Summary

The S&P Indices Versus Active (SPIVA) Latin America Scorecard measures the performance of actively managed funds across Brazil, Chile and Mexico against their respective benchmarks over various time horizons, providing statistics on outperformance rates, survivorship rates and fund performance dispersion.

Year-End 2024 Highlights

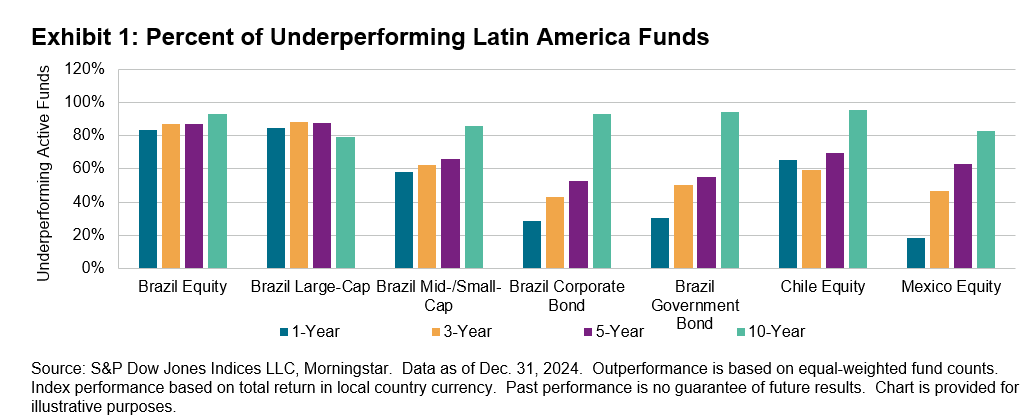

As most Latin American benchmarks declined over the course of 2024, underperformance rates among active managers significantly varied by country and asset class. Managers of equity funds in Mexico and bond funds in Brazil fared better than most, with less than one-half of funds underperforming their benchmarks. In all other categories, the majority of active funds underperformed in 2024. All categories underperformed over a 10-year horizon (see Exhibit 1).

Mexico

- The S&P/BMV IRT fell 10.7% during calendar year 2024. Fewer than one in five active Mexico Equity fund managers (18.6%) underperformed for the one-year horizon. Over longer periods, outperformance remained challenging, with 46.5%, 62.8% and 82.9% of managers underperforming the benchmark over 3-, 5- and 10-year periods, respectively (see Report 1a).

- The median active fund return surpassed the benchmark by 2.2% in 2024, better than in longer periods; median funds outperformed by 0.6% over the 3-year period and underperformed by 1.2% and 2.3% for the 5- and 10-year periods, respectively (see Reports 3 and 5). Over the 10-year period, the threshold for top-quartile managers lagged the benchmark by 0.2%.

- The survival rates of active funds in Mexico remained the highest in Latin America, at 100.0%, 100.0%, 95.3% and 78.0% over the 1-, 3-, 5- and 10-year periods, respectively (see Report 2); this marked the eighth scorecard in a row that Mexico Equity funds had the highest three- and five-year period survivorship rates among Latin America categories.

- Funds with greater assets performed slightly better than smaller funds in 2024. Average returns for Mexico Equity funds were 4.3% higher on an asset-weighted basis than on an equal-weighted basis (see Reports 3 and 4).

Brazil

- Brazil’s equity market ended 2024 in negative territory, with the S&P Brazil BMI declining 8.0% (see Report 3). Large caps, as measured by the S&P Brazil LargeCap, fell 4.8%, significantly outperforming mid- and small-cap companies, as measured by the S&P Brazil MidSmallCap, which finished the year down 15.4%.

- In 2024, 58.0% of active Brazil Mid-/Small-Cap funds underperformed their benchmark, while a larger majority of active equity funds underperformed their benchmarks in other categories, with underperformance rates of 84.7% among Brazil Large-Cap funds and 83.1% for Brazil Equity funds. Active managers within all categories, with the exception of Brazil Large-Cap funds, fared even worse relative to their respective benchmarks over the longer 10-year period ending in 2024, with underperformance rates of 93.1%, 79.1% and 85.9% in the Brazil Equity, Brazil Large-Cap and Brazil Mid-/Small-Cap fund categories, respectively (see Report 1a).