Since the first publication of the S&P Indices Versus Active (SPIVA) U.S. Scorecard in 2002, S&P Dow Jones Indices has been the de facto scorekeeper of the ongoing active versus passive debate.

The SPIVA Japan Scorecard measures the performance of actively managed funds offered in Japan against their respective benchmarks over various time horizons, covering large-, mid- and small-cap segments, as well as international and global equity funds.

Mid-Year 2023 Highlights

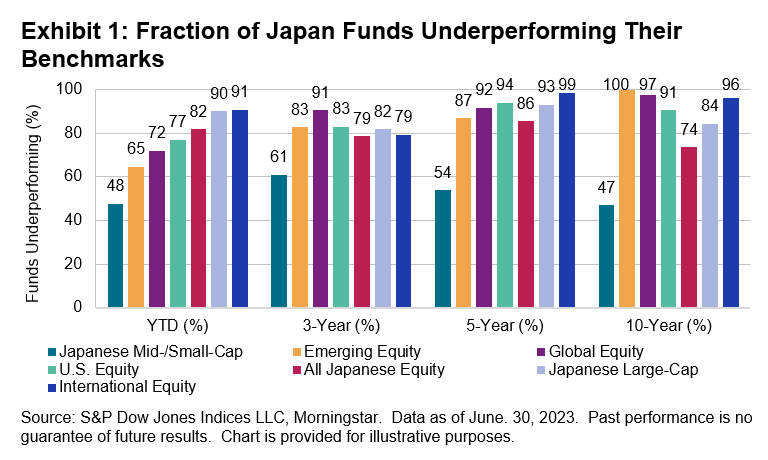

It was a challenging first half of 2023 for active management, as over one-half of funds underperformed their benchmarks in all but one of our reported categories.

For domestic Large Cap funds, 91% trailed the S&P/TOPIX 150, while Japanese Mid-/Small-Cap funds were the exception, with an underperformance rate of 48%.

- The S&P/TOPIX 150 posted 25.5% in the first six months of 2023, and 90% of Japanese Large-Cap funds underperformed the index over the period.

- International Equity funds, which was the category with the lowest underperformance rate in 2022 (42%), had the highest underperformance rate in the first half of 2023 (91%). At the five-year horizon, 99% of active managers in this category lagged their benchmark.

- Results for active managers were better in the Japanese Mid-/Small-Cap funds category, where 48% of actively managed funds underperformed the S&P Japan MidSmallCap in the first six months of 2023. These relatively better results were maintained in the long-term record of actively managed Japanese Mid-/Small-Cap funds, with 61%, 54% and 47% underperforming over the 3-, 5- and 10-year periods, respectively.