Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 27, 2025

By Adam Wilson and Tony Lenoir

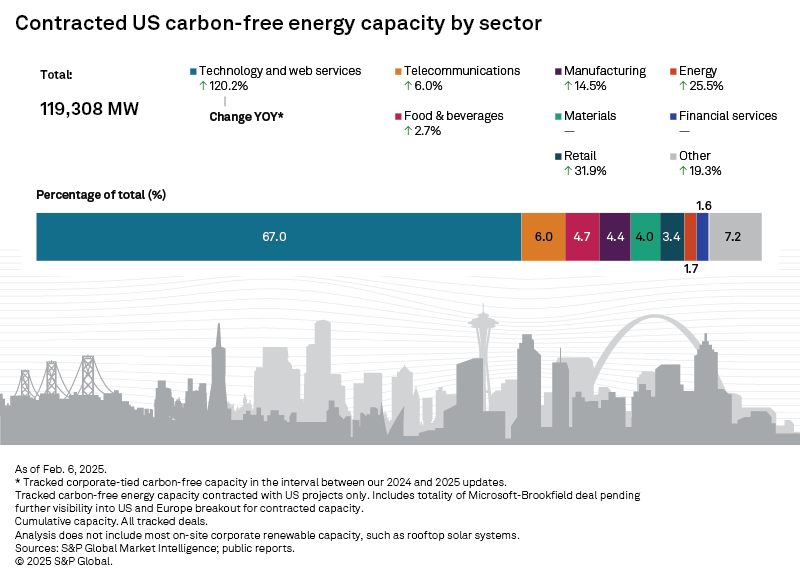

The rise of AI has caused expectations for datacenter electricity demand — and by extension, overall power demand — to skyrocket since the unveiling of ChatGPT in the fall of 2022, prompting a rush toward clean energy purchases. Corporations in the US have contracted nearly 48 GW of additional clean energy capacity in the 12 months since our February 2024 update, with Big Tech driving most of the activity.

Download the 2025 corporate carbon-free energy report and its Excel companion.

➤ Overall, tracked clean energy capacity contracted by corporate offtakers in the US jumped 66.4% between our 2024 and 2025 updates.

➤ The technology and web services sector led the surge, contributing nearly 92% of total new additions.

➤ Nuclear energy makes up 43% of the tracked 47.6-GW increase year over year.

➤ Corporate buyers contracted nearly 14 GW of US solar capacity in 2024, compared to about 2.2 GW of wind capacity.

➤ Texas continues to lead all US states in corporate-tied clean energy capacity, accounting for 27.6% of the tracked total, but Missouri, Pennsylvania and North Dakota experienced the largest annual increases.

➤ US offtakers account for more than 92% of tracked clean energy corporate procurement in the US, according to S&P Global Commodity Insights tracking. European corporations make up the bulk of the balance.

Tech companies pivot to nuclear

Faced with unprecedented load growth due to the rising need for energy-intensive AI datacenters, US tech companies dominated the corporate energy procurement market in the interval under review. Recent projections have datacenter energy consumption doubling to nearly 800 TWh by 2030 — more than triple the amount of electricity California consumed in 2023. To maintain pace with ambitious, self-imposed clean energy targets, datacenter companies were forced to take assertive action in energy procurement.

Microsoft Corp. and Brookfield Renewable Corp. announced one of the largest corporate renewable deals in history in May 2024, partnering to add 10.5 GW of renewable capacity to the grid in the US and Europe by 2030. Seven months later, Switch Inc. announced a partnership with advanced nuclear technology startup Oklo Inc. to build 12 GW of nuclear energy. Based on S&P Global Commodity Insights tracking, US tech companies signed clean energy deals across the US and the rest of the world totaling over 47 GW between February 2024 and February 2025.

Switch's announcement with Oklo was not the only nuclear deal announced in 2024. Nuclear generation resurged in 2024, given the technology's ability to service large loads without interruption and without emitting greenhouse gases. Over 20 GW worth of nuclear deals were announced since February 2024 — all to tech companies — though most of this capacity is unlikely to come online before 2030. See S&P Global Commodity Insights' 2025 US datacenters and nuclear energy report.

Solar remains the preferred technology for corporate offtakers securing clean energy capacity in the US, however, accounting for 49.1% of overall corporate-tied US clean-energy capacity tracked as of this report. Wind is a distant second, representing only 23.9% of the total.

Data visualization by Chrisallen Villanueva.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Theme

Location

Products & Offerings

Segment