“It takes 500 small details to add up to one favorable impression."

Cary Grant

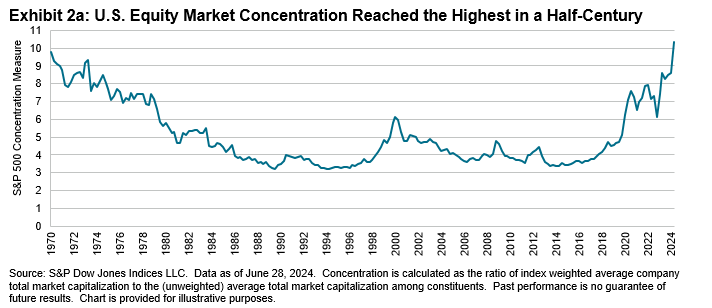

The S&P 500® Equal Weight Index has outperformed the S&P 500® over more than two decades of live history, with a similar long-term rate of excess returns observed over a hypothetical back-tested history extending back to 1970 (see Exhibit 1). These observations are not new, but an equal weight approach to large-cap U.S. equities may be of particular interest in times such as the present, when the equity markets are at high levels of market concentration relative to history.

In the context of the current market dynamics, this paper summarizes a wide range of observations on the potential sources and drivers of relative performance in the S&P 500 Equal Weight Index—ranging from market concentration to sector, factor and single-stock perspectives.

The Current Market Context

The U.S. equity market has, among other features, been recently characterized by strongly extended price trends and the relative dominance of a few mega-cap companies. This could make equal weight strategies particularly interesting because, first, trends in concentration and momentum tend to reverse at some point (even if it is hard to identify when that will occur) and second, because diversification strategies can be more important when markets are relatively concentrated.

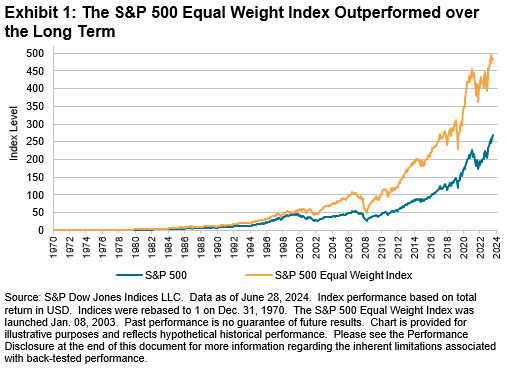

There are numerous ways to see that the U.S. equity market is unusually concentrated at present. Particularly germane to comparisons between equal- and market-cap-weighted indices is that as of June 28, 2024, the (unweighted) average market capitalization of the S&P 500 constituents was USD 96.3 billion dollars but, in contrast, the index-weighted average market capitalization was USD 998.6 billion dollars. In other words, a strategy tracking the S&P 500 would—on a portfolio-weighted basis—have an average market capitalization more than ten times larger than an equally weighted one.

Using this ratio (between the weighted and unweighted average market cap) to represent “concentration,” we can see that concentration has risen sharply over the past 10 years, recently reaching extremes not seen for more than half a century (see Exhibit 2a).