Since the first publication of the S&P Indices Versus Active Funds (SPIVA) U.S. Scorecard in 2002, S&P Dow Jones Indices has been the de facto scorekeeper of the ongoing active versus passive debate.

The SPIVA Canada Scorecard measures the performance of Canadian actively managed funds against their respective benchmarks over various time horizons, covering large-, mid- and small-cap as well as international and global equity funds.

Mid-Year 2022 Highlights

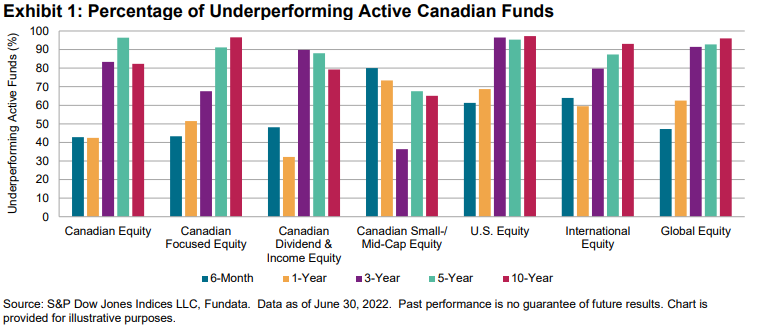

In the turmoil of the first half of 2022, actively managed funds in Canada navigated the challenges relatively well. Less than one-half of active funds underperformed their benchmarks in the Canadian Equity (43%), Canadian Focused Equity (43%), Canadian Dividend & Income Equity (48%) and Global Equity (47%) categories (see Exhibit 1 and Report 1). Underperformance rates generally increased with measurement horizons, with a cross-category average of 90% of active funds underperforming over the past 10 years.

Sign up to receive updates via email

Sign Up

- Canadian Equity Funds: The S&P/TSX Composite fell 9.9% in H1 2022 and Canadian Equity funds dropped 9.0% and 9.3% on equal and asset-weighted bases, respectively. Underperformance rates hit 43% over six months, climbing to 83%, 96% and 82% over the 3-, 5- and 10-year horizons, respectively.

- Canadian Focused Equity Funds: The blended benchmark of 50% S&P/TSX Composite + 25% S&P 500® + 25% S&P EPAC LargeMidCap fell 14.7% in H1 2022, outperforming 43% of Canadian Focused Equity funds. This rose to 68%, 91% and 97% over the 3-, 5- and 10-year horizons, respectively.

- Canadian Dividend & Income Equity Funds: The S&P/TSX Canadian Dividend Aristocrats® Index fell 5.3% during H1 2022, while Canadian Dividend & Income Equity funds lost 5.8% and 5.5% on equal and asset-weighted bases, respectively. Underperformance rates reached 48% over six months, and rose to 90%, 88% and 79% over the 3-, 5- and 10-year horizons, respectively.

- Canadian Small-/Mid-Cap Equity Funds: The S&P/TSX Completion Index dipped 10.9% in H1 2022, and 80% of Canadian Equity Small-Mid-Cap funds underperformed the index. Funds in this category lost 16.4% and 15.6% on equal- and asset-weighted bases, respectively, over six months.

- U.S. Equity Funds: The S&P 500 shed 18.3% in the first six months of 2022, and 61.3% of U.S. Equity funds underperformed the index. Very few funds in the U.S. Equity category outperformed over the long term, with 97%, 95% and 97% underperforming over 3-, 5- and 10-year horizons, respectively.

- International Equity Funds: 64% of International Equity funds trailed the S&P EPAC LargeMidCap, and 87% and 93% underperformed over 5- and 10-year periods, respectively.

- Global Equity Funds: The S&P EPAC LargeMidCap fell 18.5% during H1 2022 and Global Equity funds sank 19.7% and 19.6% on equal and asset-weighted bases, respectively. Over the six-month period, 47% of funds in the category trailed the benchmark. Over the 3- 5- and 10-year periods, 91%, 93% and 96% of funds underperformed, respectively.

- Fund Survivorship: Liquidation rates for all categories were in single digits for the one-year period ending June 30, 2022. Canadian Focused Equity had the highest attrition rate, at 96%. Over the 10-year period, 47% of Canadian Equity funds merged or liquidated and an average of 40% of funds disappeared across all categories (see Report 2).