SUMMARY

Can investment results be attributed to skill or luck? Genuine skill is more likely to persist, while luck is random and fleeting. Thus, one measure of skill is the consistency of a fund’s performance relative to its peers. The Persistence Scorecard measures that consistency and shows that, regardless of asset class or style focus, active management outperformance is typically relatively short-lived, with few funds consistently outranking their peers.

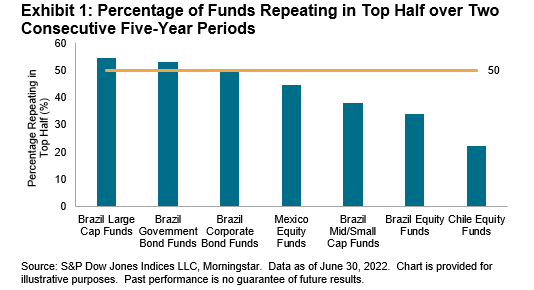

In each of our reported regional fund categories across Brazil, Chile and Mexico, of all the funds whose performance placed them in the top quartile for the 12-month period ending June 2018, less than 5% of all funds, and no equity funds, managed to remain in the top quartile for each of the next four years (see Report 2). Exhibit 1 illustrates that across most categories, less than 50% of funds were able to repeat their top-half status over two consecutive five-year periods (see Report 6).

REPORT HIGHLIGHTS

Brazil

- Top-performing Brazilian equity fund managers were unable to maintain their outperformance in subsequent years. Equity funds were the least persistent—by the fourth year, none of the funds in the Brazil Equity, Brazil Large-Cap and Brazil Mid-/Small-Cap categories had remained consistently in the top quartile (see Report 2).

- Bond funds fared slightly better, but still the majority of corporate bond and government bond fund managers did not maintain consistent outperformance for five years in a row; only 3% of them did so (see Report 2).

- The Brazil Corporate Bond Funds category was a highlight within the five-year transition matrix (see Report 5). The chance of a winning fund remaining in the top quartile after two consecutive five-year periods was the highest among all the categories, with 50% of funds remaining in the first quartile.

Chile

- The lack of persistence by equity managers was equally visible in Chile—none of the top performing funds in the first 12-month period repeated their outperformance for the subsequent four years (see Report 2).

- Report 3 shows that only 29% of the top-quartile funds in the first period of the three-year transition matrix remained in the top quartile at the end of the three years.

- Funds in the second, third and fourth quartiles of the five-year transition matrix were more likely to be liquidated (44%, 44% and 67%, respectively) than to stay where they were or move to a higher-ranked quartile (see Report 5).

Mexico

- Similar to the other regions, top-quartile managers in Mexico had difficulty replicating their outperformance in subsequent years. After one year, just 27% of managers remained in the top quartile, and after two years, none remained (see Report 2).

- The five-year transition matrix shows that a third of top-quartile managers moved to quartile four over the five-year period, and only a third remained in the top (see Report 5).

- Consistent with what we observed in the SPIVA® Latin America Mid-Year 2022 Scorecard, Mexico had a higher fund survival rate than Brazil and Chile across all periods measured. Reports 3, 4, 5 and 6 show that, on average, Mexican funds had less chance of being shut down than Brazilian and Chilean funds.