Introduction

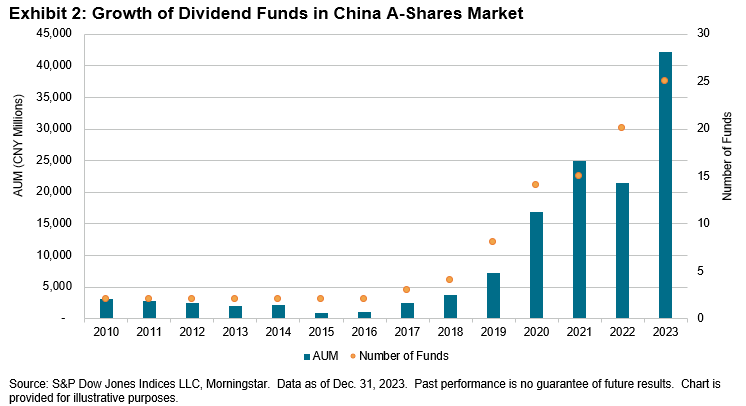

Dividend indices stand as one of the most recognized factor-based investment strategies. As of year-end 2023, there were 377 dividend-focused exchange-traded products (ETPs) globally, amassing over 500 billion in assets under management (AUM). In the China A-shares market, the dividend strategy surged to prominence as 2024 kicked off, exhibiting robust performance amidst recent market turbulence. With an AUM increase of over CNY 20 billion in 2023, dividends have emerged as the primary factor strategy in China's ETF industry.

This paper undertakes a comprehensive examination of the Chinese dividend market, providing insights into the historical performance of the high dividend yield strategy.

Dividends in the China A-Share Market

Cash dividends may serve as a significant indicator of a company’s future prospects and governance discipline, particularly in developed markets. However, in the China A-shares market, companies have historically displayed reluctance to distribute profits to shareholders, opting instead to retain earnings for reinvestment. Stock dividends once dominated the market, garnering substantial interest from retail investors. This phenomenon underscored a corporate emphasis on refinancing while neglecting the distribution of earnings to shareholders.

In response to the need to enhance shareholder rewards and corporate governance, Chinese authorities introduced a series of dividend encouragement policies. The China Securities Regulatory Commission (CSRC), for instance, raised the minimum cash dividend payout level to 30% in 2008, compelling companies to distribute profits. Concurrently, the State Administration of Taxation (SAT) gradually reduced taxes on dividends to encourage public investment in dividend-paying stocks. The reduction in personal income tax on dividends from 20% to 10% in 2005, further lowered to 5% in 2013 and eventually eliminated in 2015, incentivized investors to hold stocks for more than one year. In 2023, the CSRC issued a "cash dividend guidance for publicly listed companies," urging clarity in dividend policies and stabilization of investor expectations. The document also reiterated the importance of a 30% dividend payout ratio, and encouraged companies to start paying interim dividends. These policies played a pivotal role in fostering a cash dividend culture in the China A-share market.

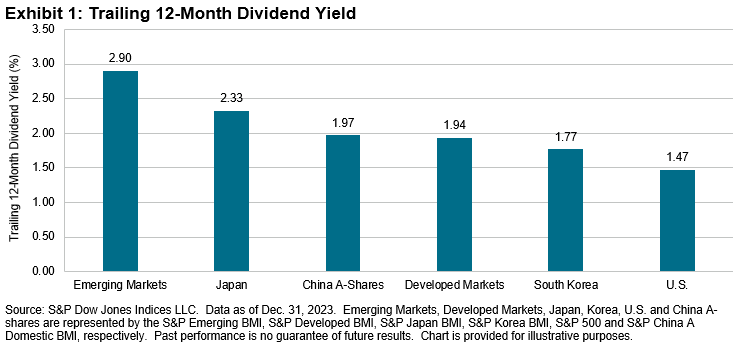

As of Dec. 31, 2023, the trailing 12-month dividend yield of the S&P China A Domestic BMI stood at 1.97%, aligning with the dividend yield level of the S&P Developed BMI and surpassing that of the S&P 500® (see Exhibit 1). Indexed assets tracking dividend strategies in the China A-shares market surged from CNY 2 billion in 2013 to CNY 42 billion by Dec. 31, 2023, reflecting an impressive annualized compound annual growth rate (CAGR) of 36% (see Exhibit 2). Moreover, the number of dividend funds tripled over the past four years.