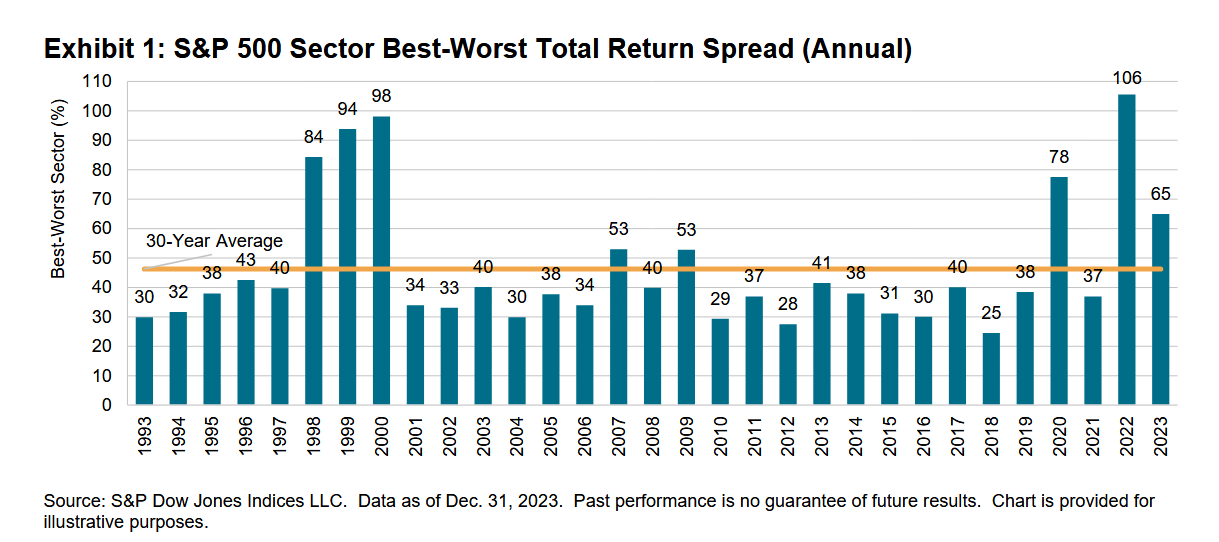

In recent years, the S&P 500® sectors have exhibited elevated dispersion, including their widest-ever spread between the best and worst performers in 2022, highlighting an opportunity for studying the impact of sector selection (see Exhibit 1). In a rapidly evolving global investment landscape, S&P 500 sectors remain tools in active and passive portfolio construction and worthy of consideration.

In this paper, we will:

- Review sector characteristics, performance and influence on stock returns;

- Evaluate the impact of skew on active selection of stocks, sectors and industries;

- Present case studies on strategic and tactical portfolio applications of sector indices.

1. Introduction

“Look deep into nature, and then you will understand everything better.”

Albert Einstein

Imagine equity markets as a deep rainforest, grown dense through the centuries with new ways of investing, constantly born out of soil made from those that came and went long before. Teeming with life and ripe for exploration, this nested series of complex systems perpetually lures intrepid investors seeking answers to the questions: What features drive the behavior of a stock, and how can those help us make sense of the world? As colorful and novel species in this evolving landscape attract the adventurer’s curiosity, so too should a curiously old and large tree with many branches found towering above the canopy. Like sectors, this tree not only endures, but also remains intertwined with the ecosystem of stocks that surround it, providing clues on how to thrive in constantly evolving conditions.

In this paper, we explore how the enduring power of sectors and industries helps to define markets and serve as the framework for myriad investing strategies. Just as the allure of active stock selection persists, so too does evidence that outperformance relative to indices is elusive. Decades of data suggest that sectors and industries may sometimes be more effective exposures than single stocks to diversify risk and express views on market and economic conditions around the world.

We will review past performance of sectors through the lens of 21st century market cycles, identify consistent patterns that continue to make sectors useful and highlight the potential of sectors to improve diversification and performance in global portfolios.

Sectors and industries concentrate securities with similar business models and risk factors, aligning company types around characteristics that largely transcend borders and make them relevant for investors worldwide. The growing use of sectors and industries among diverse investor types in a wide and growing array of liquid index-based strategies and holding periods is reflected in asset levels for related exchange-traded funds (ETFs; see Exhibit 2). This paper examines historical sector and industry index performance and tests strategic long-term use of one or more sectors to gain consistent exposure or correct an unintended bias, as well as tactical use with the intent of adjusting allocations depending on market or economic conditions. The outcomes reaffirm the enduring power of sectors and industries as building blocks in modern equity allocations.