Summary

Can investment results be attributed to skill or luck? Genuine skill is more likely to persist, while luck is random and fleeting. Thus, one measure of skill is the consistency of a fund’s performance relative to its peers. The Persistence Scorecard measures that consistency and shows that, regardless of asset class or style focus, active management outperformance is typically relatively short lived, with few funds consistently outranking their peers.

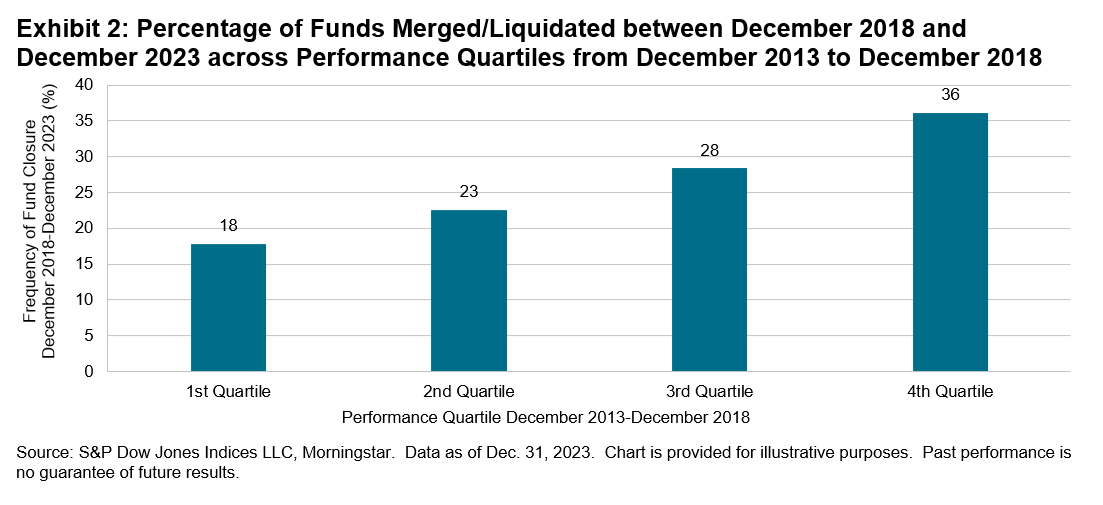

In five of the six reported equity fund categories and all four reported fixed income categories, not a single manager whose performance placed them in the top quartile for the 12-month period ending December 2019 managed to remain in the top quartile for the next four years (see Report 2 and Report 8). The results improve by lowering the bar from the top quartile to the top half: the proportion of funds remaining in the top half over four consecutive years is higher than would be expected if the performance were completely random in 4 of the 10 reported categories (see Exhibit 1).

Report Highlights

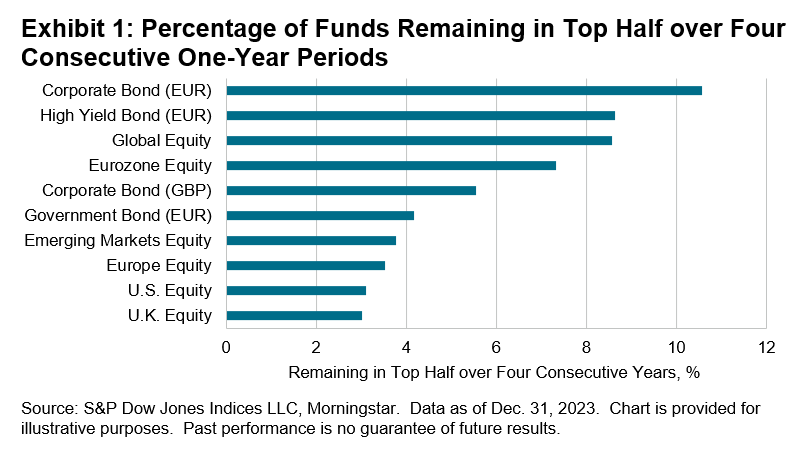

2023 was a challenging environment for active equity managers in Europe and, just like in previous years, persistence of outperformance was hard to find. While prior outperformance was not a reliable indicator of future outperformance, persistent underperformance did significantly increase the frequency of subsequent fund closures.

- Over a five-year horizon, it was statistically nearly impossible to find funds that consistently remained in the top performance quartile year after year. Of the 1,118 actively managed funds whose performance over the 12-month period ending December 2019 placed them in the top quartile in their respective categories, just two funds remained in the top quartile in each of the four subsequent one-year periods ending December 2023.

- Over discrete five-year periods, there were also few funds whose relative outperformance persisted. Just 17% of top-half U.K. Equity funds remained in the top half for two consecutive five-year periods, while the equivalent percentage for EUR-denominated High Yield Bond funds was 15%.

- Over the long term, poor performance has proven to be a reliable indicator of future fund closures. Across the 10 categories reported by our scorecard, an unweighted average of 36% of actively managed funds whose performance placed them in the bottom quartile in the five-year period ending December 2018 were subsequently merged or liquidated over the next five years, while the comparable figure for funds in the top quartile was just 18% (see Exhibit 2 as well as Reports 5 and 11).