Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Mar, 2025

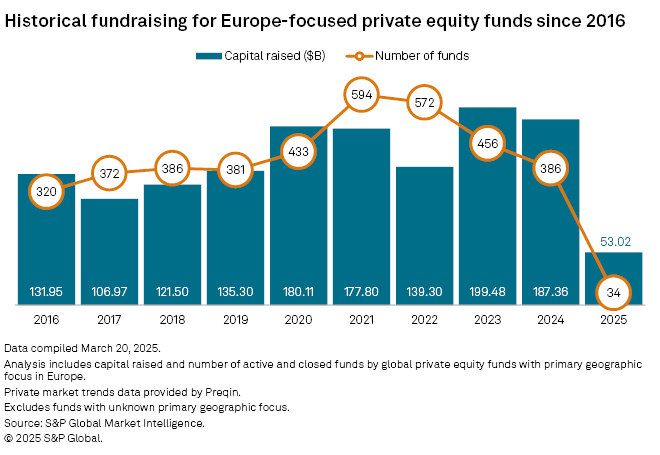

The number of Europe-focused private equity and venture capital funds fell for a third straight year in 2024, with active and closed funds numbering 386, down from 456 in 2023, according to S&P Global Market Intelligence data.

The 2024 figure is the lowest number of funds since 2019.

Liquidity issues have been a headwind for Europe-focused funds. Exits were hard to come by, slowing distribution to investors, said Christiaan de Lint, managing partner at Headway Capital Partners LLP.

"The lack of distributions made dedicated programs less capable to make follow-on investments or re-ups in their existing managers," said de Lint.

|

– Download a spreadsheet with data in this story. – Read about Asia-focused private equity fundraising. – Explore more private equity coverage. |

Europe followed the trend of a decline in global private equity exits, which reached a five-year low of $392.48 billion in 2024, mainly due to a mismatch in valuation expectations between buyers and sellers.

"Firms have been quite cautious in launching [funds] because they're very aware that they need to deliver returns to their investors," said Michael Henningsen, managing director at private equity placement agent Raymond James Private Capital Advisory.

"Until they've had exits, whether that's full sales of portfolio companies, IPOs, recapitalizations or a secondary process, it will be challenging for managers to deliver returns to their investors."

Flight to quality

The amount of capital raised has nonetheless been strong. In 2024, although total capital raised decreased to $187.36 billion from $199.48 billion in 2023, it was the second-highest amount in at least a decade.

Limited partners exercised caution and focused on allocating to larger and more familiar players, de Lint said. "It's easier to invest with a big fund than a low mid-market fund," which may struggle in the challenging environment.

Thirty-one Europe-focused private equity funds reached final close in 2024 with at least $1 billion in capital, accounting for 66% of all capital raised by Europe-focused vehicles, according to Market Intelligence data.

EQT AB (publ) secured $23.95 billion at the final close of its EQT X fund, the largest Europe-focused vehicle of the year.

The fund's largest limited partners were Government Pension Investment Fund of Japan and California Public Employees' Retirement System, which allocated $540.25 million and $500 million, respectively.

The second-largest fund was Cinven Ltd.'s Eighth Cinven Fund SCSp, which secured $14.44 billion.

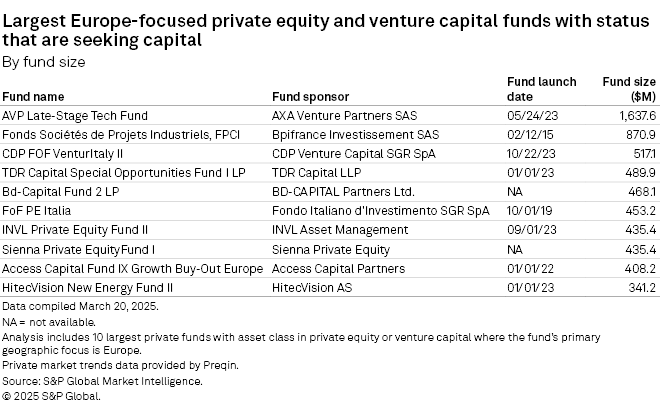

The largest fund in the market is managed by AXA Venture Partners SAS, which has pulled in $1.64 billion for its AVP Late-Stage Tech Fund.

A tailwind is Europe's massive increase in spending on defense and infrastructure, which is likely to open opportunities for private equity. Germany alone plans to spend €1.08 trillion on infrastructure and defense, WSJ reported.

Private equity momentum in Europe will likely remain restrained in 2025, but European valuations are lower and also more rational compared to the US market in recent years, according to placement agent Reach Capital.