Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 7 Apr, 2020

By Neeraj Kumar and Danny Haydon

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

As we established a few weeks back, the ongoing impact of coronavirus (COVID-19) is still widely visible and is significantly impacting a number of industries. Supply chains have been disrupted, unemployment rates have skyrocketed, and the public health crisis has escalated in many countries. Despite the implementation of unprecedented government stimulus packages and interest rates dropping to near zero, the pandemic is still affecting many industries. In this blog, we update our prior analysis and explore the top five industries most impacted by COVID-19 during the month of March 2020.

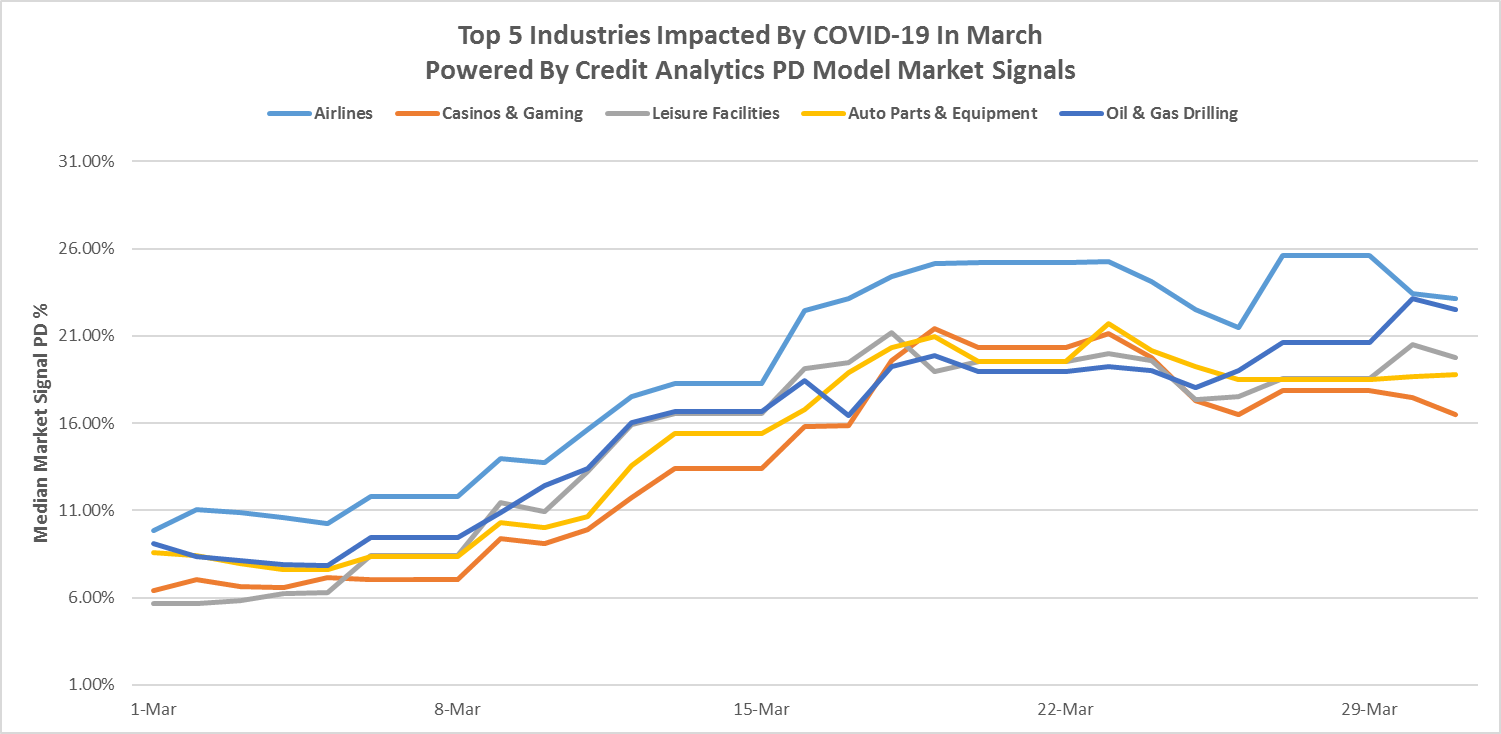

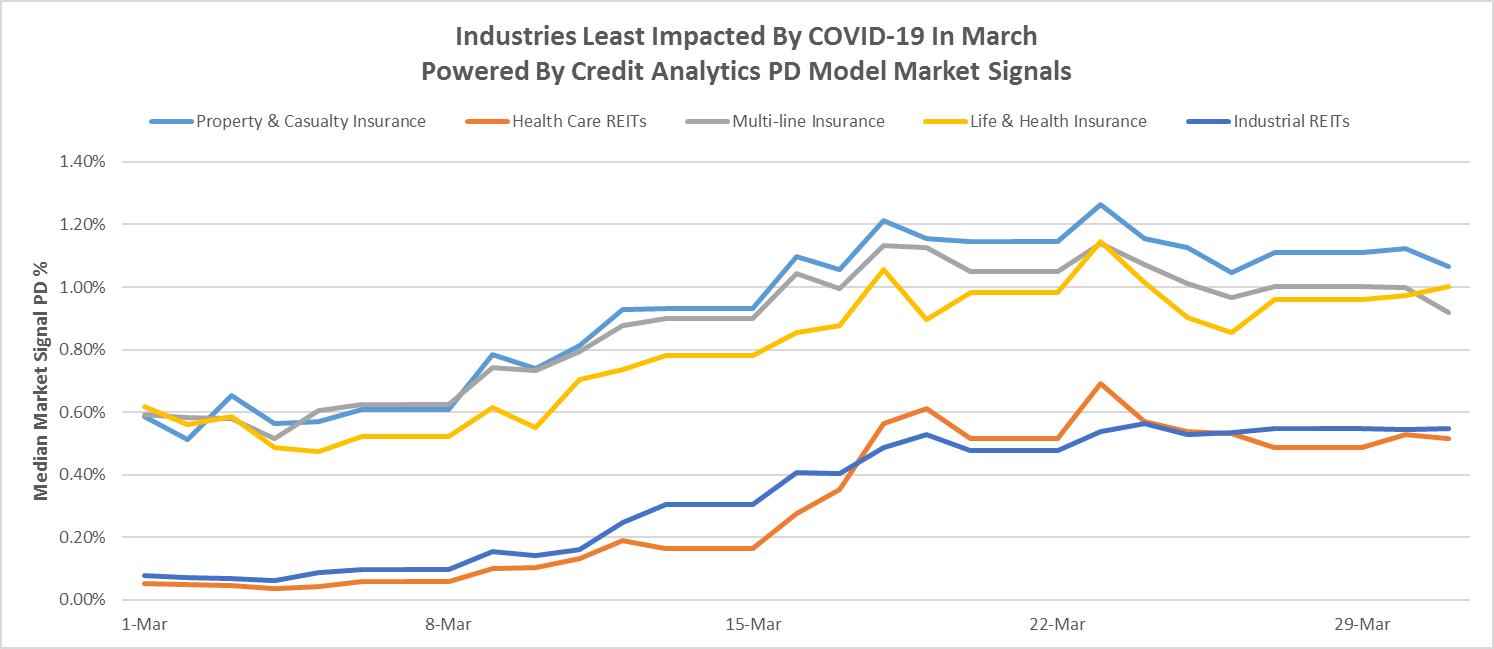

This time around, the analysis also includes an assessment of the industries least impacted by COVID-19, giving an indication of relative strength. Our approach is consistent to the prior analysis; we leveraged the Credit Analytics Probability of Default Model Market Signals (PDMS) which uses stock price movements and asset volatility as inputs to calculate a one year probability of default (PD).

Industries Most Impacted by COVID-19

Source: Probability of Default Model Market Signals, S&P Global Market Intelligence, March 31, 2020. For illustrative purposes only.

Based on our analysis, the industry most impacted is the Airlines industry. The median PD at the start of March is 9.84% which maps to ccc+ credit score. Airlines PD increases to 25.2% (ccc-) by March 23, dips on March 26 to 21.5% (ccc) following the US government stimulus package announcement (including $58bn bailout for Airlines), but quickly returns to over 25.6% (ccc-) the next day. The main reasons for the elevated PD include: the mass grounding of air traffic, border closures, and shelter-in-place policies across the globe, all of which have caused detrimental impacts on stock performance and raise concerns about the potential viability of some Airlines.

Two other heavily impacted industries in March are the Casino & Gaming industry and Leisure Facilities. Casino & Gaming’s median PD was 6.41% (b-) at the start of March, increasing steadily to 16.46% (ccc) by the end of the month. Similarly, Leisure Facilities was 5.64% (b-) at the start of March and rose to 19.74% (ccc) by the end of March. With widespread closures of gaming facilities; the postponement of most sporting events, including the Summer Olympics; and the introduction of social distancing measures, Casinos and Leisure Facilities have been brought to a standstill. Both of these industries were new additions to the top five, having experienced large changes to median PD during March.

Similar to our previous analysis conducted at the end of February 2020 for the prior two months, the Auto Parts & Equipment and Oil & Gas Drilling industries remain in the top five most impacted industries. Auto Parts & Equipment moved from 8.57% (b-) to 21.7% (ccc) on March 23, dipping to 19% (ccc) on March 26 on the back of the US government’s stimulus package announcement and stays at this level through the end of March. The Oil & Gas Drilling industry sector median PD started the month at 9.1% (ccc+). On March 8, the oil price war between Saudi Arabia and Russia led to a dramatic fall in oil prices. Combined with the impact of COVID-19, the demand for oil has been drastically reduced, causing the median one year PD to rise throughout March ending at 22.5% (ccc).

Industries Least Impacted by COVID-19

We also analyzed the industries that have been the least impacted by COVID-19 from a PD perspective. We found that the Insurance (Property & Casualty, Multi-Line, Life & Health) and REITs (Health Care, Industrial) industry sectors were least impacted, yet still showed rising PDs.

Source: Probability of Default Model Market Signals, S&P Global Market Intelligence, March 31, 2020. For illustrative purposes only.

We continue to see market stresses and increasing unemployment rates, which we expect to elevate PDs in the coming months. A tool like Credit Analytics PDMS model allows the surveillance of credit risk from an individual company perspective, as well as providing a macro view for different countries and industries via benchmarks.

To summarize, from March 1 to March 31, the five industries most impacted by COVID-19 are as follows:

|

Industry |

Median PD as of March 1, 2020 |

Median PD as of March 31, 2020 |

|

Airlines |

9.84% |

23.16% |

|

Casinos & Gaming |

6.41% |

16.46% |

|

Leisure Facilities |

5.64% |

19.74% |

|

Auto Parts & Equipment |

8.57% |

18.81% |

|

Oil & Gas Drilling |

9.1% |

22.5% |

The five industries least impacted by COVID-19 are:

|

Industry |

Median PD as of March 1, 2020 |

Median PD as of March 31, 2020 |

|

Property & Casualty Insurance |

0.59% |

1.06% |

|

Health Care REITs |

0.55% |

0.52% |

|

Multi-line Insurance |

0.59% |

0.92% |

|

Life & Health Insurance |

0.62% |

1.00% |

|

Industrial REITs |

0.08% |

0.55% |

Government intervention looks to be slowing the spread of COVID-19 at different speeds in different countries. We will continue to monitor the impacts of these social distancing measures and stimulus efforts in our next blog.

Click here for research on the top five most impacted industries mentioned in our blog.

Click here if you are interested in learning more about our Credit Analytics tools used in this analysis.

Topic Page

Location

Products & Offerings