Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 7 Sep, 2021

This is the final blog in a three-part series on “Fund Financing Through a Credit Lens” with a focus on AIFs. In the first blog, Understanding the Basics of AIFs, we looked at how fund financing works and a number of critical factors to consider when assessing AIF exposure. In the second blog, Credit Risk Factors for AIFs, we looked at some of the potential risks and available tools to evaluate their creditworthiness. We now look take a deeper look at the key credit risk factors to consider when assessing AIFs, and how S&P Global Market Intelligence’s Credit Assessment Scorecard for AIFs (“AIF Scorecard”) can help you assess different types of these investments.

The increased leverage within the AIF universe globally poses potential credit risks to various lenders to the funds. Our Credit Assessment Scorecards provide a framework to help navigate today’s climate and assess the probability of default (PD). This is especially important for low-default portfolios that lack extensive internal data necessary for the construction of statistical models that can be robustly calibrated and validated.

AIF Scorecard Methodology

The AIF Scorecard covers various types of these investments, including private equity funds (PEs), hedge funds (HFs) and funds of funds (FOFs). It also covers entities not organized as funds, but that have characteristics similar to PEs or HFs and execute strategies that include elements of both PE investing and HF trading.

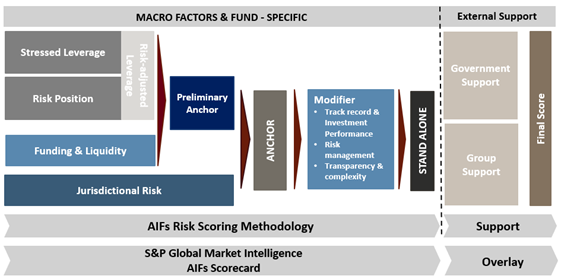

Chart 1 below illustrates the holistic approach of the S&P Global Ratings AIF methodology. The AIF Scorecard leverages this global criteria, taking into account a number of risk factors to determine an anchor score, including: risk-adjusted leverage, funding and liquidity and jurisdictional risk. The anchor score is then modified after analyzing of AIF’s investment performance track record, risk management and transparency and complexity to obtain a standalone credit score for the AIF. Although many asset managers are supportive of the funds they manage, they are under no obligation to provide additional capital or liquidity (in excess of general partner commitments). Hence, it is not common to make an adjustment for group support unless a guarantee of the fund is in place, which may impact the final credit score for the AIF.

Chart 1: The Global AIF Framework

Source: S&P Global Market Intelligence. For illustrative purposes only.

Six Key Drivers of Credit Risk for AIFs

The AIF Scorecard is designed to model the most relevant quantitative and qualitative drivers of underlying credit risk. This includes:

Incorporating Different Characteristics Across Fund Types

Our assessment guidelines help users understand and incorporate different risk characteristics into their analysis. Choosing three of the key risk drivers highlighted above, this section dives further into the different approaches when considering different fund types.

Risk-adjusted stressed leverage. We use two distinctive ways to measure stressed leverage. For funds that employ transparent and traditional strategies and have stable asset profiles that do not change over a short period of time, we apply the stressed asset approach. Typically, this approach is used for PE funds, infrastructure funds, direct loan funds and mezzanine funds. We apply haircuts on the fund’s assets to calculate a stressed asset value, and then compare that against total liabilities. By doing so, we assess the fund’s ability to repay outstanding financial obligations in adverse economic situations. The level of haircut for each asset class (e.g., stock, bond and real estate) is set by S&P Global Market Intelligence, using historical data and expert judgement in accordance with the characteristics of the funds.

For funds that employ complex strategies and high asset turnover, we apply a risk-based approach. Typically, this approach is for HFs that actively trade various assets in line with market movements. In the approach, we calculate the fund’s Value at Risk (considered as the possible maximum loss in a severe economic downturn) and compare it against net asset value to assess the fund’s capacity to absorb the loss with net assets, without impacting debt holders in a stressed situation.

The calculated stressed leverage, whether it is based on the stressed asset approach or the risk-based approach, is adjusted with an assessment of market risks, portfolio concentration and risk of strategy to arrive at the risk-adjusted stressed leverage. The importance of each factor, plus its impact on adjusting the risk-adjusted stressed leverage, are determined using these typical characteristics of different funds.

Funding stability and diversity. We assess the fund’s funding stability and diversity holistically by looking at both equity and debt. In terms of equity, we assess the stability and diversity by examining if the fund’s equity is of a permanent nature, whether it has an ability to limit investors’ redemptions when necessary and the nature and diversity of the investor base. The permanent nature of equity and an ability to limit redemptions are especially important for PE funds and those with a long-term investment period, as the underlying assets of these funds are usually extremely illiquid and can be quite vulnerable to investors’ redemptions.

In terms of debt, a fund’s relationship with banks, including facilities that are committed or unsecured, and the maximum borrowing period are all positive factors to stability and diversity. Further, beyond the composition of banking facilities we must also assess the credit standing of these banks. Typically, we expect facilities from non-investment grade financial institutions to be less reliable in severe economic situations.

One additional component to the above, which is especially relevant for HFs, is the fund’s relationship with prime brokers. Typically HFs are able to source working capital from prime brokers as an additional funding source beyond traditional banking credit lines.

Liquidity. The liquidity ratio or liquidity reserve to trading capital ratio is a primary quantitative indicator of liquidity, depending on the fund type. The liquidity ratio compares liquidity sources against liquidity uses in a stressed scenario over the next 12-month horizon to see how sufficiently liquidity sources cover liquidity uses. This ratio is commonly used for funds with stable asset profiles, such as those typically seen in PE funds.

On the other hand, the liquidity reserve to trading capital ratio compares cash and cash equivalents against capital employed in trading (i.e., the sum of long-term debt and equity) to assess the fund’s ability to respond to margin calls. This ratio is therefore typically more relevant for HFs that actively trade various assets, utilizing leverage as part of the strategy

With respect to qualitative measures for all fund types, asset liquidity, cash flow reliability and covenants are important indicators of creditworthiness. In general, a better score is afforded to funds holding higher-rated bonds, as those assets are more marketable and are expected to generate stable interest income even in a stressed situation.

Going One Step Further with Private Market Insights

Collecting information on a fund’s defined investment policy, stability of funding, liquidity needs, track record on performance and more is critical in analyzing the above parameters in the AIF Scorecard. With many funds typically being private in nature, S&P Global Market Intelligence’s expanding private market coverage with robust private company data — including coverage of 16+ million companies worldwide[1] — provides a comprehensive view of capital flows in the alternative markets. From investor targeting and manager selection during fundraising to sourcing investment opportunities to deployment of capital to the eventual exit, you can make informed decisions at each step of the fund lifecycle.

S&P Global Market Intelligence is collaborating with Preqin,[2] a leading provider of data on alternative assets, to help uncover new insights across private markets. Our Private Company Data coverage now incorporates Preqin’s data and metrics, including fund profiles, contacts, fundraising, performance, deals and exits associated with 40k firms and 106k+ funds across multiple asset classes.

Now you can identify new business opportunities, conduct competitor and market analysis and keep ahead of industry developments with data on all aspects of the market and comprehensive coverage on fund managers, funds, deals/exits, investors and more.

Location

Products & Offerings