SUMMARY

- S&P Dow Jones Indices has been the de facto scorekeeper of the ongoing active versus passive debate since the first publication of the SPIVA U.S. Scorecard in 2002. Over the years, we have built upon our experience by expanding scorecard coverage into Australia, Canada, Europe, India, South Africa, Latin America, the Middle East and North Africa, and Japan. While this report will not end the debate surrounding active versus passive investing in Japan, we hope to make a meaningful contribution by examining market segments in which one strategy performs better than the other.

- The SPIVA Japan Scorecard reports on the performance of actively managed Japanese mutual funds against their respective benchmark indices over 1-, 3-, 5-, and 10-year investment horizons.[1] In this scorecard, we evaluated returns of more than 777 Japanese large- and mid/small-cap equity funds, more than 743 international equity funds investing in global, international, and emerging markets, as well as U.S. equities.

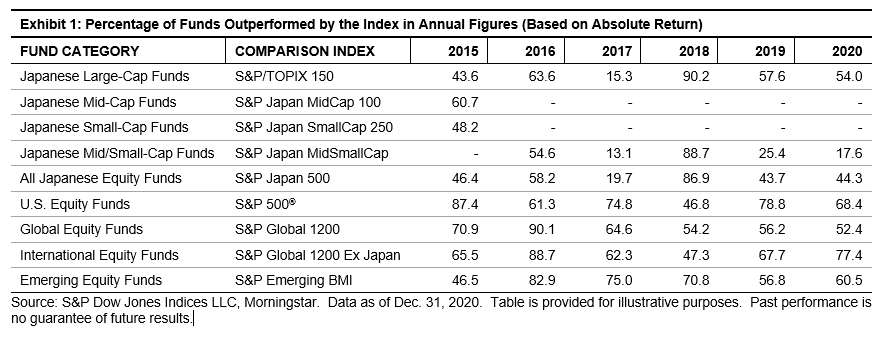

- Japanese Equity Funds: In 2020, the S&P/TOPIX 150 gained 10.3%, and the S&P Japan MidSmallCap was nearly flat. Over the same period, 46.0% and 82.4% of large- and mid/small-cap equity funds beat their respective benchmarks, with equal-weighted average returns of 10.5% and 13.2%, respectively. Benchmark-relative performance of domestic equity funds in 2020 was better than in 2019, with higher percentages of funds outperforming the benchmark.

Over the 10-year horizon, 22.7% and 52.4% of large- and mid/small-cap funds managed to outperform their benchmarks, while 35.0% and 35.7% of funds were liquidated, respectively. The large-cap funds recorded equal- and asset-weighted average excess returns of 3.2 bps and 4.3 bps relative to benchmark, respectively, while the mid/small-cap funds reported excess returns of 3.86% and 1.85% on equal- and asset-weighted bases, respectively. Japanese mid/small-cap funds tended to deliver higher benchmark-relative excess return compared with Japanese large-cap funds.

- International Equity Funds: In 2020, fewer funds in the U.S. and global equity fund categories underperformed their benchmarks than in 2019, while the opposite was observed in the international and emerging market equity fund categories. For U.S. and global equity funds, 68.4% and 52.4% underperformed their respective benchmarks, and 77.4% and 60.5% of international and emerging market equity funds lagged their benchmarks, respectively. For 2020, global equity funds delivered an equal-weighted excess return of 5.1% versus the S&P Global 1200, while the rest of the foreign equity fund categories reported negative equal-weighted average returns relative to their benchmark indices. Significant divergence between the asset- and equal-weighted average returns were observed for global equity funds, with asset-weighted return exceeding the equal-weighted returns by 14.1%.

Over the 10-year period, the majority of foreign equity funds underperformed their respective benchmarks. More than 90% of global, international, and emerging equity funds underperformed their respective benchmarks, while 78.3% of U.S. equity funds failed to beat the S&P 500®. However, U.S. equity funds had the worst benchmark-relative excess return on both equal- and asset-weighted bases (-6.1% and -6.0%, respectively). Foreign equity funds had a 10-year liquidation rate of 46.3%, which was much higher than that of domestic equity funds (35.3%).