Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 5 April, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Biofuels Promote Net-Zero Progress

According to the proverb, there are many paths to the top of the mountain. And for the energy transition to have any chance of reaching the summit, it is likely that most paths will have to be explored simultaneously.

One promising route is biofuels. They're substitutes for fossil fuels derived from fast-replenishing natural feedstocks, including crops (especially sugar cane and palm), used cooking oil, rendered animal fat, municipal solid waste, or from hydrogen for so-called e-fuels.

While the use of food crops as biofuel feedstock has created controversy among environmental groups and anti-poverty campaigners, biofuels have advantages compared with other potential fossil fuel substitutes. Chief among them is their compatibility with existing conventional combustion engines, meaning they clear a path for sectors that would otherwise be hard to decarbonize, chiefly shipping and aviation.

Road transportation is already further along the process of transformation with the rapid rollout of electric vehicles and more interest in hydrogen, given the projected shortage of critical battery metals. However, it may be a long time before hydrogen fuel cells powerful enough to propel container ships are developed or people trust a battery-operated passenger plane. Biofuels could play a supporting role in smoothing the transition, as a bridging technology, much as nuclear power baseload capacity supports the rollout of renewables. Better to achieve real progress than waste valuable time in the search for perfection. Biofuels replaced 2.2 million b/d of oil demand in 2022, almost all of which was used for road transportation, and provided about 5% of the sector's oil demand.

Currently, 70% of global biofuel is created in the Americas, thanks to Brazil's sugar cane and the US' corn, but S&P Global Commodity Insights projects Asia to grow at a more rapid pace to gain share. India has instituted mandated biogas blending for road transport and financial support for biomass aggregation machinery, a move to use its approximately 500 million metric tons of agricultural waste per year.

This trek won't be easy. At present, biofuel usage has grown by 4% a year over the past five years. The International Energy Agency's Net Zero Roadmap from September 2023 calculated that growth would need to be 13% a year if the 2030 staging post is to be reached on time. And the "food versus fuel" debate is likely to remain contentious. But biofuels could help the world, particularly the developing world, scale the net-zero mountain.

Today is Friday, April 5, 2024, and here is today’s essential intelligence.

- Written by Tom Cobbe.

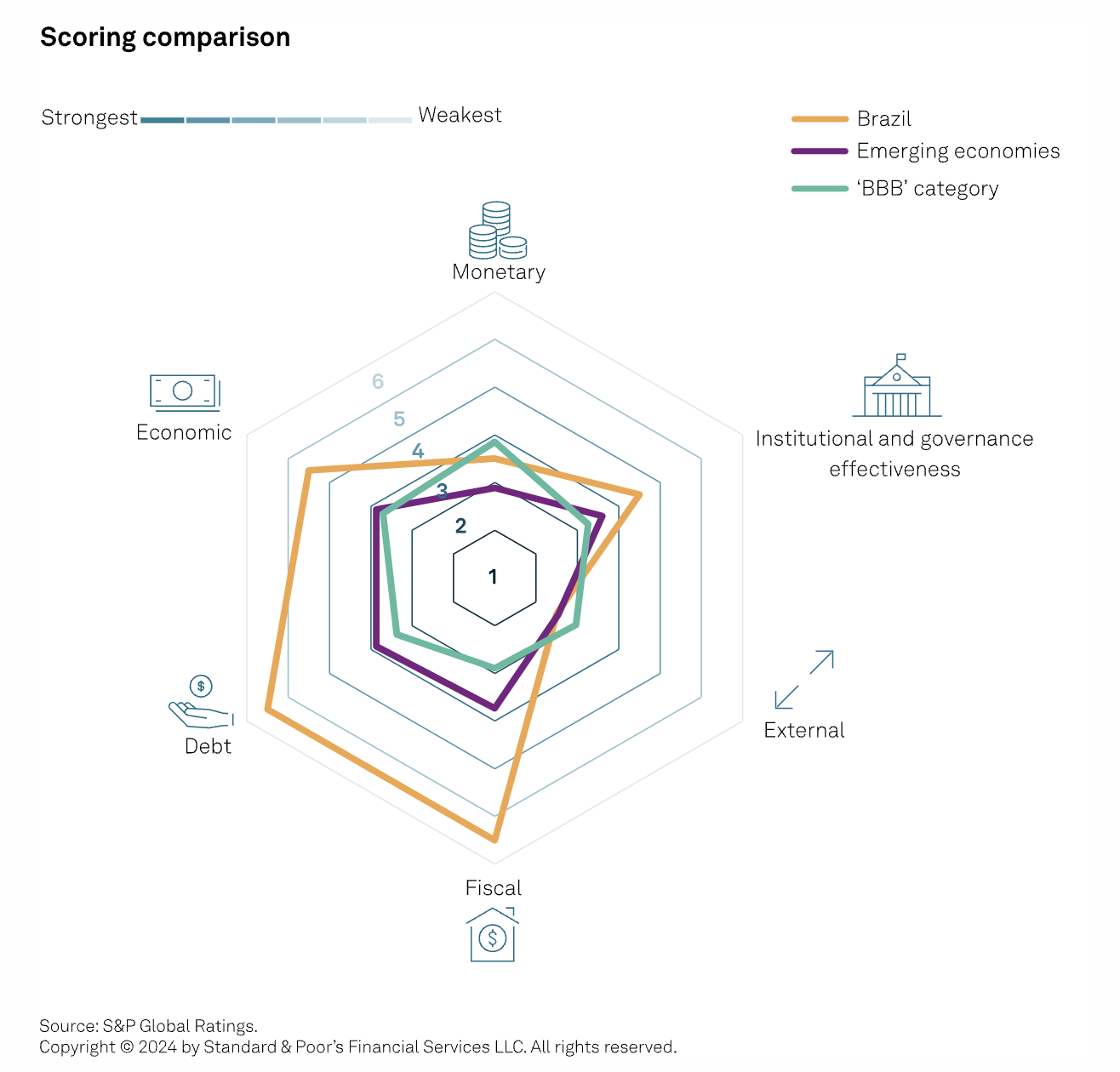

Assessing Brazil's Potential Path To Investment Grade

Following the approval of a comprehensive and revenue-neutral tax reform, Brazil has strengthened its track record of pragmatic policies, helping anchor macroeconomic stability. As a result, S&P Global Ratings raised its global scale sovereign credit ratings on Brazil to 'BB', with a stable outlook, from 'BB-' on Dec. 19, 2023. That said, historically Brazil's reform transition periods have been long, translating into delayed or even lower-than-expected economic benefits.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

Global Credit Conditions Q2 2024: Between Economic Resilience And Market Exuberance

Most economies maintained better-than-expected growth in 2023, helping offset the negative impact of persistently higher interest rates. Defaults will remain near current levels by the end of the year after peaking around the third quarter of 2023.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

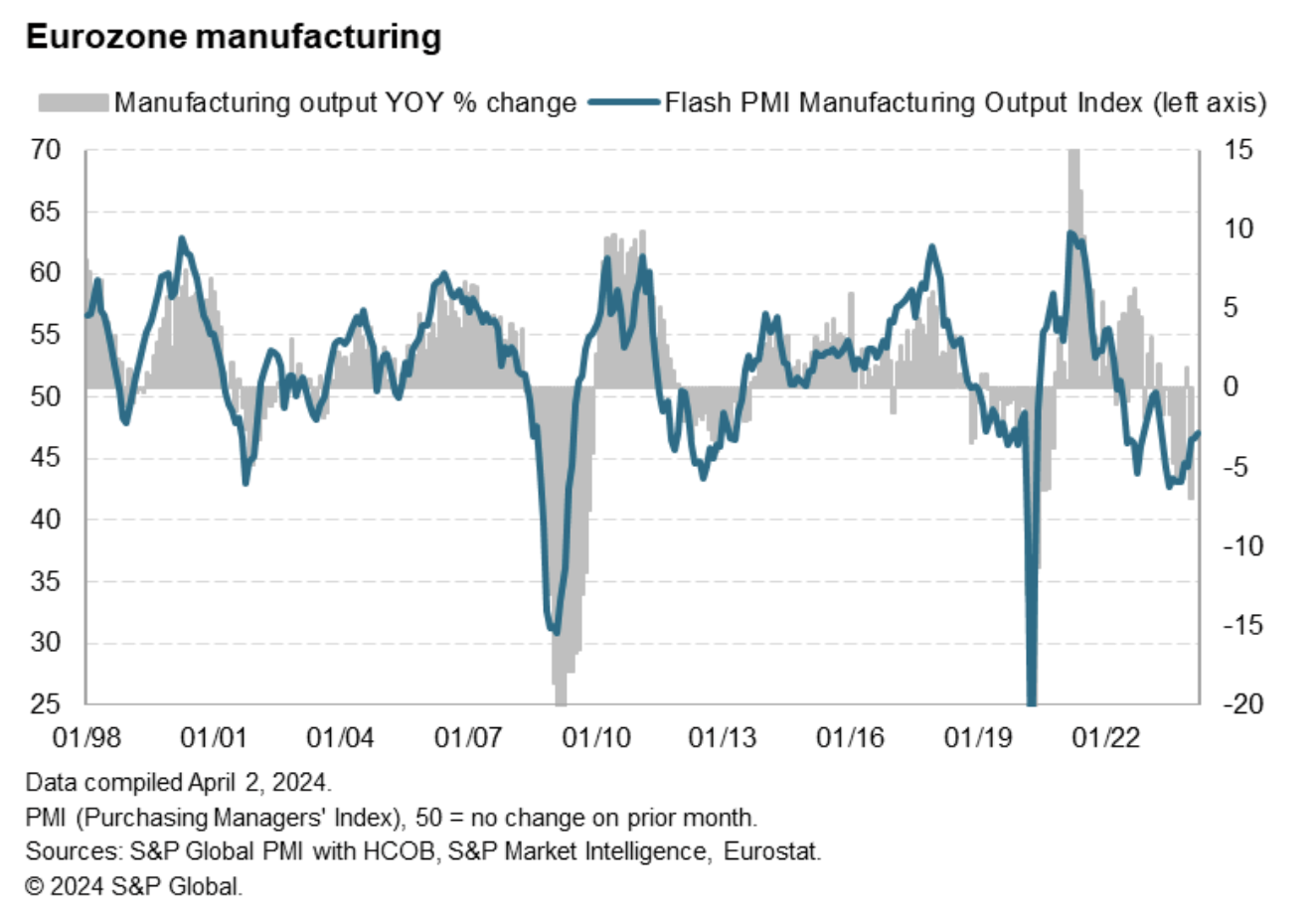

Eurozone Manufacturing Prospects Brighten As PMI Leading Indicators Lift Higher

Eurozone manufacturing output has contracted in all bar two of the past 22 months, according to the PMI® survey data compiled by S&P Global. The data follow official statistics showing production in January was some 7.0% lower than a year ago. With the exception of the pandemic lockdowns, this represented the steepest annual rate of decline since 2009. But leading indicators hint at production stabilising and potentially returning to growth in the near future. In fact, production has already returned to growth outside of France and Germany, helping the downturn moderate in March to its slowest for nearly a year.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Sustainability Insights Research: Risky Business: Companies' Progress On Adapting To Climate Change

Physical climate risks are on the rise but progress on adapting to them still varies, leaving some financial and non-financial corporates vulnerable. Only about one-fifth of companies in the sample disclosed an adaptation plan. Some companies are not prioritizing adaptation planning, which could ultimately increase the cost to adapt, and the amount of change required. Sectors indirectly exposed to physical climate risks — such as communications services, information technology and consumer discretionary — could see rising exposure, absent adaptation. Regulation and disclosure requirements could speed up climate adaptation planning.

—Read the article from S&P Global Ratings

Access more insights on sustainability >

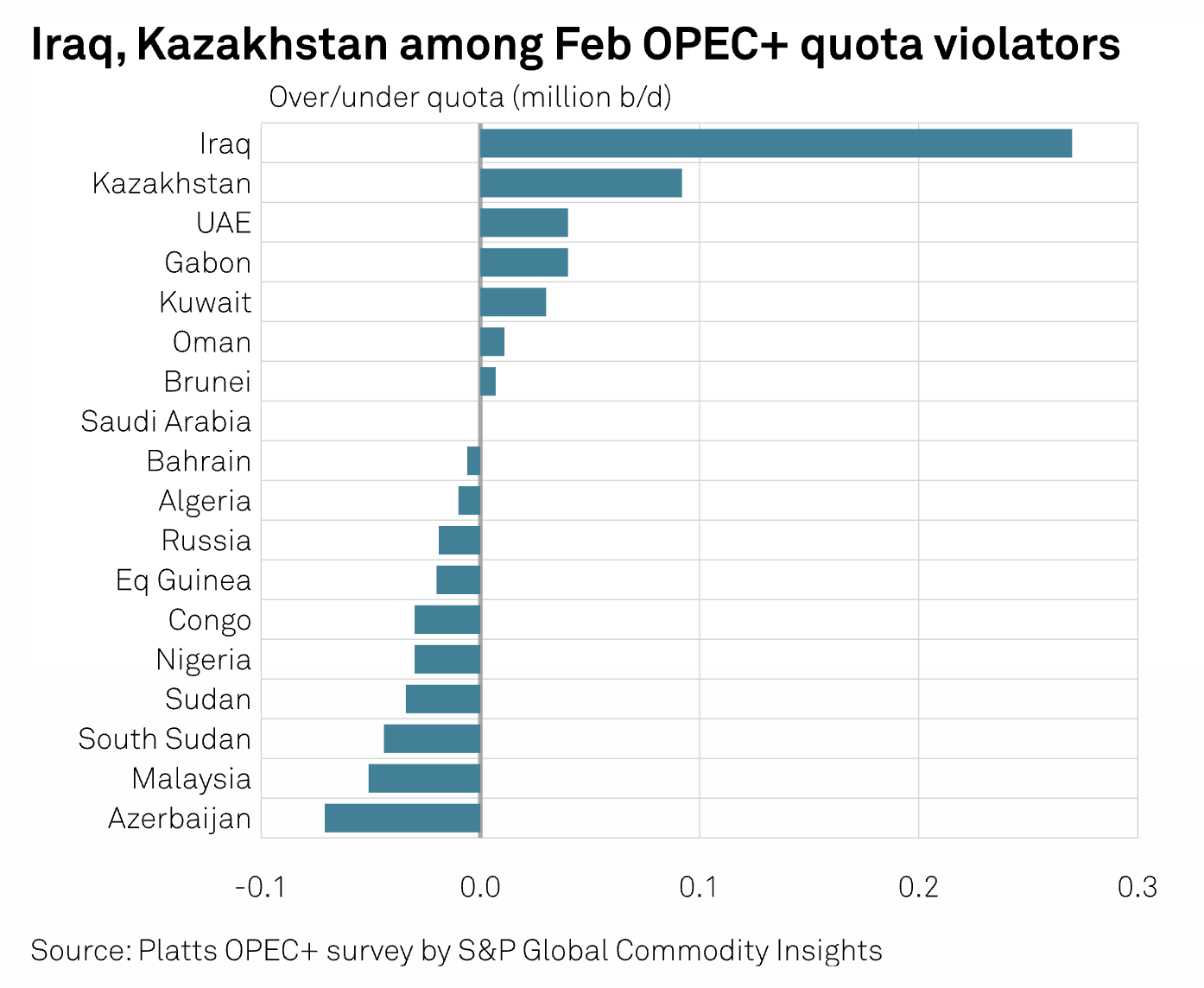

OPEC+ Overproducers To Submit Compensation Plans By April 30

OPEC+ member countries that produced above quota in the first quarter of 2024 have until April 30 to submit detailed compensation plans, OPEC said April 3 in a statement released following a meeting of the Joint Ministerial Monitoring Committee overseeing the alliance's output. One delegate said compensation measures apply to all members who over-produced.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Generative AI: Outlook, Opportunities and Challenges

While Generative AI has been the technology story of 2023 around the world, it has accelerated the rush to regulate AI and created a run on the high-performance chips known as graphics processing units (GPUs), which typically run AI workloads.

—Read the article from S&P Global Market Intelligence