Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 22 Jul, 2021

By Suming Xue

This is the second blog in a three-part series on AIFs. These funds provide an option to invest in different asset classes − such as hedge funds (HFs) and private equity (PE) − primarily for Limited Partners (LPs) that are typically large pension funds, insurance companies, and family offices. In the first blog, Fund Financing Through a Credit Lens: Understanding the Basics of AIFs, we looked at how fund financing works and a number of critical factors to consider when assessing AIF exposure. We now look further at some of the potential risks with AIFs and available tools to evaluate their creditworthiness.

Key questions when assessing an AIF’s creditworthiness

Identifying an AIF’s potential credit risks may be challenging, and a series of questions should be addressed to help better understand the financial strengths and weaknesses.

S&P Global Market Intelligence’s AIF Credit Assessment Scorecard is constructed to assist in analysing the specific risk factors relevant to AIFs. This includes such factors as concentration, market risk, funding and liquidity risk, and country-level issues. In addition, a good understanding of an AIF's investment performance track record, its internal governance and risk management practices, and the regulatory environment in markets in which it operates can further refine the analysis.

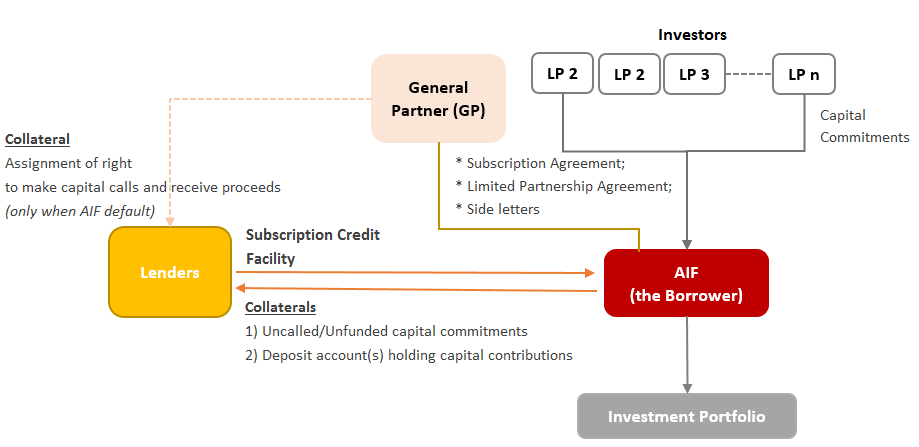

An example of recovery prospects with subscription credit facilities

Historically, subscription credit facilities (capital call facilities) have been used for short-term bridge financing, secured against investors’ committed capital (see Figure 1 for an illustration of a facility structure). According to Preqin, in the past decade, the proportion of funds using subscription credit facilities peaked at 53% for vintage 2016 funds, more than double pre-financial crises 2007-2008 levels.[1] This expansion of subscription credit facilities can be attributed to the fact that these facilities lend against the LP’s uncalled capital commitment,[2] rather than the investments held by the fund. This has the benefit of improving liquidity and operating efficiency, and enhancing competitiveness in investment bidding and cash flow management.

Figure 1: Simple Version of the Structure of a Subscription Credit Facility

Source: S&P Global Market Intelligence. For illustrative purposes only.

Typically, the primary source of repayment for a subscription credit facility is from the unfunded capital commitment of the eligible LPs.[3] Increased pressure due to COVID-19 has made many lenders (both private lenders, as well as financial institutions) ponder what the impact would be if an AIF fails to repay a subscription credit facility, or if LPs are not in a position to pay and/or the amount called from the LPs is a significant amount of an LP’s total commitment.[4]

To address this concern, S&P Global Market Intelligence’s Capital Call Facility Loss-Given Default (LGD) model is designed to identify key aspects that one should consider to assess such potential losses. This includes the creditworthiness of eligible LPs and their total committed, as well as unfunded, capital and their previous loss experience.

As mentioned earlier, identifying an AIF’s potential credit risks may be challenging, and there are a number of questions that should be considered. Taking these questions into account, S&P Global Market Intelligence’s AIF Credit Assessment Scorecard helps assess the likelihood that an AIF will default, and the Capital Call Facility LGD model provides an indication of the potential loss in the event of default. Together they provide lenders with a holistic view of credit risk.

[1] “Subscription Credit Facilities”, Preqin Special Report, June 2019.

[2] Uncalled capital commitment is the portion of an investor’s capital commitment that is unfunded and may be subject to a capital call, excluding any amounts subject to a pending capital call that have not yet been funded as a capital contribution.

[3] Eligible LPs are those that meet the criteria lenders set in the subscription credit facility agreement, for example, having an acceptable credit rating.

[4] There has been only one known institutional default, i.e., Abraaj Group liquidation case in 2018/19. Although there is an elevated concern at the systemic risks given the sizeable exposure to such facilities and the recent influx of new providers entering the subscription lending market from Europe, the U.S., and Asia, there is no anecdotal evidence suggesting that any AIFs failed to repay subscription credit facilities. The purpose of the article is to suggest a tool for estimating the LGD for subscription line facilities in the case of an AIF default, if and when one happens.

Blog

Theme

Location

Products & Offerings