Summary

In an environment characterized by large-cap dominance, it was not surprising to see that a majority of actively managed equity funds underperformed their assigned benchmarks in 2024. Fixed income managers had a mixed year, with pockets of high outperformance.

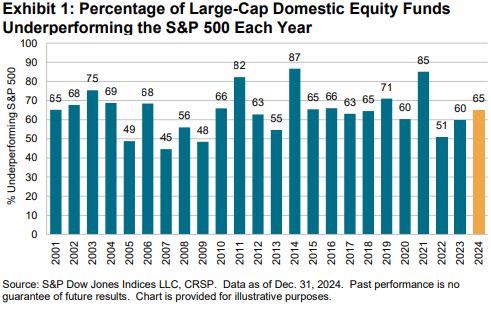

In our largest and most closely watched comparison, 65% of all active large-cap U.S. equity funds underperformed the S&P 500®, worse than the 60% rate observed in 2023 and slightly above the 64% average annual rate reported over the 24-year history of our SPIVA Scorecards.

Across asset classes, underperformance rates typically rose as time horizons lengthened. At the one-year horizon, 7 of 22 equity categories and 11 of 16 fixed income categories saw majority outperformance. Over the 15-year period ending December 2024, there were no categories in which a majority of active managers outperformed.

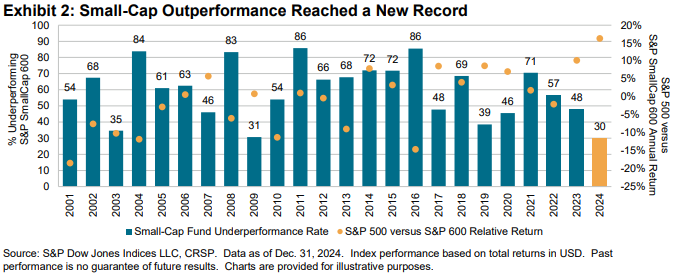

Despite opportunities to tilt toward outperforming large caps, 62% of all Mid-Cap funds lagged the S&P MidCap 400®. But there was a striking divergence in the performance of smaller-capitalization U.S. equity managers. Perhaps benefiting from the relatively lower benchmark performance—a 16% return differential separated The 500™ and the S&P SmallCap 600®—only 30% of All U.S. Small-Cap funds underperformed. That was their lowest underperformance rate across more than two decades of our annual SPIVA Scorecards.

The positive momentum for small-cap managers was not confined to the U.S, as evidenced by just 43% of International Small-Cap funds underperforming at the one-year horizon. Other international equity categories were not as fortunate: 84% of funds in the Global category underperformed the S&P World Index, and 69% of International funds underperformed the S&P World Ex-U.S. Index. Meanwhile, reversing their H1 2024 majority outperformance, 71% of Emerging Markets funds underperformed over the full year in 2024. China's weak performance in H1 and strong recovery in H2 may have posed a headwind for managers who had previously benefited from an underweight to China.

Fixed income results were generally better, with an average one-year underperformance rate of 41% across all fund categories 3 and majority outperformance reported in 11 out of our 16 categories. Performance among credit managers was mixed: 70% of General Investment-Grade funds outperformed, but 66% of High Yield funds underperformed. Municipal categories saw majority outperformance across the board as did emerging debt. At the other extreme, 95% of Government Intermediate funds underperformed.