Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 09, 2024

We see these 10 themes shaping the business environment in the Latin America region in 2024.

Download our strategic report on global themes for 2024

1. Economic growth will slow.

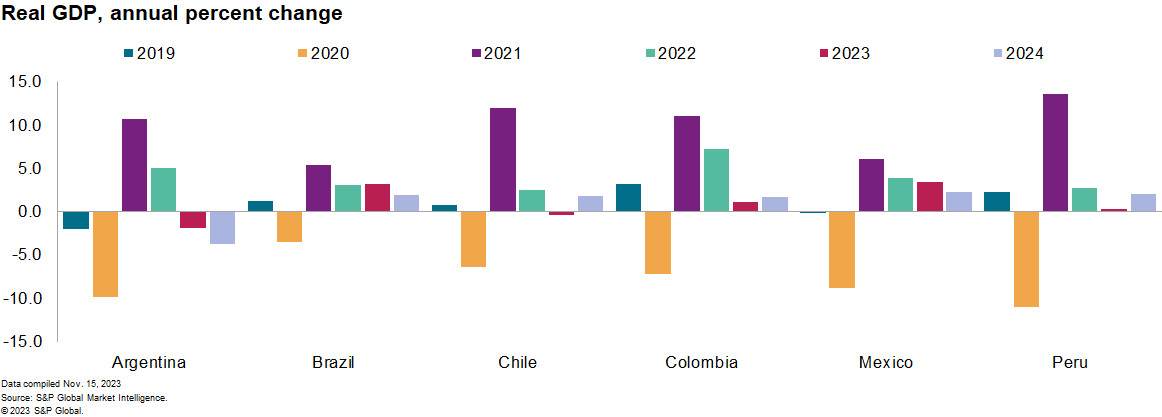

Latin America has reached the end of its post-pandemic recovery and faces softer external markets for commodities like copper and food. At the regional extremes, Argentina will remain in recession, while Guyana is set to grow rapidly in 2024. Risks to our 2024 regional baseline include severe adverse weather conditions via El Niño, which could disrupt agricultural output, increase food price inflation, and damage infrastructure.

2. Inflation will decline, increasing scope to ease monetary policy.

We expect both headline and core inflation to continue falling in 2024, although more slowly than in 2023. Further declines in inflation will support a less restrictive monetary stance in 2024, particularly in Brazil, Chile, and Peru. Argentina will be an outlier where inflation will increase and remain at triple-digit levels. Services inflation — which has remained sticky in 2023 due to demand shifting from goods to services — should decline because of the region's economic slowdown. We do not expect labor costs to put upward pressure on prices, other than those related to minimum wages, which are likely to increase in real terms.

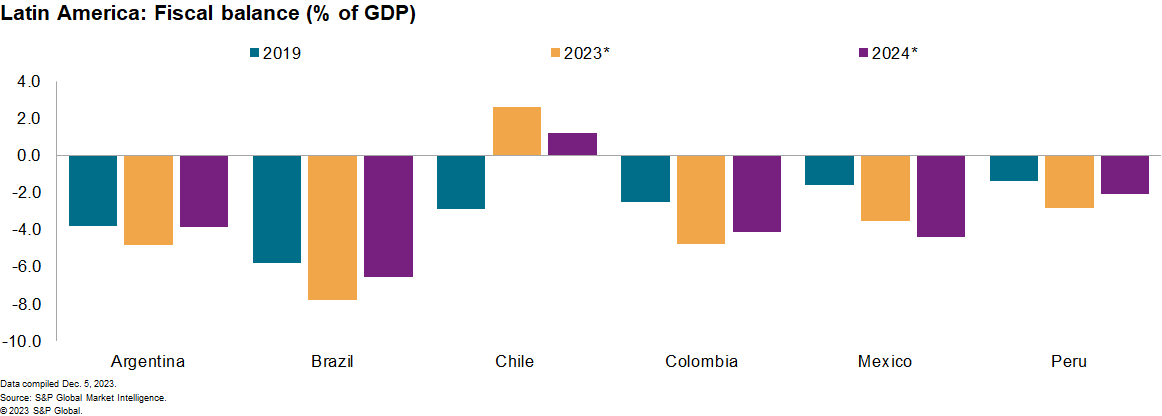

3. Commitment to fiscal discipline is likely.

Most Latin American governments will maintain fiscal sustainability in 2024. Indicators suggest low political appetite to return to prior policies of maintaining strongly expansionary fiscal policy combined with debt accumulation and, in some cases, excessive recourse to central bank "money printing." Chile, Trinidad and Tobago, and Dominican Republic will be among the strongest performers in terms of improving fiscal metrics. The largest expenditure cuts across the region will take place in Argentina, where President Milei has promised a reduction in government spending of at least 5% of GDP. A slight fiscal deterioration is likely in Mexico, with the government likely to increase spending to complete flagship projects before the June presidential election.

4. Argentina will face the most severe challenges in meeting debt repayments in 2024.

Debt-related developments in Latin America will be dominated by how Argentina addresses its heavy 2024 repayment schedule. A renegotiation of the IMF agreement to ensure the prompt disbursement of funds needed to meet the US$2 billion repayments due in January and April remains at a preliminary stage. Unless the new administration obtains fresh funds to meet debt repayments, a debt restructuring process is likely. Bolivia, Ecuador, and El Salvador also will also face acute liquidity constraints. More broadly, Latin America's public-debt levels appear on a positive trend.

5. Argentine and Bolivian banks will be among the most vulnerable amid moderate deterioration.

The banking outlook for 2024 is projected to diverge within the region. Banks in Mexico and most of Central America face a potential economic slowdown from a resilient base, given past caution with credit disbursements and strong capitalization. Ecuador, Colombia, Chile, and Peru will likely see their nonperforming loans (NPLs) rising through at least the first half of 2024, although their high loan-loss provisions will cover potential losses. Argentine and Bolivian banks will be highly exposed to their countries' sovereign debt position.

6. Opposition-led congresses across the region are highly likely to slow policymaking.

Most Latin American presidents will face the challenge in 2024 of their ruling parties lacking control of their domestic legislatures, slowing policymaking across the region. They will therefore need to secure — and nurture — alliances with opposition parties to progress their legislative programs.

7. Latin America's foreign policy unity will be tested by Argentina's Milei assuming power.

Under Brazilian leadership, Latin America adopted a relatively cohesive foreign policy during 2023. Milei's victory in Argentina is likely to generate regional policy splits. Milei has withdrawn Argentina's plans to join the BRICS grouping and favors a closer relationship with the US.

8. Argentina will face the highest risk of civil unrest in 2024.

Extensive austerity measures to reduce the fiscal deficit under President Milei would increase the likelihood of protests and industrial action across all sectors in Argentina. Vandalism, looting, and disruption to critical infrastructure such as ports are likely if the new government withdraws subsidies and social benefits. Countries including Peru, Ecuador and Colombia face higher risks of disruptive protests affecting extractive projects.

9. Energy transition and adjustments to global supply chains will continue to boost investment.

Latin America is attracting significant and diverse foreign investment, particularly in the critical minerals, renewables, and manufacturing sectors. Excluding Mexico and its concentration of automotive-focused pledges due to the ongoing nearshoring opportunity, the sectors attracting greatest investor interest in the region have been mining, renewables, and hydrocarbons. A key indicator of investment dynamics will be the launch of bidding rounds in the Chilean lithium sector, and likely further lithium investment opportunities in Argentina.

10. Organized crime-related risks will increase.

Major organized criminal groups are likely to continue expanding in Central and South America, seeking to secure control over wider drug trafficking routes through international ports. These larger international groups have started building alliances with local groups in Colombia, Ecuador, Guatemala, Paraguay, Bolivia, and Venezuela, fueling domestic rivalries, and exacerbating street-level violence, particularly in ports and surrounding urban areas. Their efforts to secure supply chains through ports and infiltrate drugs into legitimate cargo will worsen risks of cargo seizure and theft, and extortion targeting ports, mining and cargo.

Learn more about our data and insights

— With contributions from Tomás Baioni

Editor's note: This blog is based on a strategic report that was initially published in December 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.