Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 5 Feb, 2024

In a hyperinflationary environment since 2018, and hitting an astounding 134% annual average consumer price inflation rate last year, Latin America and Caribbean market Argentina faces a volatile present and future. Still, the second-largest South American country (Brazil is the biggest in territory terms) has a relatively stable mobile market competition-wise, with the three major operators having a fairly even share of the total for the last four years.

Considering the latest results from the third quarter of 2023, Argentina's mobile subscriptions are led by América Móvil SAB de CV's Claro Argentina (39%), followed by Telecom Argentina SA's Personal (33%) and Telefónica SA's Telefónica de Argentina SA, branded Movistar (28%). Those ratios have barely changed over the last four years despite the challenging economy.

Also unchanged was how dominant the prepaid model is, accounting for 55.1% of Argentina's total subscription base as of the third quarter of 2023. Prepaid lost some of its market share due to increased machine-to-machine (M2M) adoption, which grew from a 3.6% share in the first quarter of 2019 to 7.1% in the third quarter of 2023, according to our estimates. Excluding M2M, postpaid subscriptions decreased from 39% to 37.8% of the market share in the same period, reflecting the macroeconomic conditions of high inflation and lower average household income.

Finance

Argentina's deteriorating economy and rampant inflation had a significant impact on mobile industry revenue over the last four years, which was only aggravated by the COVID-19 pandemic. According to S&P Global Market Intelligence, the country registered inflation of 134% in December 2023 on average annually, the highest in 32 years, impacting both companies and consumers.

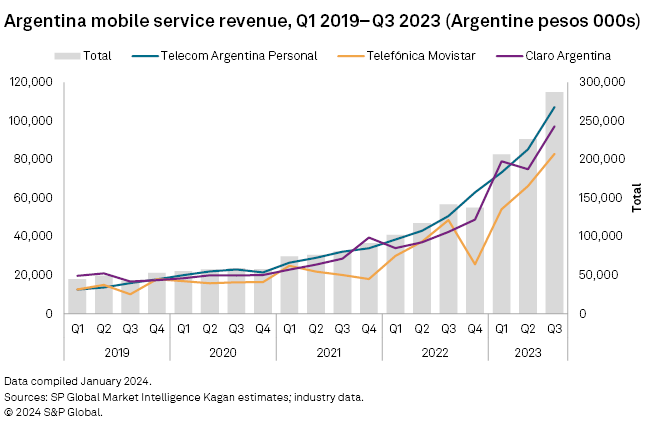

For instance, when reviewing data in local currency, the industry's total mobile revenue grew 104%, from 144.3 billion Argentine pesos in the third quarter of 2022 to 294.5 billion pesos in the quarter ended September 2023. Over the same period, the total market subscribers were up only 3%.

Reviewing data converted from Argentine pesos into US dollars mutes the impact of hyperinflation and actually skews in the opposite direction when reviewed in local currency. In the first quarter of 2019, total mobile service revenue converted to US dollars for the entire country was $1.04 billion, dropping to $827.2 million in the third quarter of 2023.

Industry total monthly average revenue per user in US dollars went through the same impact, hitting the lowest in recent years during the fourth quarter of 2020 at $3.86. By the third quarter of 2023, it was $4.20, still down 23% year over year. Worth noting are Movistar's heavy swings on both revenue and ARPU in 2022, reportedly due to a $72.4 million impairment impact. Over the last five years, industry ARPU in Argentina has ranged in the mid-single digits in US dollars per subscriber per month.

Deregulation

Argentina President Javier Milei's new government is still struggling to stabilize the economy. A reform proposal called "Omnibus Law" promised a complete economic overhaul but ultimately excluded a dollarization plan for a later date to gain traction in Congress. If the currency replacement still happens, it would take at least a year or more to be effective.

The Omnibus Law also seeks to deregulate industries including telecommunications. Argentina's communications regulator Enacom (Ente Nacional de Comunicaciones) went through a 180-day federal intervention by Milei's decree in January 2024 with the intention to review rules and foster investment in new technologies. As noted, mobile service revenue should take a hit in 2024, but not as much as it did in 2020, when it plunged 41% on a yearly basis to $2.27 billion.

Technology

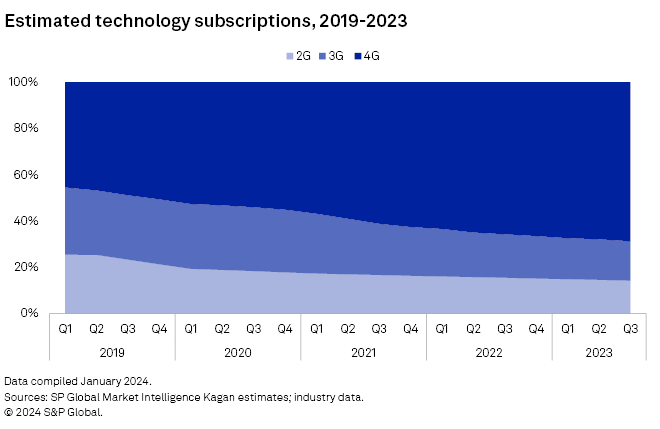

What did change over the last four years was the 4G dominance on the market, growing from 45.5% of the total subscriptions back in the first quarter of 2019 to 68.7% at the end of September 2023, It now has a total of 43.4 million subs, according to Kagan estimates.

In a year-over-year comparison, 4G grew 7.7% in the third quarter of 2023, but 3G and 2G decreased 7.1% to 10.7 million and 5% to 9.0 million, respectively. While 5G is still being deployed in Argentina with soft launches and with Dynamic Spectrum Sharing (DSS, which uses bands assigned to 4G), hyperinflation may impact operators' capital expenditure capacity for updating the network, as well as customers' disposable income to buy new compatible smartphones and data packages.

Spectrum and Towers

In October 2023, Argentina's regulator Enacom hosted its 5G auction offering the 3.5 GHz band and raising $875.1 million. Claro and Personal both grabbed 100 MHz, while Movistar got a 50 MHz block.

Relative to Mexico and Brazil, Argentina has an enviable spectrum allocation. Including this last auction, Kagan estimates 787.4 MHz in total for the country, implying 80,916 subscriptions per MHz, a lower spectrum congestion than Brazil's 150,431 subs per MHz (excluding millimeter spectrum) and Mexico's 212,331 subs per MHz.

Also unlike Mexico and Brazil, Argentina's tower market is still more driven by the operators. Argentina has about 4,021 subscriptions per tower. Mexico's ratio is lighter, with 2,675 subs per tower, while Brazil sits somewhere between with 3,084 subs per tower. Enacom said the country had 26,735 antennas (4G) in June 2023.

Major groups

Personal

The market leader in revenue terms, Telecom Argentina's Personal tried to keep a stable track record for the topline in recent years. That does not mean the company is immune to the impact of the macroeconomy. In the third quarter of 2023, revenue declined 11% to $306.3 million, while ARPU fell 14% to $5.01. In local currency, it grew 112%, which is below the average annual inflation.

Personal's subscriber base grew 4% in the third quarter of 2023, boosted by 10% growth in prepaid subs. The company has 20.7 million mobile subscriptions.

Movistar

Movistar is part of Telefónica Hispam, which includes Chile, Peru, Colombia and Mexico. Argentina's Movistar is the biggest market in revenue of those for Telefónica. In the third quarter of 2023, revenue was down 33% to $223.8 million and ARPU was down 34% to $4.21.

Over the last four years, the company lost regular prepaid and postpaid subscribers, but managed to grow M2M, which is now 12.1% (2.1 million) of its total (17.8 million) subs. The machine-to-machine segment helped grow subs by 1% for the year ended September 2023.

Claro

Like its competitors, Claro struggled at the end of 2020 due to the COVID-19 pandemic and the increase of inflation-linked costs and dollar-based expenses, which remains an issue today. The company showed a third-quarter 2023 revenue decrease of 4%, down to $277.6 million, and a 20% decrease in ARPU ($3.39). América Móvil cited the 130% devaluation of the Argentine peso, though its decline was not as steep as its competitors.

Unlike its competitors, Claro managed to grow all segments of its customer base, even considering postpaid without M2M. By the end of September 2023, it was the market leader with 24.5 million subscriptions, up 3% year over year. Prepaid grew 3% to 15.2 million subs, while postpaid excluding M2M grew 2% to 8.2 million and M2M grew 11% to 1.1 million.

Mobile virtual network operators

There is only one MVNO in Argentina: Imowi, a 14,000-subscriber company from Cámara de Cooperativas de Telecomunicaciones (Catel) that uses Movistar's spectrum combined with its own infrastructure to reach underserved areas. It currently offers 3G and 4G, with plans to deploy 5G when the 3.5 GHz band becomes available.

Nuestro, an MVNO from Federación de Cooperativas del Servicio Telefónico de la Zona Sur Limitada (Fecosur), used Telecom Argentina's network for regional coverage in rural areas, but it's now out of business. Last year, Enacom approved local Internet Service Provider (ISP) TELECENTRO S.A. to launch an MVNO, but MNOs Movistar and Personal questioned the price imposed by the regulator to share their networks. As of January 2024, Telecentro has not launched its mobile operations.

As of Feb. 22, US$1 was equivalent to 838.30 Argentine pesos.

Wireless Investor is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

BLOG

RESEARCH

Location

Segment