SUMMARY

The S&P 500® made an all-time high on the first trading day of 2022, but as monetary taps tightened, U.S. equity markets turned bearish. The Federal Reserve had telegraphed its intention to raise rates before the year turned, but when the conflict in Ukraine triggered a spike in energy and raw commodity prices, producing a 40-year high in U.S. inflation, the central bank accelerated its plans. A series of rate hikes helped send the S&P 500 into a 20% drawdown by mid-June, and fixed income offered few safe harbors as yields rose across the curve and longer-dated Treasury bonds made their worst start to a year this century.

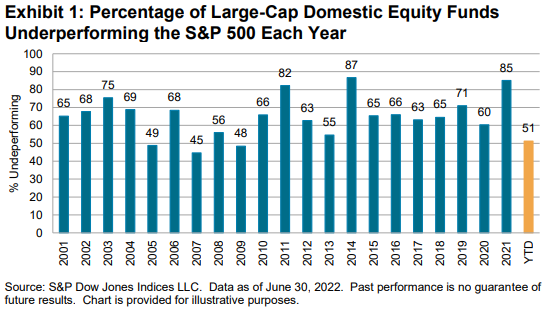

Declining markets make active management skills all the more valuable, and our report shows that a significant minority of active managers were able to outperform in several categories. After suffering an 85% underperformance rate in 2021, just 51% of large-cap domestic equity funds lagged the S&P 500 in the first six months of 2022, putting actively managed large-cap U.S. equity funds on track for their best (i.e., lowest) underperformance rate since 2009.

Similarly, 54% of mid-cap and 63% of small-cap funds underperformed the S&P MidCap 400 and the S&P SmallCap 600, respectively, in H1. There was a wide range of performance across various domestic equity categories, topped by a creditable 33% of Mid-Cap Core funds underperforming in H1. At the other end of the spectrum, a turn to outperformance from value accompanied a disappointing period for growth managers, 79%, 84% and 89% of whom underperformed in the large-, small- and mid-cap Growth categories, respectively, in H1.

In international equities, a majority of actively managed funds underperformed in every category during H1 but, in relative terms, managers in the International Small-Cap category continued to outshine their peers, with just 57% underperforming compared to H1 underperformance rates of 68%, 71% and 74%, in the Global, International, and Emerging Market categories, respectively.

The February 2022 completion of the merger between IHS Markit and S&P Global brought a new range of fixed income indices to the S&P DJI stable, and this edition of our SPIVA U.S. Scorecard welcomes a new range of fixed income comparison indices, as well as several new fixed income categories. Highlights from the H1 fixed income statistics included 93% of Core Plus Bond funds and 59% of actively managed high-yield U.S. funds outperforming the iBoxx $ Liquid Investment Grade Index and iBoxx $ Liquid High Yield Index, respectively, but benchmark-beating returns were harder to find in the Loan Participation, General Municipal Debt and Intermediate U.S. Government categories—with underperformance rates of 83%, 86% and 89%, respectively.

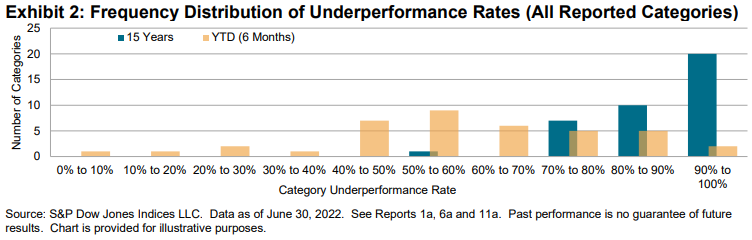

Echoing a frequent theme of SPIVA Scorecards over the past 20 years, underperformance rates generally rose with the length of the period in which they were measured. Exhibit 2 illustrates the marked differences in the distributions of short- and longer-term underperformance rates across all the reported fund categories in our scorecard. While there was a broad mix of underperformance rates in H1, over a 15-year horizon, more than 70% of actively managed funds failed to outperform their comparison index in 38 out of 39 categories.