INTRODUCTION

A key dimension of any active versus passive debate is managers’ ability to consistently deliver above-average returns over multiple periods. Persistence in performance is one out of many possible ways to differentiate skill from luck.

In this report, we measure the performance persistence of active funds in Brazil, Chile, and Mexico that outperformed their peers over consecutive three- and five-year periods. We also analyze how their performance ranking transitioned over subsequent periods.

SUMMARY OF RESULTS

Brazil

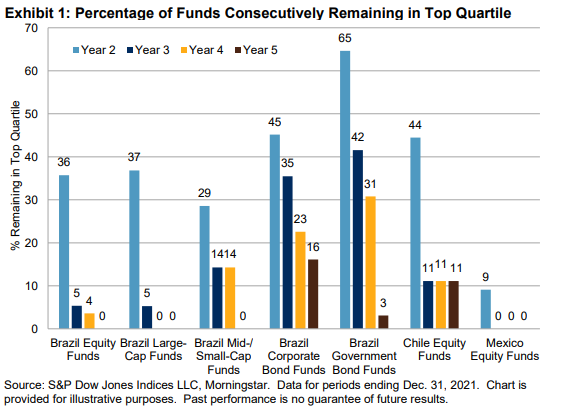

- Top performers in Brazilian fixed income fund categories showed better chances than equity categories of remaining in the top quartile over three years (see Report 1).

- Report 2 highlights the inability of top-performing equity fund managers to consistently repeatsuccess in subsequent years. The Brazil Large-Cap Fund category was the least persistent—by the fourth year, none of them remained in the top quartile. Moreover, none of the top performers in the Brazil Equity Fund and Brazil Mid-/Small-Cap Fund categories remained in the top quartile by the fifth year./li>

- The majority of corporate bond fund managers did not maintain consistent outperformance for five years in a row; only 16% of them did so. Brazil Government Bond Funds did not showbetter results; 3% of them delivered consistent outperformance for five years in a row (see Report 2).

- The five-year transition matrix (see Report 5) highlights the Brazil Government Bond Fund category. The chance of a winning fund remaining in the top quartile after five one-year periods was the highest among categories, with 66% funds remaining in the first quartile

Chile

- Report 2 shows the lack of persistence by equity managers in Chile—11% of top-performing funds in the first 12-month period repeated their outperformance after five years.

- Report 3 shows that 29% of the top-quartile funds in the first period of the three-year transition matrix remained in the top quartile.

- Funds in the second, third and fourth quartile of the five-year transition matrix were more likely to be liquidated (56%, 33% and 60%, respectively) than to stay or move to lower quartiles (see Report 5).

Mexico

- As observed in the SPIVA® Latin America Mid-Year 2021 Scorecard, Mexico had a higher rate of fund survivors than Brazil and Chile in the three- and five-year periods. Reports 3, 4, 5 and 6 show that Mexican funds had less chance of being shut down than Brazilian and Chilean funds.

- The five-year performance persistence test (see Report 2) shows that top-quartile managers had difficulty replicating their outperformance in subsequent years. After one year, just 9% of managers remained in the top quartile, and by the end of year two, none remained.