Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 6 Mar, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Elevator Going Up: The Cost of Energy Security

Imagine economic prosperity as an elevator. Some countries get to ride to the top floor — the penthouse — where capital and goods are plentiful. Other countries are less lucky. Their elevator stops on a lower floor, or worse, gets stuck between floors.

Much like an elevator, moving upward in economic prosperity takes energy. The consumables in your kitchen, the car in your garage and the clothes on your back all require energy to be produced. For a long time, most of that energy has been produced using fossil fuels. As the world embarks on an unprecedented effort to reduce carbon emissions, the question for many countries is how to both meet Paris Agreement on climate change benchmarks and ride the elevator up to the penthouse. In the end, many countries conclude that to succeed, they must be masters of their own destiny, leading them to the question of energy security.

Daniel Yergin is the vice chairman of S&P Global, chairman of the CERAWeek energy conference and the author of numerous books on energy markets, including The Prize: The Epic Quest for Oil, Money, and Power, which won a Pulitzer Prize. Yergin’s latest book, The New Map: Energy, Climate, and the Clash of Nations, examines the geopolitical complexities of energy markets. Recently, Yergin returned to the topic of geopolitics in an article published by S&P Global, “The return of energy security.”

Renewable sources of energy have advantages in terms of emissions and energy security. A solar panel, once installed, can never fall victim to geopolitical rivalry. However, renewables are frequently costlier than fossil fuels and suffer from intermittency challenges. At present, only 7% of the world’s energy is derived from renewable sources. Oil and gas provide 55% of global energy, and coal provides 27%. Countries focused on energy security tend to focus on the bulk of the market, meaning that guaranteeing access to fossil fuels is their primary concern.

This concern is by no means limited to developing countries. As energy prices rose during the COVID-19 pandemic and again during the days following the Russian invasion of Ukraine, the US and EU became focused on achieving energy security through plentiful fossil fuels. During those years, the Biden administration repeatedly authorized the release of oil from the US Strategic Petroleum Reserve, established as a backstop for energy security, to compensate for a shortfall in petroleum supply. American and European leaders called for more drilling of oil and natural gas to establish price stability and safeguard their economies.

If energy security is achieved through more fossil fuels in the penthouse countries at the top of the economic stack, then it is unsurprising the countries on the lower floors also focus on guaranteeing access to coal, oil and natural gas. Of the global population, 80% live in developing countries, yet their energy consumption is comparatively tiny. According to Yergin, per capita electricity consumption in sub-Saharan Africa, excluding South Africa, is less than 4% that of Europe. When countries such as India and Brazil decline to participate in sanctions against Russian energy, they do so out of economic self-interest.

Balancing energy security with the imperatives of the energy transition is difficult. To reduce emissions in the near term, Yergin recommends further development of natural gas globally. Natural gas has the advantage of producing fewer emissions than other fossil fuels, which is why it is frequently promoted as a “bridge fuel” for the energy transition. Around the world, countries have announced investment and new facilities to develop natural gas as an energy source. While by no means a net-zero source, natural gas can provide a measure of energy security with lower emissions for those countries rising in the elevator.

Today is Wednesday, March 6, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

GCC Corporate And Infrastructure Outlook 2024: Holding Up Against Refinancing Needs

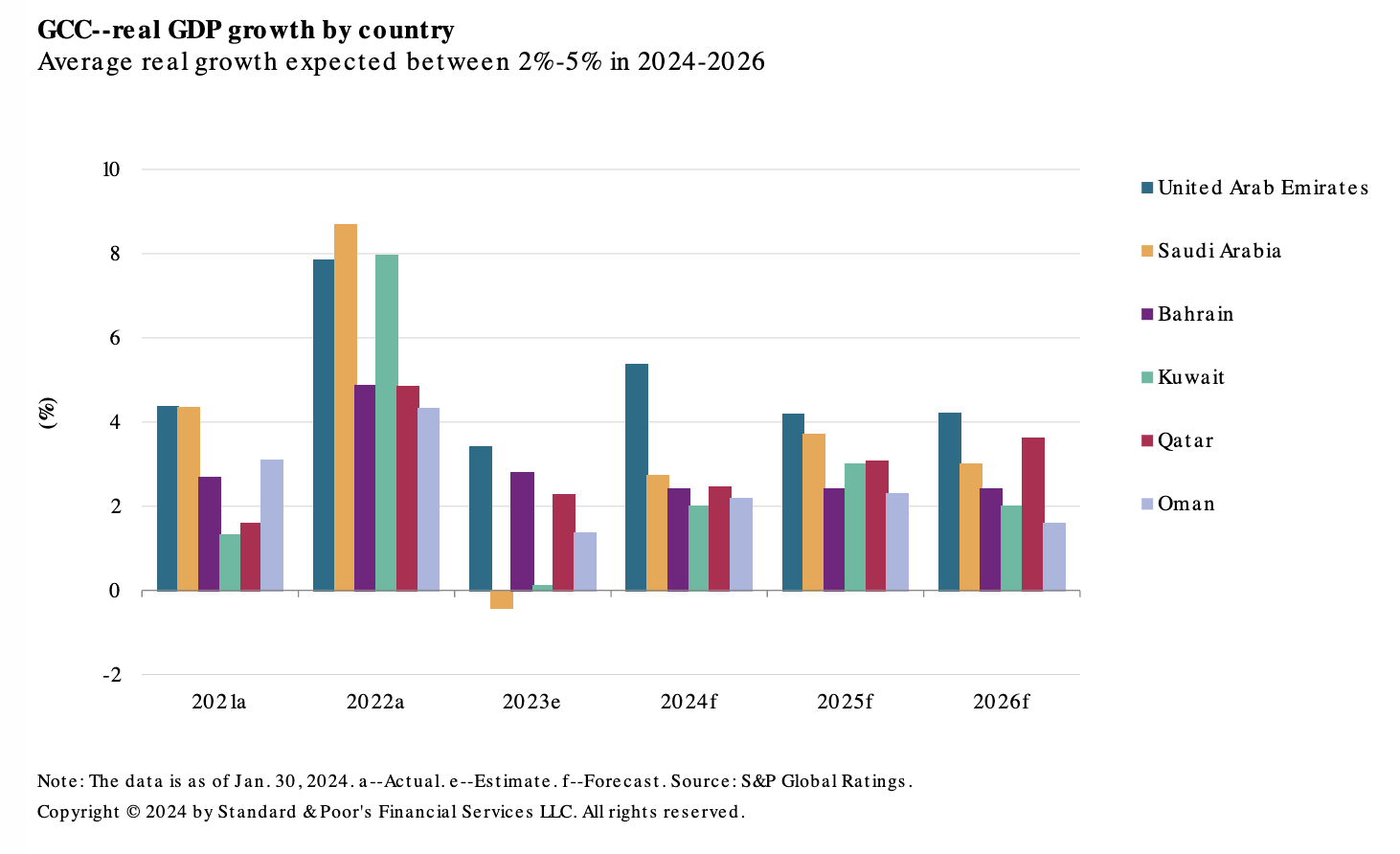

S&P Global Ratings believes that most GCC corporate and infrastructure firms benefit from broadly supportive credit conditions in their domestic markets. This is despite soft global economic growth, high interest rates and considerable geopolitical risks in the Middle East. More than 95% of the outlooks on rated GCC corporate and infrastructure firms are stable, attesting to S&P Global Ratings’ view that ratings will remain resilient in 2024.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

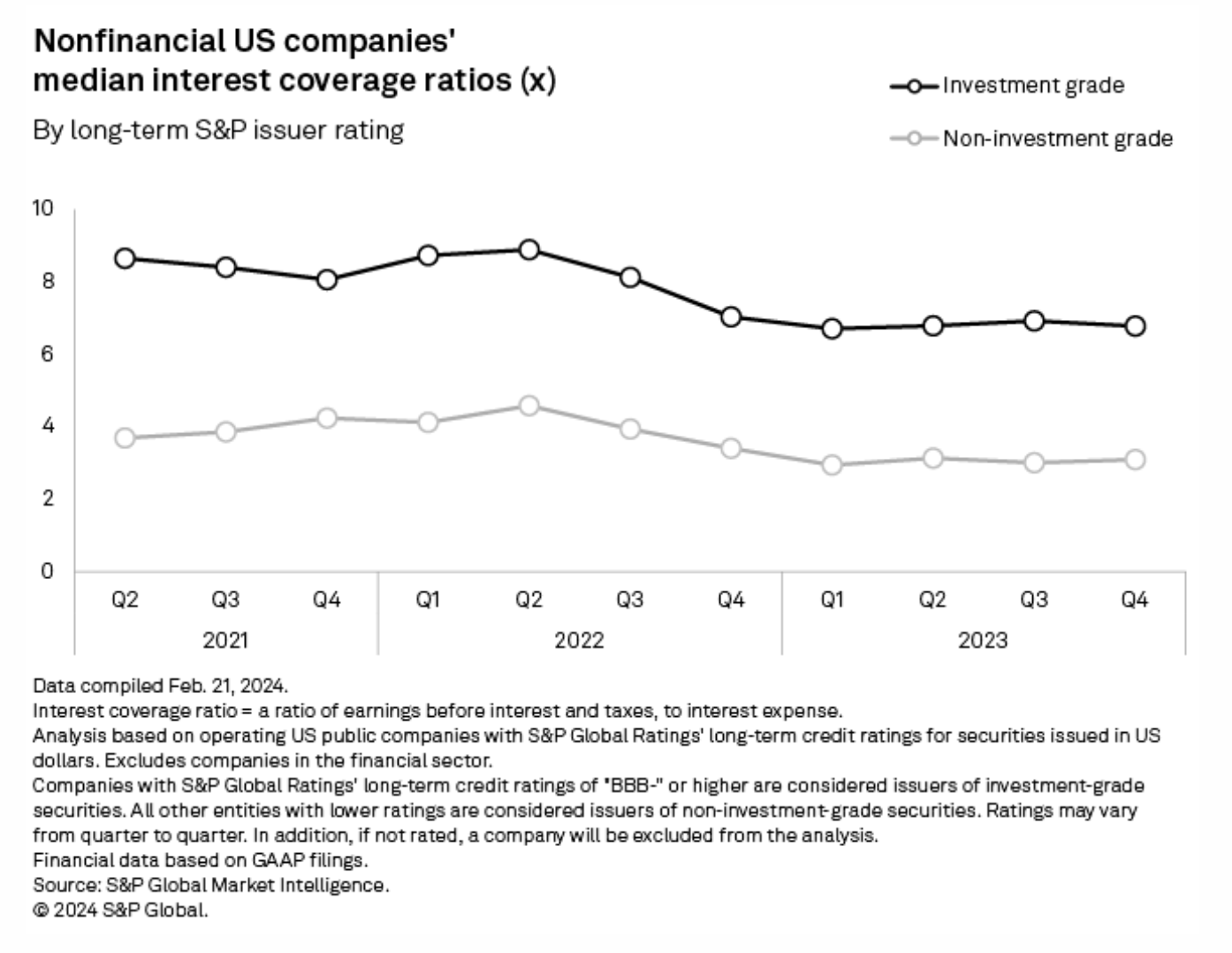

Interest Payments Chip Further Into US Corporate Earnings In Q4 2023

Interest payments are eating further into US companies' profits as total debt as a percentage of equity falls. In the fourth quarter of 2023, earnings before interest and tax was able to cover debt-interest payments 6.78 times for the median investment-grade rated company, according to the latest S&P Global Market Intelligence data. This interest coverage ratio declined from a revised 6.92 a quarter earlier. Companies rated below investment grade by S&P Global Ratings recorded an improvement in their median coverage ratio, with the fourth-quarter figure of 3.09 up from 3.01 in the third quarter of 2023.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

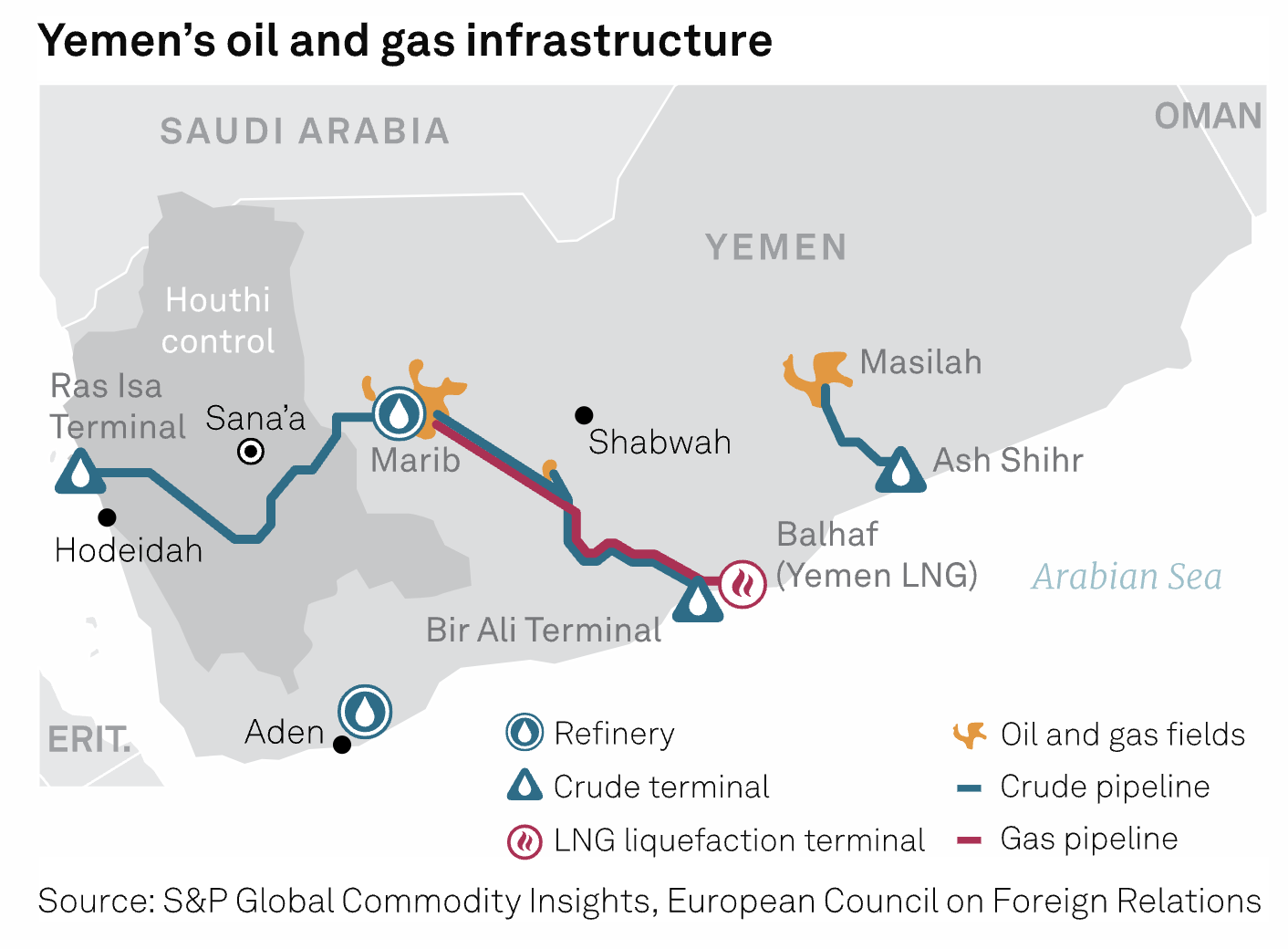

Freight Rates On Notice After Rubymar Sinks, First Ship Casualty Of Red Sea Crisis

The sinking of the UK-owned bulk carrier Rubymar after a Houthi missile strike off the coast of Yemen threatens to cause an environmental crisis in the southern Red Sea and heightens once again the risks of commodities shipping through the critical Bab al-Mandab Strait. The 32,211-dwt general cargo ship, which was carrying 18,000 mt of ammonium phosphate sulfate fertilizer from Saudi Arabia, sank on March 2, the ship's broker said, 13 days after being severely damaged by a Houthi missile from Yemen and becoming the first vessel lost since attacks on Red Sea ships started in November.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Navigating The Path To Sustainable Agriculture, Food Systems

In this episode of the ESG Insider podcast, we’re exploring solutions to sustainability challenges in food systems and agriculture. Climate change poses risks to global food supply chains and agricultural production. At the same time, the world's growing population means food needs are increasing.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainability1

Access more insights on sustainability >

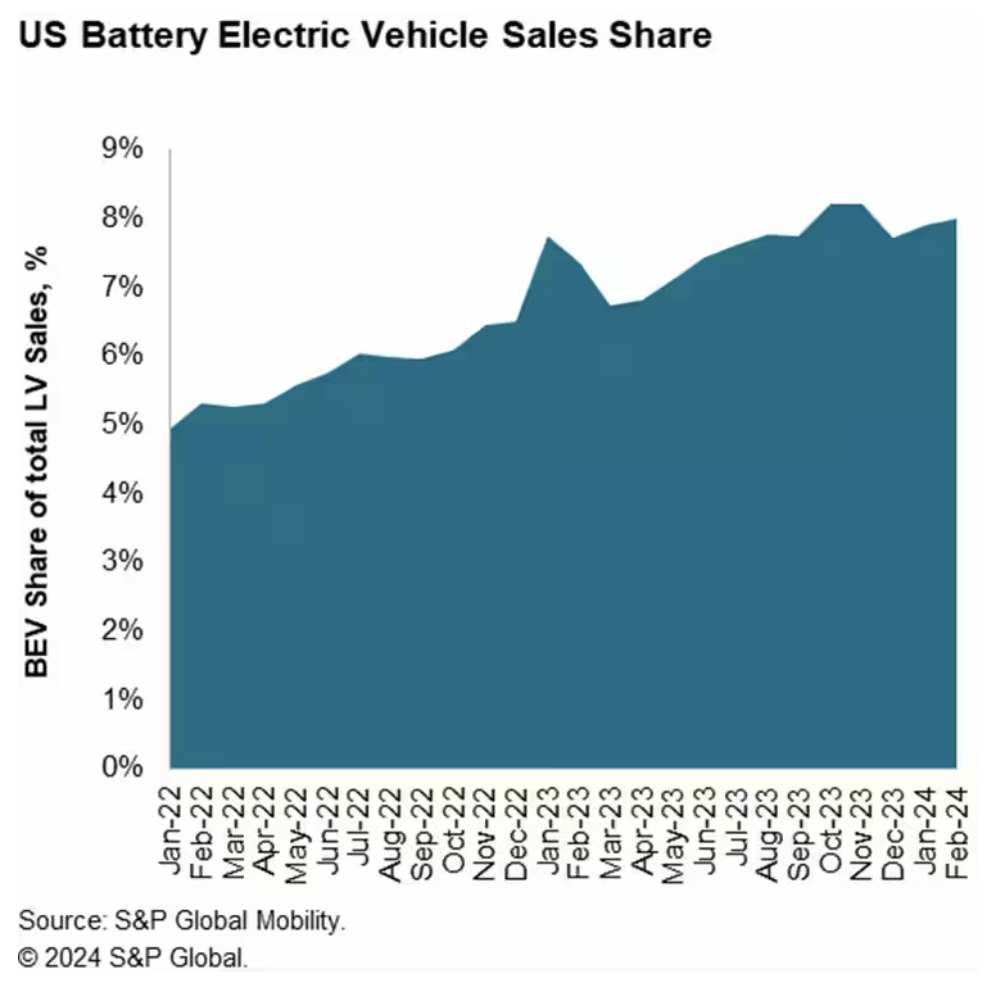

Listen: Rumored Weakening Of Tailpipe Emissions Rule Would Move US In Wrong Direction, Analyst Says

The Environmental Protection Agency last April pitched its strongest-ever limits on greenhouse gas emissions from passenger cars and trucks. But reports have surfaced that the EPA may be planning to soften that regulation. Dave Cooke, senior vehicles analyst with the Union of Concerned Scientists, joined the podcast to share why he believes any weakening of the car rule would be a bad idea. He pushed back on critics’ assertions that the proposal was unachievable and gave his take on the importance of vehicle electrification for meeting broader climate goals.

—Listen and subscribe Captiol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

February 2024 US Auto Sales To Bounce Mildly

We expect that auto sales in February should recover mildly from the January 2024 result, but sustained momentum seems tough to come by, given the current purchase environment facing auto consumers," said Chris Hopson, principal analyst at S&P Global Mobility. "While pricing, inventory, and incentive trends are seemingly moving in the correct directions, respectively, to promote new vehicle sales growth, high-interest rates, and uncertain economic conditions continue to push against any consistent upshift for demand levels."

—Read the article from S&P Global Mobility