Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Apr 29, 2024

By Cecillia Zheng and Choon Gek Khoo

S&P Global published the Southeast Asia (SEA) power and renewable market briefing for the first quarter of 2024 (Q1 2024). The report discussed the power demand, supply, pricing, and major market events in the quarter, as well as the latest proposed or enacted policies and regulations. The report is now accessible via Connect.

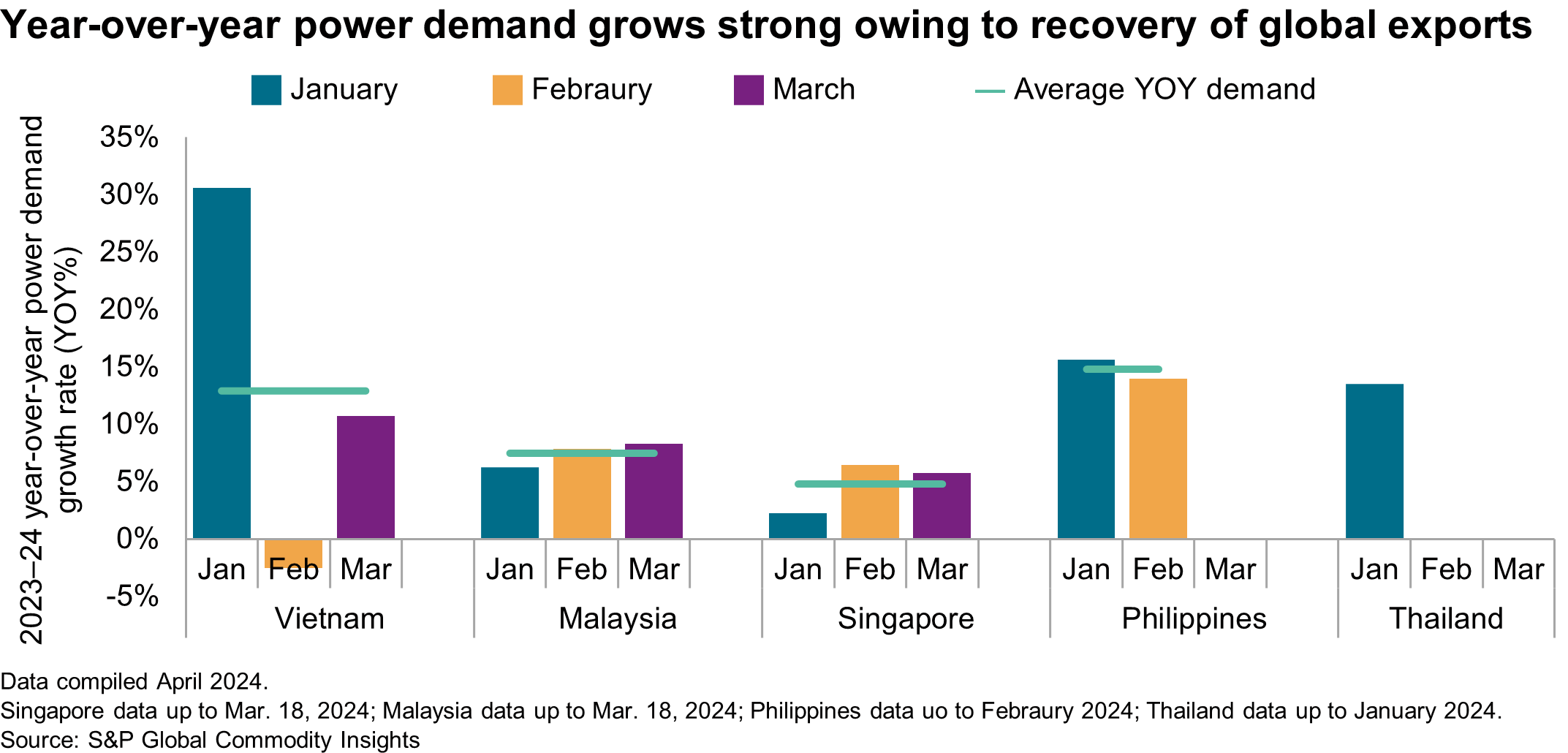

Data from the power market suggests a significant year-over-year (YOY) increase in power demand during the Q1 2024 for major Southeast Asian (SEA) countries, including Vietnam, Malaysia, Singapore, the Philippines, and Thailand. This growth falls within a range of 4.8% YOY to 14.8% YOY compared to the Q1 2023. This upsurge reflects an elevated power demand, likely driven by the growing export demand.

Vietnam's power demand in the Q1 2024 exhibited a strong rebound, averaging a 12.9% YOY growth compared to the same period in 2023. This surge is primarily attributed to a positive upswing across several sectors, including construction, tourism, and a manufacturing-driven export boom. However, February saw a temporary 2.6% YOY decline in power demand owing to a week-long business and factory shutdown for festive holidays.

Malaysia witnessed a surged in power demand growth during Q1 2024, averaging 7.5% YOY. This robust increase signals a strengthening recovery in power demand. The surge is primarily driven by the rebound in the global export market for semiconductors. This, in turn, has fueled growth across several subsectors, including wholesale and retail trade, transportation and storage, and business services.

Singapore saw the slowest power demand growth of all SEA countries in Q1 2024, averaging only 4.8% YOY. The growth started slowing in January (2.3% YOY), and growth stronger in February and March (average 6.1% YOY). This slowdown aligns with a weaker-than-expected demand from manufacturing sectors, especially for pharmaceutical and precision engineering in the early of 2024. Nevertheless, the nation's overall economic growth trajectory remains positive.

The Philippines' power demand data indicates robust growth, averaging 14.8% YOY. This surge is primarily fueled by factors such as a rise in domestic demand, particularly within the recovering tourism sector, and sustained expansion in manufacturing coupled with increased public infrastructure spending.

Thailand's January data reveals a surge in power demand, averaging an impressive o13.5% YOY compared to the same period in 2023. This acceleration is likely driven by government's efforts to boost tourism and offset weaknesses in exports.

Major SEA countries are experiencing robust power demand growth, signaling strong economic momentum. This growth is fueled by a combination of various factors, including resilient domestic power demand associated with resurgent manufacturing and tourism sectors. Looking ahead, power demand is expected to further strengthen in 2024 owing to anticipated improvements in global exports. However, a degree of uncertainty remains regarding the sustainability of this recovery momentum throughout the year, given rising global economic concerns.

If you are interested in learning more about our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.