Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 31 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Has China Hit Peak Food?

The drivers of food demand are straightforward — the more people there are to feed and the higher their household income, the more they will spend on food. China, the economy and population of which have boomed over the past few decades, is now a crucial player in many agricultural markets. But as the country’s birth rate drops, even though the Chinese government lifted the one-child policy in 2016, many are wondering about the ripple effects on global food demand.

According to S&P Global Commodity Insights, China’s economy grew 10% per year from 1990 to 2013, and its population has grown by 25% over the past 30 years. China is the largest importer in several agricultural categories, including soybeans. This is just one of the industries that has been transformed by China’s population increase and may be hit by its decline. The World Bank expects the country’s population to fall by 80 million people over the next 25 years. For perspective, that is about equal to Germany’s current population.

China mainly uses soybeans to produce soybean meal, which feeds the country’s animal protein industry. As Chinese demand for soybeans exploded in the last three decades, Brazil rose to become the world’s biggest soybean producer and exporter. However, Chinese animal protein consumption has started to subside along with economic and population growth. According to S&P Global Commodity Insights, the amount of soybean crush processed in China is estimated to grow by only 3 million metric tons from 2016 to 2023, compared with 33 million metric tons from 2010 to 2017.

“By S&P Global calculation, the price of soybeans in Brazil is now below the cost of production for converting pasture ground to crop production. This was unthinkable not long ago,” said Paul Hughes, S&P Global Commodity Insights’ chief agricultural economist and director of research for agribusiness.

In the short term, S&P Global Ratings expects sales growth in China’s food and beverage sector to decrease to 3% in 2023 from 5%-11% over the past two years. Although beverage sales, mostly of bottled water, are rising on increased interest in outdoor activities, slowing food sales brought the overall sector down. Consumers have been more inclined to eat out and less inclined to purchase premium, higher-priced products.

Droughts, floods and heat waves could also spell trouble for food demand in China. An S&P Global Ratings article from August 2022 reported that combating drought at the time would “require more expensive irrigation options, which, combined with crop damage, could spur food inflation.” Inflation would, in turn, hurt domestic consumption. “If weak harvests lead to more imports, the risk could spill over onto global markets,” S&P Global Ratings added. With China facing extreme heat and heavy rainfall this summer, the food segment is likely to see similar issues.

China’s population is in the early stages of decline, and the pace of its economic growth may have peaked, so it remains to be seen exactly how the rest of the world will be affected. But after so many years of China being a key player in food markets, the ripples will probably spread far. “It is hard to imagine a portion of the global agriculture and food supply chain that will not feel the impact,” Hughes said.

Today is Monday, July 31, 2023, and here is today’s essential intelligence.

Written by Claire Delano.

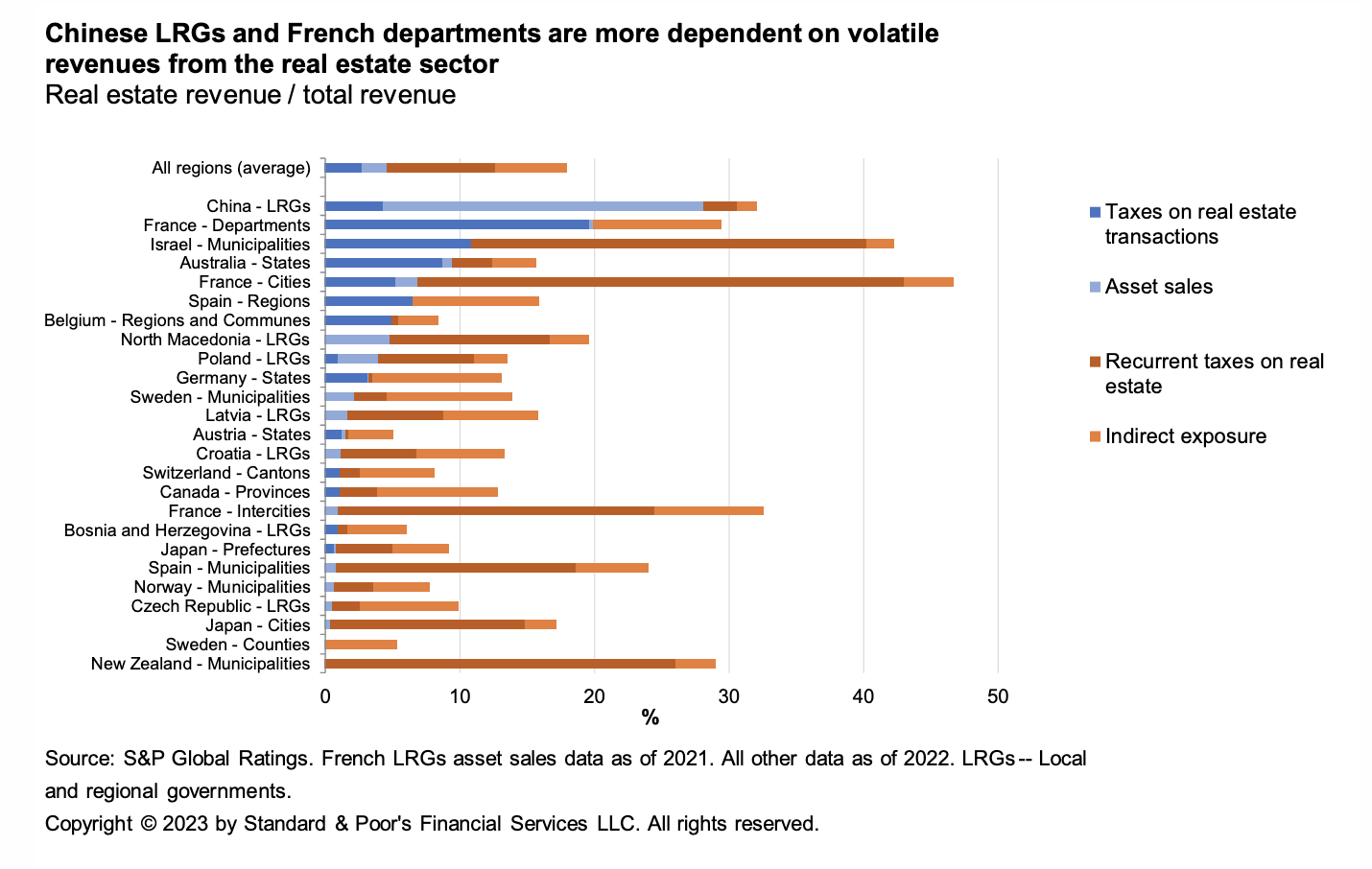

Chinese And French LRGs, And Cities Globally, Could Lose Revenue From Real Estate Slowdowns

LRGs' revenues from the real estate sector are somewhat volatile. Proceeds from land and other asset sales, as well as property transaction fees, tend to follow market trends. Exposed LRGs might see revenues decline in the short term due to a fall in valuations and fewer property transactions. S&P Global Ratings notes that recurrent property taxes based on assessed value (ad valorem) could be less volatile than transaction-based taxes because the former are usually derived from an officially-registered cadastral value, rather than what the market might dictate.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Listen: Street Talk | Episode 114: Regional Banks Feel Funding Pressures, But Q2 2023 Results Target Biggest Bears

Many regional banks’ second-quarter earnings might have fallen short of the Street’s estimates, but results contradicted the bear case that weighed heavily on the institutions’ stock prices during the spring, according to Terry McEvoy, managing director at Stephens. In the episode recorded on July 24, McEvoy, the superregional bank analyst at Stephens, discussed the key takeaways from the first week of regional bank earnings, including what results tell the investment community about banks’ liquidity, credit quality and valuations.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

Access more insights on capital markets >

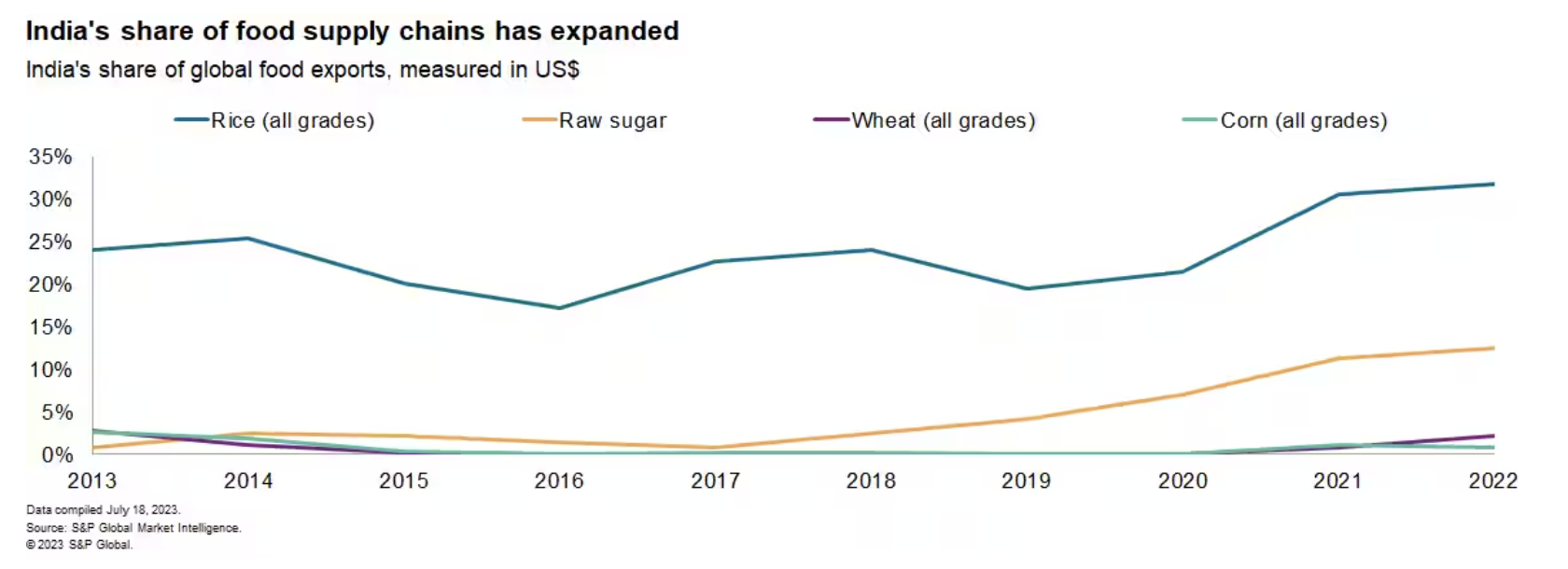

India’s Food Supply Chain Intervention

The Indian government has banned exports of non-basmati rice grades to tackle domestic food price inflation. India accounted for 32% of all rice exports in 2022 compared with 24% in 2013 as the government sought to boost export supplies. The export controls may spread to other foodstuff. A similar ban last year does not appear to have affected exports, though this time the government may not issue as many exemptions.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

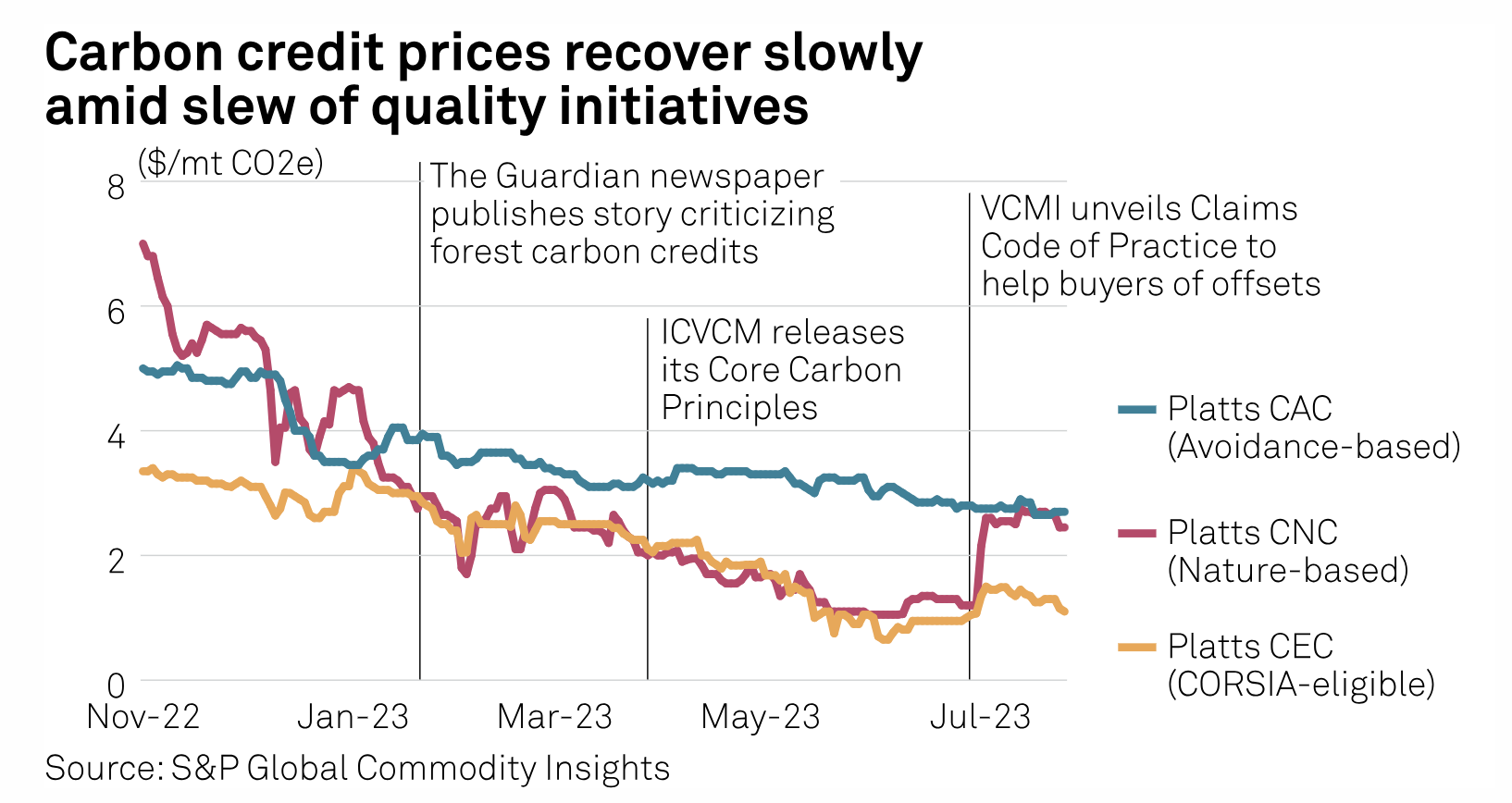

Voluntary Carbon Market Players Hope New Quality Guidance Will Boost Liquidity

A much-awaited framework that helps define high-quality carbon offsets was unveiled July 27, with labeled credits available to buyers by end-2023. The Integrity Council for the Voluntary Carbon Market said that it has finalized its Assessment Framework, which will be used to evaluate whether carbon credits meet its high-integrity Core Carbon Principles (CCPs). Many in the industry are hopeful this release will bring more certainty to the market and lead to more carbon reduction and removal projects.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: BASF On Open Innovation

Benjamin Raerup Knudsen, vice president/research for North America at BASF, joins Chemical Week senior editor Vincent Valk to discuss the company's open innovation initiatives. Topics include how BASF approaches partnerships in innovation, core areas of focus for research and how to protect IP and trade secrets in an open innovation ecosystem. The Chemical Week podcast is the industry’s premier platform for wide-ranging discussion of issues impacting the global chemicals sector, hosted by veteran industry journalist Vincent Valk and the editors of Chemical Week.

—Listen and subscribe to Chemical Week, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

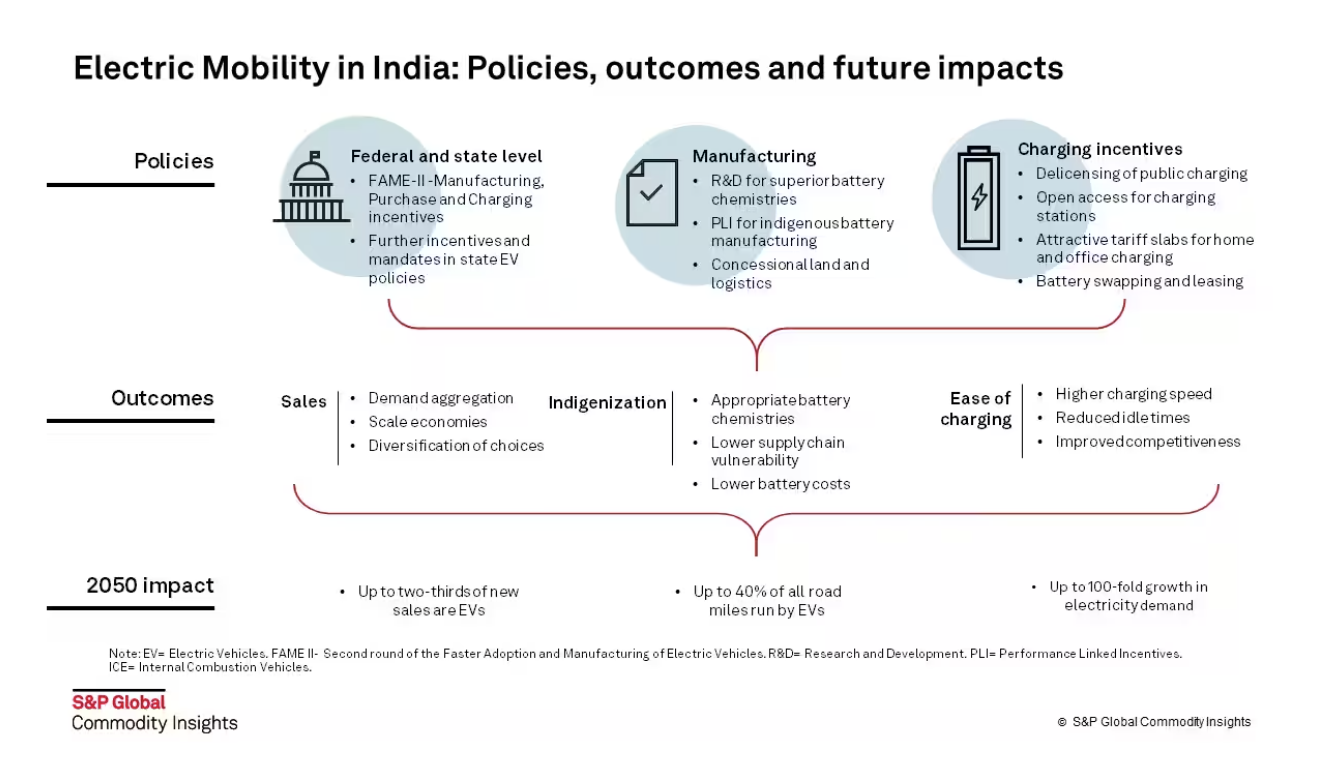

A High Electric Mobility Scenario For India Leads To A Relatively Small Increase In Electricity Demand Relative To Energy Efficiency Gains

The electric mobility transition is not only set to disrupt the automobile sector ecosystem, but also the ways in which electricity demand is managed. Already, EV sales have crossed 10 million units annually, with its penetration growing from less than 2% to more than 5.5% within one year. 2W and 3W sales contribute 95% of overall EV sales, but the sales of commercial electric four wheelers (4W) has been climbing. Over time, diversity of EV categories will play a major role in growth of EVs' electricity demand, as well as the charging cycles or demand patterns.

—Read the article from S&P Global Commodity Insights

Content Type

Segment

Language