SUMMARY

After a dismal 2022, the market recovered with a vengeance in 2023 and the S&P 500® gained an impressive 26%. Optimism that the U.S. Federal Reserve would be able to engineer a soft landing accompanied a broadening of the rally to the S&P MidCap 400® and the S&P SmallCap 600®, which both climbed 16%. Meanwhile, despite persistent inflation concerns and a rough start to the year for regional banks, U.S. fixed income markets also gained in 2023—albeit less materially and with a few more bumps along the way.

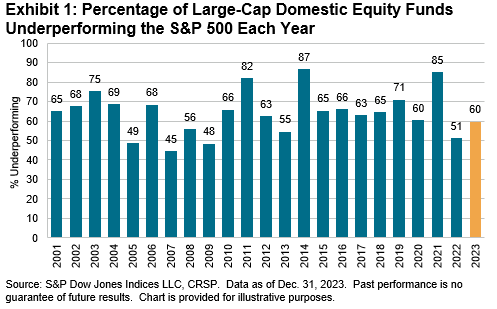

Over the full year, a majority of actively managed funds underperformed their assigned benchmarks in most of our reported fund categories. In our largest and most closely watched comparison, 60% of all active large-cap U.S. equity funds underperformed the S&P 500. This figure was better than might have been expected given the dominance of the U.S. equity market’s largest stocks, placing 2023’s underperformance rate close to, but just below, the 64% average annual rate reported over the 23-year history of our SPIVA Scorecards.

Perhaps aided by their ability to opportunistically tilt toward outperforming large caps, the results were generally better for funds in smaller-capitalization U.S. equity categories: just 50% of All Mid-Cap funds lagged the S&P MidCap 400 and only 48% of All Small-Cap funds underperformed the S&P SmallCap 600. Small-Cap Value was a particular bright spot, with only 37% of funds underperforming the S&P SmallCap 600 Value.

Turning to international equity categories, nearly three-quarters (74%) of funds in the Global category underperformed, but at least in relative terms, International Small-Cap Funds continued to offer more fertile grounds for actively managed funds: just 54% underperformed.

Fixed income results, with an underperformance rate of 59% across all fund categories, were more mixed, with 9 out of our 17 reported categories posting majority underperformance. At one extreme, 98% of funds in the General Investment-Grade category and 80% of High Yield funds underperformed. Municipal and emerging debt were among the categories that saw majority outperformance.

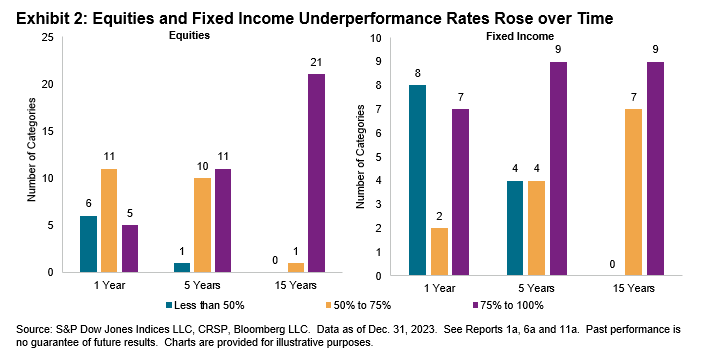

Across all categories, underperformance rates typically rose as time horizons lengthened. Exhibit 2 illustrates the point. At the one-year horizon, 6 of 22 equity categories and 8 of 17 fixed income categories saw majority outperformance, falling to just 1 equity category and 4 fixed income categories over five years. At the 15-year horizon in both asset classes, there were no categories in which the majority of active managers outperformed.