Since the first publication of the S&P Indices Versus Active (SPIVA) U.S. Scorecard in 2002, S&P Dow Jones Indices has been the de facto scorekeeper of the ongoing active versus passive debate.

The SPIVA Japan Scorecard measures the performance of actively managed funds offered in Japan against assigned benchmarks over various time horizons, covering large-, mid- and small-cap segments, as well as international and global equity funds.

2023 Highlights

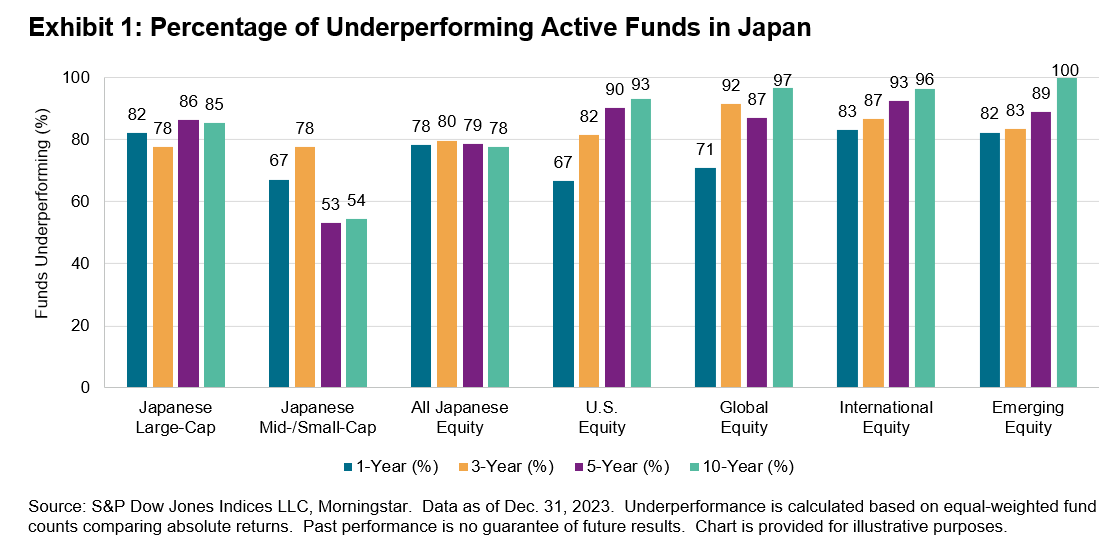

It was a challenging year for active management, with most equity funds underperforming their benchmarks in every reported category in 2023. 82% of Japan Large-Cap Equity funds underperformed the S&P/TOPIX 150, while funds in the Japan Mid-/Small-Cap and U.S. Equity categories did relatively better, with one-year underperformance rates at 67%. Exhibit 1 summarizes the results across all our reported categories.

- Japanese Large-Cap Funds: The S&P/TOPIX 150 posted an impressive 30.7% gain in 2023, and domestic large-cap equity funds struggled to keep up; the one-year underperformance rate of 82% was the second highest in 10 years. Underperformance rates rose over longer terms, with 85% underperforming over the 10-year period.

- Japanese Mid-/Small-Cap Funds: Japanese mid-/small-cap equity managers were unable to maintain their majority outperformance from the first half of the year, recording a full-year underperformance rate of 67%. Their long-term records were also relatively better than other categories, with 54% of funds underperforming over 10 years.