Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Mar, 2025

By Eric Wolff, Anthony Rizkala, and Kip Keen

| Canadian gold will likely find other buyers after the US increased costs for Canadian imports by 25%. Pictured above is Newcrest Mining's Red Chris gold mine in British Columbia. |

The steel and aluminum sectors may strain under the weight of newly imposed US tariffs on most goods imported from Canada and Mexico, producers and experts told Platts, a part of S&P Global Commodity Insights.

US buyers of goods from Canada and Mexico face a 25% tariff as of March 4. But Canadian and Mexican miners of primary metals will still be able to sell their products into the global market with minimum impact.

The broad measures upend decades-long trading relationships between the three countries and disrupt tightly woven, cross-border industries in aluminum and steel and other sectors including metal-intensive car manufacturing. An exception for Canadian energy and critical mineral resources imposed only a 10% tariff on various commodities including aluminum, lithium, coal and uranium.

"These developments have been shocking," said Jonathan Wilkinson, Canada's minister of natural resources, speaking March 4 at the Prospectors & Developers Association of Canada conference in Toronto. "Most Canadians — seeing our long-time best friend treat us essentially as an adversary — it has generated significant sadness, concern, and I'd say anger."

Mexican President Claudia Sheinbaum delayed her country's response, but Canada immediately imposed 25% tariffs on $30 billion worth of US goods, with plans to increase to $155 billion. Ontario premier Doug Ford said March 4 that the Canadian province will impose a 25% surcharge on electricity exports to three US states if President Donald Trump pursues further tariffs. Ford has also floated the possibility of blocking metals exports.

The aluminum and steel industries face the prospect of additional 25% tariffs for their products when sold into the US starting March 12, and the stacked tariffs will drive up costs, analysts said. But producers of battery metals told Platts that the US is not a primary market, and they will easily find other buyers for their wares, while gold and silver experts said the geopolitical instability may drive up prices.

If the trade war escalates, Wilkinson reiterated Canada's position that all options are on the table, including nontariff countermeasures. Wilkinson singled out US dependence on Canadian minerals and metals including nickel, uranium and germanium.

"I would say in that regard, certainly critical minerals in particular, I think, are an important part [of the options] that we need to consider," Wilkinson said.

The minister pointed to comments made March 3 by Ontario Premier Ford, raising the possibility that the province would block some exports of metals such as nickel.

"We don't understand the logic of this," Pierre Gratton, president and CEO of the Mining Association of Canada, told Platts. "It doesn't make sense to us. I mean our sector has always believed in free and open markets. ... The US needs what we produce. Tariffs on metals just hurt the American manufacturing sector or force them to buy from other countries, like Russia."

Steel and aluminum

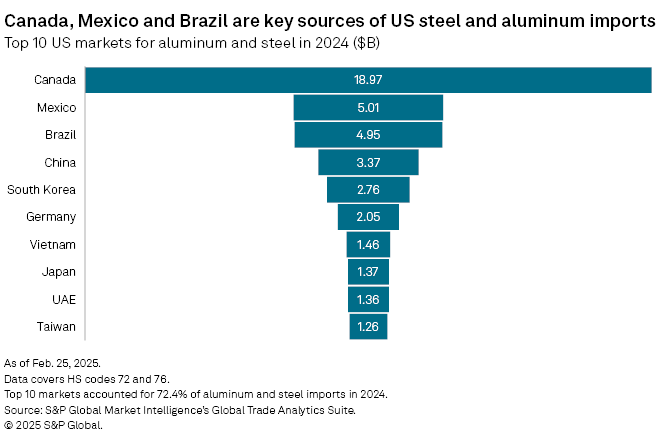

The US imported $18.97 billion in steel and aluminum products from Canada in 2024, and another $5.01 billion from Mexico, according to S&P Global Market Intelligence's Global Trade Analytics Suite data.

US steel producers have long sought increased trade protection. But tariffs on Canadian goods risk disruption to the interwoven industries.

"The [United Steel Workers union] stands firmly in favor of fixing our broken trade system and reining in the global overcapacity that for too long has threatened key domestic industries and with them good, community-sustaining jobs," David McCall, international president of the United Steel Workers, said in an emailed statement.

"Tariffs for the sake of tariffs, however, do not reflect the strategic planning we need to carry trade reform into the future," McCall said. "While we welcome efforts to rebalance our trade relationships, we urge the administration to reconsider its stance on Canada."

Platts assessed the daily TSI US hot-rolled coil index at $910 per short ton on an ex-works Indiana basis on March 3, up $10 from Feb. 28. The steel price assessment has risen 26.39% since the start of February.

The aluminum industry praised Trump for imposing tariffs on China, while warning of the risk in raising costs on Canadian aluminum. US buyers of goods from China face a 20% tariff as of March 4.

The industry spent $10 billion in expansions over the last 10 years, according to the Aluminum Association trade group.

"In order to keep that growth going, the industry needs ready access to affordable metal," Charles Johnson, president and CEO of the association, said in an emailed statement. "Today, about two-thirds of the primary aluminum and much of the scrap aluminum America uses comes from Canada. ... Our aluminum trading relationship with Canada is a very good deal for American workers and consumers."

The Platts-assessed spot 99.7% P1020 US Aluminum Transaction Premium was 41.75 cents per pound plus London Metal Exchange cash, delivered Midwest, net 30-day payment terms March 3, unchanged from the previous assessment.

This assessment, also known as the Midwest Premium, has increased 65.3% since the start of February due to pre-tariff buying and is currently sitting at an all-time high.

Silver and gold

Mexico, which produced 20.6% of the global silver output in 2023 according to Market Intelligence data, sells much of its product to Southeast Asia and South America, producers told Platts.

"It's a very small impact to us," Dan Dickson, CEO of Endeavour Silver Corp., told Platts on the sidelines of the conference. "Ultimately from the Mexico standpoint, it's going to be about reciprocal tariffs and what comes through." The company's silver assets in Mexico include the Guanacevi and Bolañitos mines.

The geopolitical instability may benefit gold and silver, both of which have enjoyed a year-long bull run and set new price highs in the last 12 months, according to Market Intelligence data.

"Geopolitical risk and tariffs, all these things will continue to drive precious metals," said Steven Reid, managing director at CIBC Capital Markets, speaking on a panel at the conference.

Reid and some other analysts cast the tariffs as a threat to base metal prices, given the potential for demand to fall on higher prices and broader impacts to the global economy.

But metals and mining finance experts on the panel underscored the unpredictable nature of the tariff threat. The Trump administration has launched trade policies "at a rapid pace and has taken two steps forward, one step back at times in some of their decisions," Joshua Goldfarb, managing director of investment and corporate banking at BMO Capital Markets, said on the conference panel.

The duty rate is already up in the air. On March 4, the first day of the tariffs, Commerce Secretary Howard Lutnick said Trump may make adjustments on March 5 after ongoing talks with Canada and Mexico.

"I think he's going to work something out with them," Lutnick said, according to media reports. "It's not going to be a pause, none of that pause stuff."

Similar to certain other experts, Goldfarb said he expects precious metals to benefit from tariffs. Higher prices could continue to benefit precious metals miners, though inflation and rising costs may eat away at fatter margins.

Battery metals

The tariffs raise prices for a swath of metals that the US imports including battery metals such as lithium and cobalt, where the US depends on imports. Simon Moores, CEO of Benchmark Mineral Intelligence, said he has already seen an increase in pricing.

"That's an immediate jump from tariffs," he said.

The higher costs cause problems for industries including battery-makers that buy lithium, cobalt and graphite from non-US producers. That makes it tougher for those domestic industries to compete without significant mines for the metals in the US.

"Your supply chain strategy is completely exposed," Moores said.

Globally, US battery metals consumption is dwarfed by China. China's electric vehicle industry will consume 366,255 metric tons of lithium carbonate equivalent in 2025, according to the latest forecast by Commodity Insights' Metals and Mining research team, in a report released Feb. 25. That is nearly half of global EV consumption for the year and double what US carmakers will use.

Though US buyers of Canadian battery metals face the relatively smaller tariff of 10%, Canadian producers expect to redirect their wares to the rest of the global market.

"It's always been interesting to me that people would typically focus on the principal or the basic premise that US auto market demand somehow represented the bulk of the market," Ken Brinsden, president and CEO of Patriot Battery Metals Inc., told Platts at the conference. The company is developing the Shaakichiuwaanaan lithium project in Quebec.

"We don't get overly concerned. It's just not really the main game," Brinsden said. "The main game is all about China and Korea."