Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Apr, 2025

|

With its latest revamp, Europe's largest bank shifts its focus further toward growth markets in Asia. |

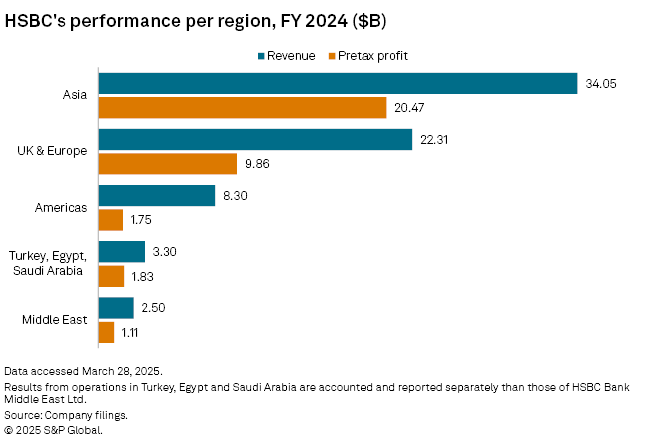

HSBC Holdings PLC's latest restructuring shows a clear shift toward Asian markets and paves the way for medium-term growth in wealth management in the region.

The UK-based group, which generates most of its revenue in Asia, has been steadily pivoting to the region over the past few years. Its new strategy is seen as another step on that journey, with HSBC launching a dedicated division around its second home market of Hong Kong and betting on further expansion elsewhere on the continent.

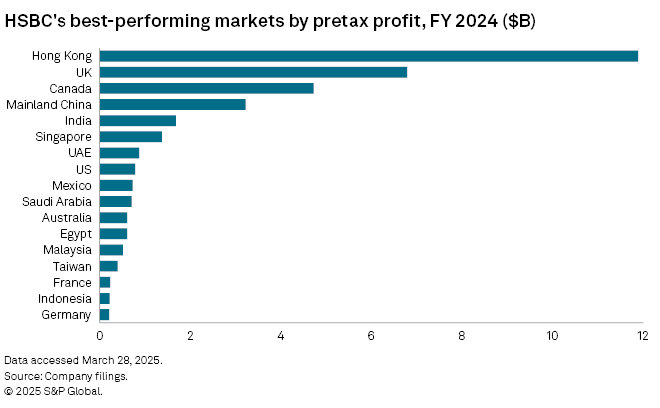

HSBC is targeting higher revenue from wealth management in Asia, where changing economic dynamics provide fertile ground for medium-term growth, with Hong Kong set to overtake Switzerland as the world's biggest cross-border wealth hub by 2030, new CEO Georges Elhedery said at a business conference March 18.

"There's underlying market growth, a rising middle class in a number of Asian economies, the rising need for diversification of financial investments," Elhedery said. Wealth in Asia is expected to increase at a compound annual growth rate (CAGR) between high single digits and 10% over the next five years, with HSBC poised to capture more of that growth, the CEO said.

Key growth driver

Analysts consider this strategy a good bet for boosting revenue and profitability at the group level over the next few years.

Asian wealth management is "a significant business" for HSBC and among the areas of "clear competitive advantage and accretive returns" where the group aims to reallocate $1.5 billion of costs from the winding down of nonstrategic operations, said Alessandro Roccati, senior vice president financial institutions at Moody's Ratings.

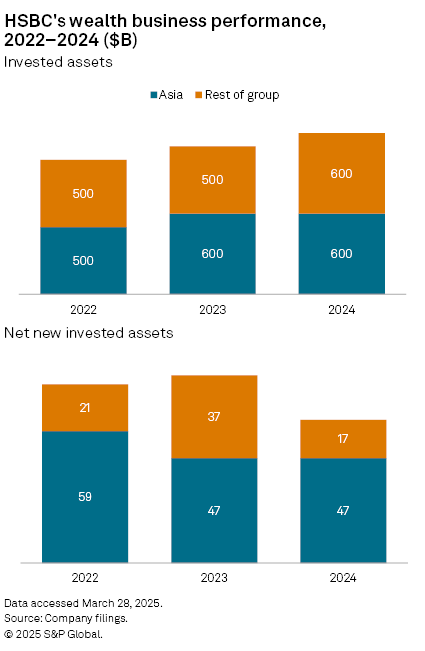

The business is already a major contributor to HSBC's wealth fee revenue, which has grown by a double-digit percentage rate in each quarter of 2024, said Richard Barnes, a senior director in S&P Global Ratings' financial services ratings team. Wealth fees accounted for 11% of total revenue in 2024, "so it is a pretty important business" for HSBC, Barnes said. Hong Kong's expected rise to the world's top cross-border wealth hub is a trend "playing into their hands," while there is also "good growth" across the rest of Asia and the Middle East where HSBC has a strong presence too, Barnes said.

HSBC booked a 32% year-over-year increase in wealth revenues in Asia in 2024, which drove the 18% increase in group wealth revenue for the period, bank filings show. With $47 billion, Asia accounted for the bulk of the $64 billion of net new invested assets that HSBC attracted in 2024 and roughly half of the group's total invested assets for the period, the filings show. This supports HSBC's target of growing group wealth fees by a double-digit CAGR over the medium term, the bank said.

Playing on strengths

Despite the heightened uncertainty due to geopolitical and trade tensions at the moment, HSBC seems to have "a niche and competitive advantage when it comes to Hong Kong and how they facilitate businesses in Asia," Yeterian said.

Singapore, the United Arab Emirates and Hong Kong — three regions HSBC plans to invest in over the medium term — are expected to see the strongest growth in cross-border wealth flows globally, recording CAGRs of 8.5%, 7.7% and 6.0%, respectively, for 2023–2028, according to Boston Consulting Group's most recent global wealth report.

"[W]e expect ongoing geopolitical tensions to keep demand for diversification and safe haven booking centers high over the next several years, leading to slightly faster growth of cross-border wealth overall," the consulting firm said in the report published July 2024.

HSBC considers itself well positioned to maintain its franchise throughout a potential realignment of supply chains triggered by the new US import tariffs as they are present in 85% of global trade corridors, S&P Global Ratings' Barnes said. HSBC benefited from "similar shifts in the late 2010s when the amount of trade directly between China and the US reduced and new intermediate stops such as Vietnam were introduced," Barnes said.

"There is certainly potential for disruption, but equally HSBC is there for customers as they respond to the new tariffs," Barnes added.

Keeping shareholders happy

Enhancing HSBC's focus on Asia is likely conducive to a better valuation multiple and also less likely to result in discontent among the shareholder base, said John Cronin, founder and research analyst at SeaPoint Insights.

In February 2021, former HSBC CEO Noel Quinn announced a plan of "moving the heart of the business to Asia" that kickstarted its multiyear shift to east from west. Since then, the group's share price has more than doubled and its price-to-tangible book ratio has risen to 1.28x from 0.76x, S&P Global Market Intelligence data shows. In 2024, HSBC returned more capital to shareholders as a share of profits than any other big European bank, distributing $26.9 billion in buybacks and dividends. The group is expected to rank among the top three in terms of shareholder returns in 2025, together with ING Groep NV and UBS Group AG, data by Market Intelligence's Dividend Forecasting unit shows.

In 2023, the group fended off an attempt by its largest shareholder, Ping An Insurance (Group) Co. of China Ltd., to split up the group's well-performing Asian business into a separate entity in order to boost its market value. The split-up plan presented by Ping An in 2022 was rejected by HSBC's management and the group's annual general meeting by a majority. In late 2023, Quinn said HSBC's strategy to keep the group together while shifting its focus to Asia has worked better for shareholders, resulting in higher operating performance and return on tangible equity for the group.

Elhedery's plan continues the pivot to Asia while not completely deemphasizing other key markets, such as the UK, Cronin said.