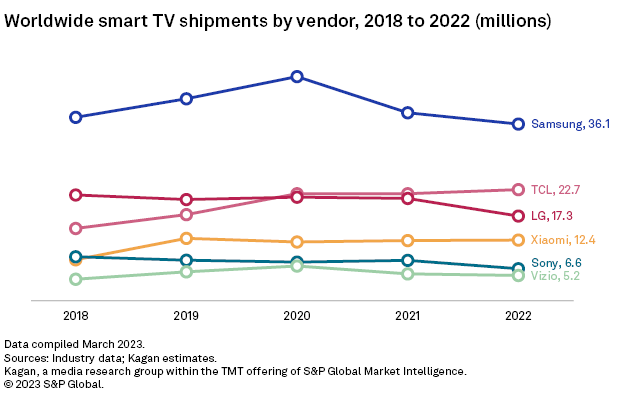

Global smart TV shipments in fourth-quarter 2022 declined an estimated 4.3% year over year as consumer spending remained dampened by persistent inflationary pressures in much of the world. Estimated smart TV shipments for the full-year 2022 fell to a five-year low at 137.1 million units primarily due to demand cooling off to pre-pandemic levels amid macroeconomic headwinds throughout the year.

On top of the overall weakened consumer spending, the rapidly cooling demand in mature TV markets is a key factor that led to the year-over-year declines in both fourth quarter and full year smart TV shipments for Samsung, LG and Sony.

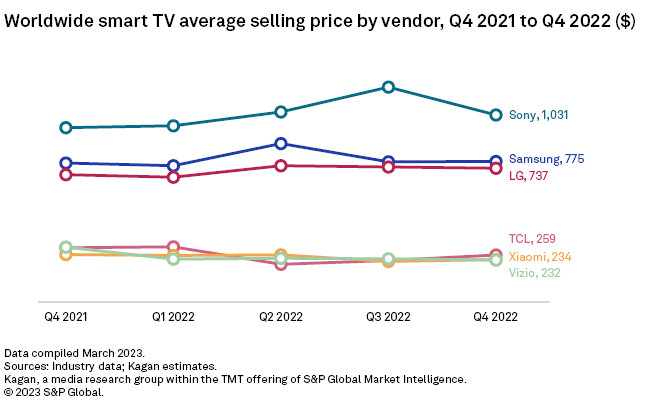

These vendors each increased the proportion of premium products among total shipments to offset losses in revenue from declining demand. With average selling prices (ASPs) for their respective smart TVs estimated to be over $700, they are the top competitors in the high-end premium TV segment, which has a large share among developed markets.

This contrasts with peers like TCL and Xiaomi that went in the opposite direction and prioritized the proliferation of their low-end products, particularly in emerging markets, which kept their estimated ASPs under $300.

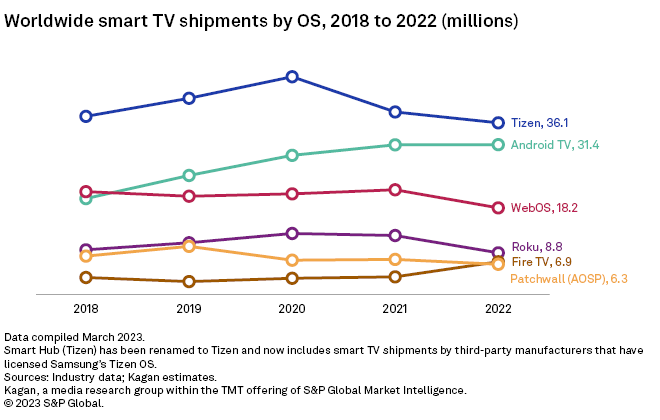

Shipments of smart TVs that run Alphabet's Android TV OS contracted 0.1% in 2022, composed primarily of TCL and Xiaomi which contributed over half of the total units shipped. Smart TVs with Amazon's Fire TV OS grew by an estimated 86%, driven partly by first-party shipments to North America.

Most OS shipments declined in 2022: Roku OS smart TV shipments were down 29% largely due to TCL's move to increase the proportion of Android TV sets among its total shipments to North America. This may have forced Roku's hand in expediting its plans to offer first-party smart TV sets with shipments starting in 2023.

Kagan's quarterly global smart TV shipment estimates are built upon analysis of publicly available industry reports and proprietary data models. Note that this analysis only includes TV sets used for home entertainment, excluding commercial sets used, for instance, in the hospitality industry and in public spaces and offices. Revenue estimates are from unit sales only and do not include revenue generated from smart TV usage through ads, platform fees, or the like.

Research

Research