Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 22 Mar, 2021

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

Having endured a full year of pandemic-related business disruption and following our last analysis in September 2020 on the impact of COVID-19, we sought to explore those industries that have recovered best and worst over the course of the last year (March 2020 – March 2021).

In our three previous blogs, dated March 2020, April 2020, and September 2020 we assessed the COVID-19 impact on industries from a Probability of Default (PD) perspective, focusing on sectors that experienced the most and least disruption. Consistent with our previous analyses, we again used the Credit Analytics PD Market Signals model (PDMS) which leverages market capitalization and asset volatility as drivers to calculate a one-year PD.

While our last analyses were conducted over shorter time horizons, in this analysis over a longer time period, we again find that Airlines, Leisure Facilities, and Restaurants were some of the most impacted industries while Insurance and REITs were the least impacted. In this blog, we take a look over the Last Twelve Months (LTM) to assess which industries have been able to adapt and recover best from the major impacts of COVID-19.

Industries Most Impacted by COVID-19

The industries that have been most impacted have changed slightly from our last blog post. The Restaurants and Auto Parts & Equipment industries have dropped out of the top five most impacted industries and have been replaced by Apparel Retail and Home Furnishing Retail.

Recovery Story

The industry that has recovered the most over the course of the last year is the Airlines industry, which experienced the greatest disruption during 2020 but has also seen the largest recovery since the peak of the COVID-19 pandemic when its PD was most elevated.

Our analysis shows that the Airlines industry median PD peaked at 26.92% (an implied credit score of ‘ccc-’) on April 2, 2020.[i] The PD then started declining around the time the $25 billion bailout was announced by the United States government.[ii] By the end of August 2020, Airlines median PD stood at 6.36% (‘b-’) before spiking again on September 23, 2020 to 13.56% (‘ccc+’). This second spike was brought on by market participants feeling the downstream impacts of the protracted recovery Airlines are facing. In particular, airline traffic was reduced by nearly 40% compared to pre-pandemic levels. [iii]

Airlines PD significantly declined to 2.83% (‘b+’) by February 28, 2021, which is near the industry’s pre-pandemic PD level. This drastic decline can be attributed to exceptionally low fares, new customer safety guidelines implemented by management teams, and the incremental return of airline customers as vaccines continue to be brought to market.

Despite being most impacted by COVID-19, Oil & Gas Drilling, Casinos & Gaming and Apparel Retail all followed similar trajectories of recovery with their PDs declining to low levels over the past year. Retail industries (covering Apparel and Home Furnishing) have benefited from the rise of e-commerce, changing business models, and lifting of lockdown and curfew restrictions in recent months. Home Furnishing Retail saw a much sharper decline during the summer of 2020 but has remained relatively stable with a PD just shy of 2% over the past eight months.

Industries Least Impacted by COVID-19

The five industries that have been least impacted remain the same as those listed on our last blog. These industries include: Multi-line Insurance, Life & Health Insurance, Specialized REITs, Property & Casualty Insurance, and Industrial REITs.

The analysis shows a similar trend to the most impacted industries, but at lower starting and ending PD levels. From elevated levels between March 2020 and July 2020, all of these industries experienced a decline in PD except for a smaller spike between September and October, which coincided with a major second wave of COVID-19 cases.

In Summary

Overall, we have seen stability and recovery in most industries and a strong correlation between increases in COVID-19 cases and sharp decreases in creditworthiness.

From March 1, 2020 to Feb 28, 2021, the five industries most impacted by COVID-19 are as follows:

|

Industry Name |

PD Level on March 1, 2020 |

Max PD LTM |

PD Level on Feb 28, 2021 |

|

Airlines |

9.84% |

26.92% |

2.84% |

|

Oil & Gas Drilling |

9.10% |

24.14% |

1.84% |

|

Apparel Retail |

7.44% |

21.12% |

2.03% |

|

Home Furnishing Retail |

3.22% |

21.98% |

1.69% |

|

Casinos & Gaming |

6.41% |

21.42% |

2.74% |

Source: PDMS, S&P Global Market Intelligence, as of March 2021. For illustrative purposes only.

The five industries least impacted by COVID-19 are:

|

Industry Name |

PD Level on March 1, 2020 |

Max PD LTM |

PD Level on Feb 28, 2021 |

|

Multi-line Insurance |

0.59% |

1.1% |

0.25% |

|

Life & Health Insurance |

0.62% |

1.2% |

0.25% |

|

Specialized REITs |

0.08% |

1.1% |

0.16% |

|

Property & Casualty Insurance |

0.59% |

1.3% |

0.37% |

|

Industrial REITs |

0.08% |

0.8% |

0.11% |

Source: PDMS, S&P Global Market Intelligence, as of March 2021. For illustrative purposes only.

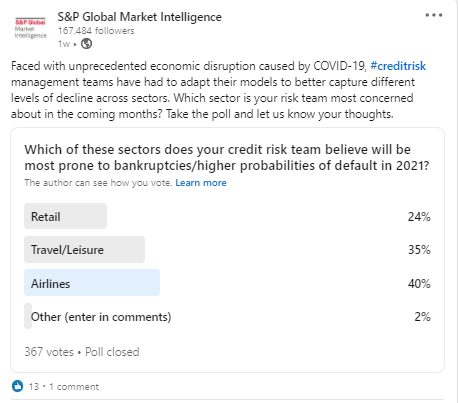

S&P Global Market Intelligence also recently conducted a poll on LinkedIn, asking the public which sectors they believe are most prone to higher PDs in 2021. The results are consistent with our analysis, Airlines, Travel & Leisure and Retail (in this order) were listed as the sectors of highest concern from the answer options provided (Airlines, Travel & Leisure, Retail, Other – respondents were given the option to enter an industry of their choosing in the comments.)

Source: S&P Global Market Intelligence LinkedIn Poll conducted March 1 through March 5, 2021. For illustrative purposes only.

Click here if you are interested in learning more about our Credit Analytics tools used in this analysis.

[i] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

[ii] “Loans to Air Carriers, Eligible Businesses, and National Security Businesses.” U.S. DEPARTMENT OF THE TREASURY, 2021, home.treasury.gov/policy-issues/cares/preserving-jobs-for-american-industry/loans-to-air-carriers-eligible-businesses-and-national-security-businesses.

[iii] “OECD Policy Responses to Coronavirus (COVID-19): COVID-19 and the Aviation Industry: Impact and Policy Responses.” OECD, 15 Oct. 2020, www.oecd.org/coronavirus/policy-responses/covid-19-and-the-aviation-industry-impact-and-policy-responses-26d521c1/.

Location

Products & Offerings

Segment