“The hare laughed at the tortoise’s feet but the tortoise declared, ‘I will beat you in a race!’”

Aesop’s Fables, translated by Laura Gibbs (2002)

After the ATM, the index fund has been claimed by some to be the most useful invention the financial sector has ever created. The relative success of index funds in equities faced a tide of professional skepticism, but they nonetheless became popular. A similar revolution may be due to occur in the bond markets, where passive investing appears to be climbing a path paved by the equity markets around a decade or so earlier.

A range of practical and theoretical (or even theological) arguments distinguish the potential for indexing in the larger and more granular fixed income markets. The choice between active and passive exposures is also relatively newer to the fixed income markets, due in part to a historical scarcity of well-known benchmarks and the practical difficulty of tracking them.

The impact of passive investing on equities since the turn of the century has been such as to fundamentally change an industry. As the data have accumulated and the range of available products has expanded, and based on a comparison of their trajectories, the stage may now be set for similar developments in professional fixed income management.

This paper explores the practical, theoretical and empirical case for an indexed approach in fixed income, outlining why passive investing came later and examining whether its growth might continue to echo, or even catch up to, that of equity markets.

The Growth of Indexing in Fixed Income

“To win a race, the swiftness of a dart availeth not without a timely start.”

Jean de La Fontaine; The Hare and the Tortoise (1668-1694)

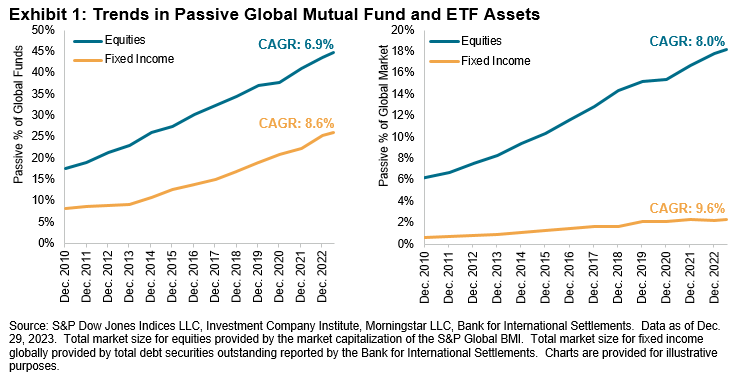

Estimating the aggregated magnitude of passive investing in any given market is difficult, not least because not all market participants report their investment strategy. The data on a particular subset of passive investment vehicles—namely global mutual funds and exchange-traded funds (ETFs)—are relatively easier to obtain and may offer representative statistics. Based on this sample, Exhibit 1 compares two measures of passive adoption in equities and fixed income, specifically the percentage of all mutual fund and ETF assets that are managed passively, and the percentage of the total equities and fixed income markets, respectively, that is represented in aggregate by those funds.

Exhibit 1 shows that the adoption of index funds in fixed income has lagged that in equities. This is partly because their story began later: the first equity index funds were created in the early 1970s, but the first passive bond fund was not introduced until 1986. A similar near-decade lag separates the launch of the first ETFs tracking the equity markets in the early 1990s and the 2002 launch of the first fixed income ETFs.