Introduction

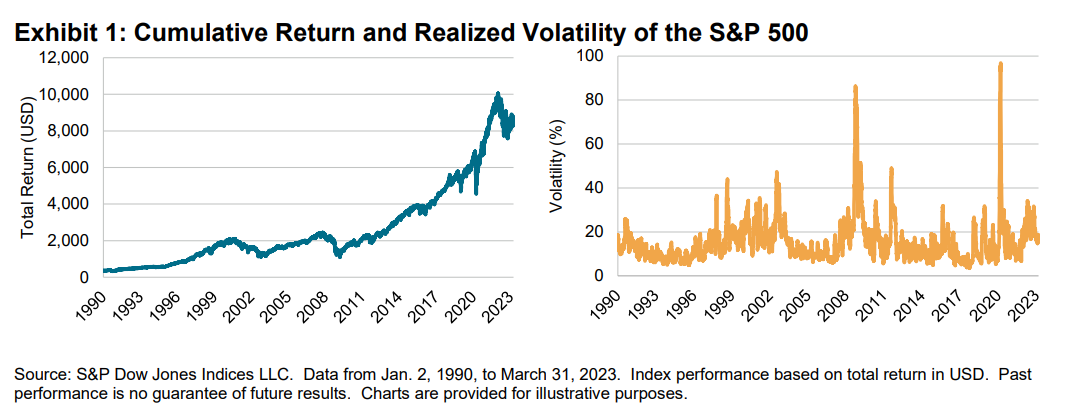

Equity markets have historically offered attractive returns. However, the volatility and risk of a significant pullback can be a notable concern for market participants. For example, the S&P 500®, the leading gauge of U.S. large-cap stocks, had an average annualized total return of 9.88% from Jan. 2, 1990, to March 31, 2023. Over this same period, the index also experienced extreme volatility spikes and periods of losses of over 50%, such as during the 2008 Global Financial Crisis (see Exhibit 4). While its one-year realized volatility has historically tended to be below 20%, during both the financial crisis and the more recent COVID-19 drawdown, volatility exceeded 80% and 90%, respectively. This level of volatility and uncertainty may not be desirable for some market participants.

Risk managed index strategies emerged as a solution designed to provide effective downside protection by reshaping the risk-distribution of the underlying equity index. While these index strategies have been historically successful in reducing volatility, their performance during past bull markets and the recent COVID-19 sell off may suggest some shortcomings.

This paper examines various risk managed indices that have the S&P 500 as the underlying equity exposure. We use S&P DJI indices as benchmarks in order to evaluate the performance for each of these index strategies.

A New Framework for Looking at Risk

Performance is often evaluated by looking at the overall return and volatility, taking the entire history of the index, starting from its launch date. However, performance can differ drastically depending on both the start date and the duration of the employed observation period. In this paper, we take a more thorough approach by considering multiple performance paths and examining tail performance. A new risk management framework is presented that offers an alternative metric for risk, focusing on the amount of protection provided and the cost of providing that protection.

Improving Hedge Efficiency: Proving Protection with Less Drag

This paper concludes by examining whether a more efficient approach to providing protection is possible in order to maximize equity market participation while simultaneously offering meaningful downside protection.