Since the first publication of the S&P Indices Versus Active (SPIVA) U.S. Scorecard in 2002, S&P Dow Jones Indices has been the de facto scorekeeper of the ongoing active versus passive debate. The SPIVA New Zealand Scorecard measures the performance of actively managed funds offered in New Zealand against benchmarks over various time horizons, encompassing both equity and bond funds.

2024 Highlights

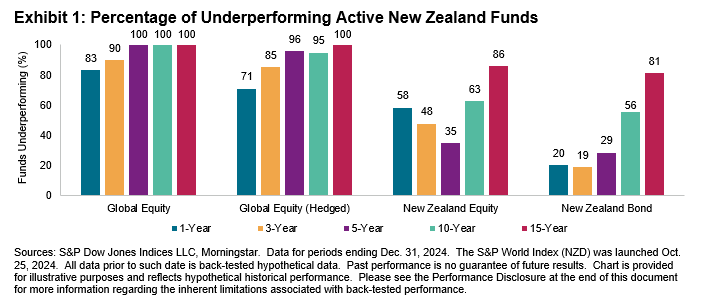

It was another challenging year for active managers across developed equity markets. A large majority of global equity funds domiciled in New Zealand lagged the S&P World Index, with 83% of Global Equity funds and 71% of Global Equity (Hedged) funds underperforming. New Zealand Equity funds fared relatively better, with a 58% underperformance rate, while the New Zealand Bond category was a bright spot, with 80% of funds outperforming. Exhibit 1 summarizes the results across all our reported categories.

- Global Equity Funds: Developed market equities had another strong year, with the S&P World Index posting a 35.5% return in New Zealand dollar terms (19.5% in U.S. dollar terms and 22.5% with currency hedging). Funds in the Global Equity and Global Equity (Hedged) categories struggled to keep up, with one-year underperformance rates of 83% and 71%, respectively. Longer term, underperformance rates were even more pronounced, with 100% of funds underperforming the benchmark over 15 years.

- New Zealand Equity Funds: The S&P/NZX 50 Index gained 11.4% in 2024 (12.2% with imputation credit), while 58% of actively managed New Zealand Equity funds underperformed it. Some did better, and the funds in this category achieved an asset-weighted average return of 14.0%. Over the 15-year horizon, 86% of funds underperformed.

- New Zealand Bond Funds: With favorable conditions for style bias in duration and credit, many active managers in the New Zealand Bond category performed well in 2024. Only 20% of funds underperformed, generating an asset-weighted average return of 6.3% compared to a 5.3% return for the S&P/NZX Composite Investment Grade Bond Index in 2024. However, more consistent performance will be required to alter the longer-term statistics, as 81% of funds lagged over a 15-year period.

- Fund Survivorship: Fund liquidation remained limited, with only one out of a total of 111 funds across all our reported categories failing to survive in 2024. The attrition rate increased over longer time horizons, with 50% of funds across all categories either merged or liquidated over the 15-year period, significantly affecting the fund underperformance rate as shown in Exhibit 2.