S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

08 Apr 2025

01 Apr, 2025

By Arpita Banerjee and Ayesha Shahbaz

US banks' commercial and industrial loan delinquencies increased while the total value of such loans dipped in the fourth quarter of 2024.

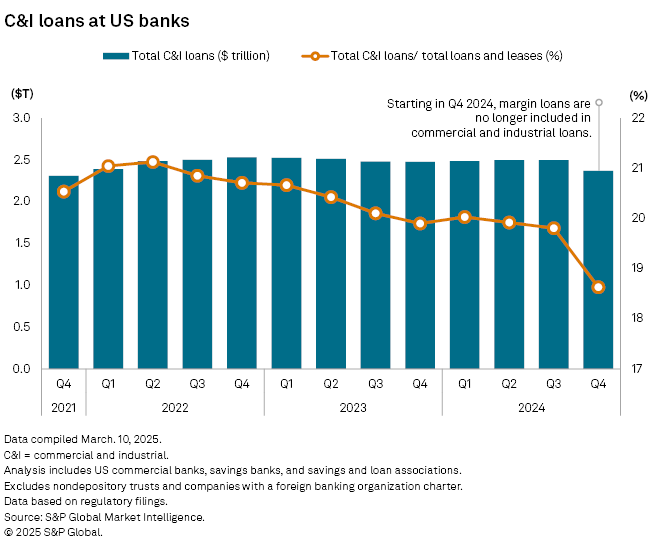

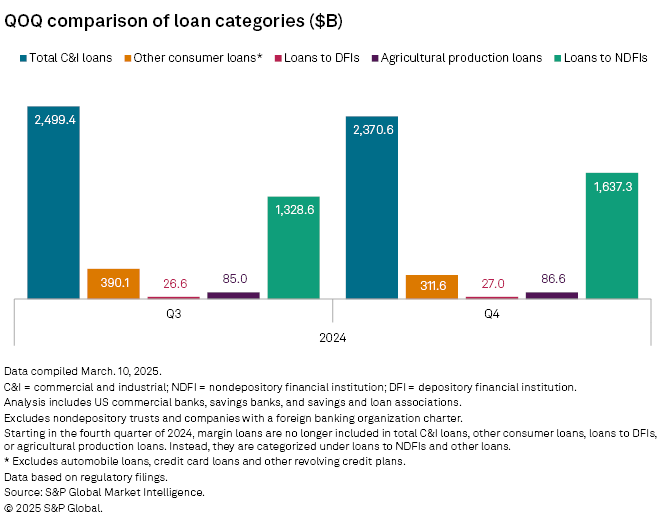

The US banking industry ended the quarter with a lower commercial and industrial (C&I) loan balance compared to levels three months ago and a year earlier, in part because of a classification change that led to the exclusion of margin loans from C&I loans. C&I loans dropped 5.2% from the prior quarter and 4.3% year over year to $2.371 trillion, according to S&P Global Market Intelligence data.

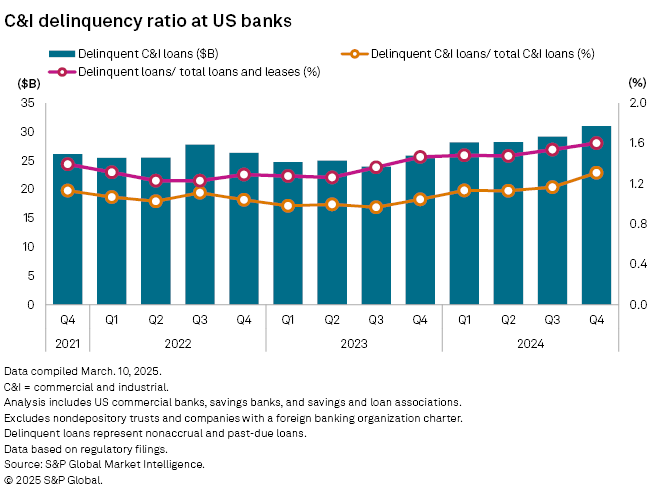

Delinquent C&I loans, meanwhile, increased about 6.4% from the previous quarter and 19.8% year over year to $31.04 billion. The C&I loan delinquency ratio was 1.31%.

Top C&I lenders in Q4 2024

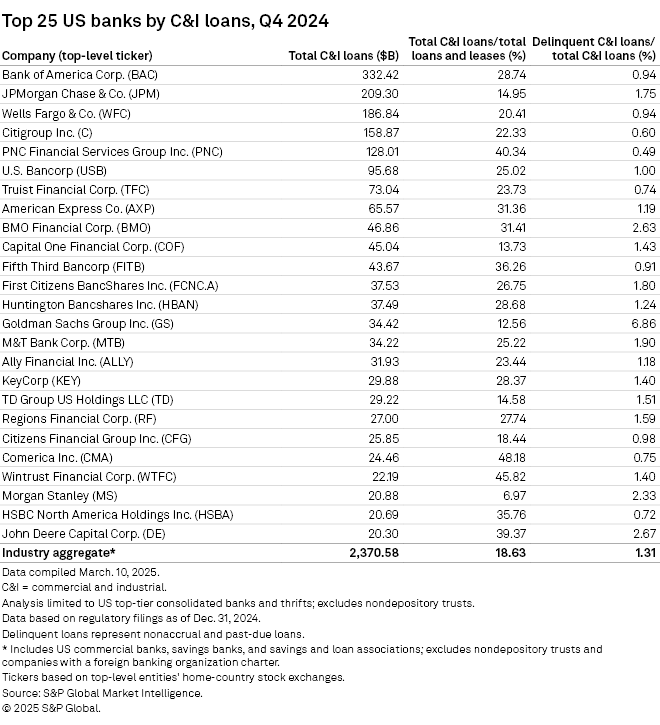

Bank of America Corp. was the top C&I lender in the fourth quarter of 2024. The bank ended the period with $332.42 billion of C&I loans, which accounted for 28.74% of its total loan portfolio. The ratio of delinquent C&I loans to total C&I loans was 0.94%.

JPMorgan Chase & Co. took second place with $209.30 billion in C&I loans at the end of the fourth quarter. Other top lenders included Wells Fargo & Co. with $186.84 billion in C&I loans, Citigroup Inc. with $158.87 billion and PNC Financial Services Group Inc. with $128.01 billion.

Among the top 25 C&I lenders, Goldman Sachs Group Inc. reported the highest proportion of delinquent C&I loans to total C&I loans at 6.86%.

During a Feb. 11 conference presentation, JPMorgan Chase COO Jennifer Piepszak said "lending demand has remained muted" in 2025, stating that despite some companies accessing loan and bond markets, much of the activity has been refinancing rather than new loan growth.

"Going back to the sort of cautiously optimistic sentiment around a wait-and-see approach, I think that is probably weighing a little bit on loan demand at this point," Piepszak said.

U.S. Bancorp CFO John Stern noted that while there are "pockets of growth" in C&I lending, particularly on the corporate and middle-market side, the pickup has been sporadic. Stern added that the C&I segment is an important factor that can help generate lending growth in the second half of the year.

"As we get through the uncertainty and people have a sense of where things are going, we think that can be a driver," Stern said during March 5 conference presentation.

A few banks noted increased C&I loan demand as customers prepared for a potentially complicated economic environment.

KeyCorp CFO Clark Khayat mentioned during a March 4 conference presentation that some customers are pulling forward inventory in anticipation of market changes.

Fifth Third Bancorp expressed confidence in its commercial lending pipeline, noting that it remains robust, as the bank expects continued investment from clients, particularly in response to economic challenges.

"So you have some customers looking at it and saying that, 'Maybe I need to go and be a little bit proactive on inventory build in this environment just to get in front of the tariff risk,'" Fifth Third CFO Bryan Preston said at a March 5 conference. "You also have others that are saying, 'I need to continue to invest in onshoring my supply chain to help protect myself ... from a tariff perspective.'"