Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 4 Oct, 2022

Credit ratings are opinions about credit risk. When a credit rating changes, the analyst explains why, in a report. The ‘why’ is important. For an equity investor, a downgrade due to a rapid decline in a company’s sales has a negative implication; whereas, a downgrade due to an increase in leverage arising from a share buyback program may be viewed as positive.

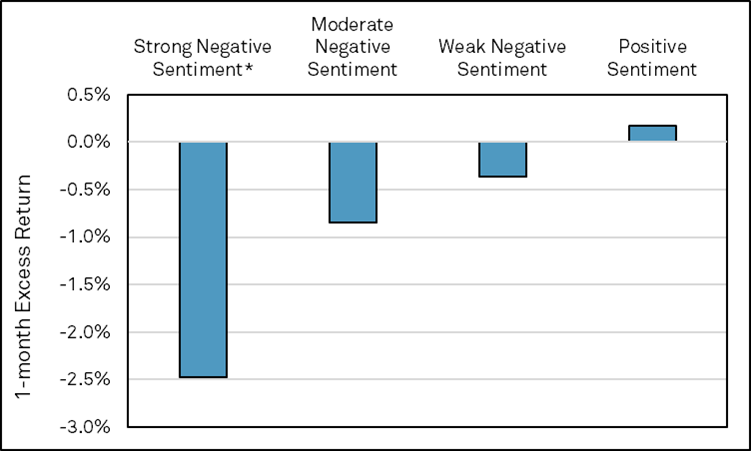

This study finds that the relative size of the price impact following a downgrade is dependent on the magnitude of the tone and the topics of focus in the report (Figure 1). Downgrades with strong negative sentiment underperform downgrades with positive sentiment by 2.7% over the following month.

Key findings include:

Figure 1: Return Comparison of Company Downgrades by Magnitude of Credit Report Sentiment, Russell 3000, 2003 - 2021.

*The return of strong negative sentiment is different from the return of positive sentiment at the 1% level.

Source: S&P Global Market Intelligence Quantamental Research. For all exhibits, all returns, and indices are unmanaged, statistical composites and their returns do not include payment of any sales charges or fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Data as at 03/31/2022.

DOWNLOAD THE FULL REPORT

Blog

Products & Offerings