Summary

Since the first publication of the S&P Indices Versus Active Funds (SPIVA) U.S. Scorecard in 2002, S&P Dow Jones Indices has been the de facto scorekeeper of the ongoing active versus passive debate.

The SPIVA MENA Scorecard measures the performance of actively managed MENA equity funds against their respective benchmarks over various time horizons, providing statistics on outperformance rates, survivorship rates and fund performance dispersion.

Year-End 2023 Highlights

2023 seemed not to be a challenging year for active equity managers. Despite strong market performance, a majority of funds across all categories outperformed their respective benchmarks over the one-year horizon. MENA Equity funds heavily outperformed, with 71% of funds surpassing the S&P Pan Arab Composite LargeMidCap Index.

MENA

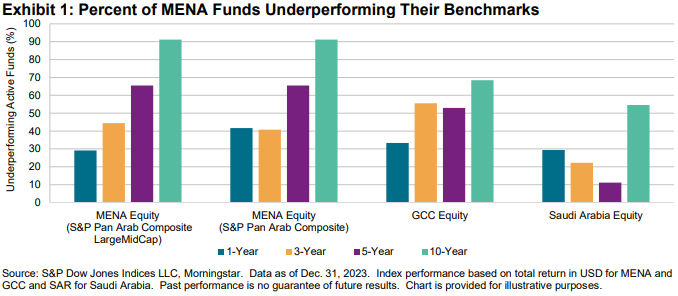

- Underperformance rates were low over the one- and three-year periods, with 29% and 44% of active funds, respectively, trailing the S&P Pan Arab Composite LargeMidCap Index. When compared to the S&P Pan Arab Composite, 42% of MENA Equity Funds underperformed in 2023.

- As time horizons extended, fund managers lost the ability to outperform in this category, with 91% of MENA Equity funds underperforming both benchmarks over the 10-year period ending in 2023.

- Over the 10-year period, 62% of MENA Equity funds merged or were liquidated, higher than the average across all categories.

GCC

- The S&P GCC Composite finished 2023 up 10.0%, and 33% of equity funds focused on the Gulf Cooperation Council (GCC) region underperformed over the one-year period. Underperformance rates rose to 56%, 53%, and 68% over the 3-, 5- and 10-year horizons, respectively

- Survival rates for active GCC Equity funds were moderate, with 79% of funds surviving over the 10-year period.

Saudi Arabia

- The S&P Saudi Arabia gained 15.7% in 2023, and 29% of funds underperformed the index. The category underperformance rate was among the smallest within all MENA categories over the one-year period.

- Over a longer time horizon, the majority of Saudi Arabia Equity funds trailed the benchmark, with an underperformance rate of 55% over 10-year period.

- The survival rate of active Saudi Arabia Equity funds was the second highest among all MENA categories, with 73% of funds surviving over the 10-year period.