S&P Global Offerings

Featured Topics

Featured Products

Events

Our Services

Investment Themes

Explore new territories with greater confidence

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Education

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Governance

Methodologies

SPICE

Your Gateway to Index Data

Our Services

Professional Resources

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Digital Assets

Indicators

Other Strategies

By Region

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Research & Insights

Education

Performance Reports

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Methodologies

SPICE

Your Gateway to Index Data

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Carbon Metrics

As concerns over climate change continue to grow, so do concerns over carbon asset risk. With the goal of promoting ESG transparency, S&P Dow Jones Indices offers four carbon exposure metrics for our global indices to help market participants understand, measure, and manage carbon risk.

Carbon Exposure Metrics

S&P Dow Jones Indices calculates these metrics using S&P Global Trucost data and analysis to determine the carbon exposure of the companies in our indices. The S&P Global Trucost analysis covers 14,000 companies, representing 99% of global market capitalization.

In the absence of company disclosure, estimations are provided using S&P Global Trucost’s granular, multi-sector assessment of company business activities and proprietary environmentally extended input-output model. The result is a complete environmental performance profile, encompassing company operations and supply chain tiers back to raw materials extraction.

Learn more about how these metrics are calculated.

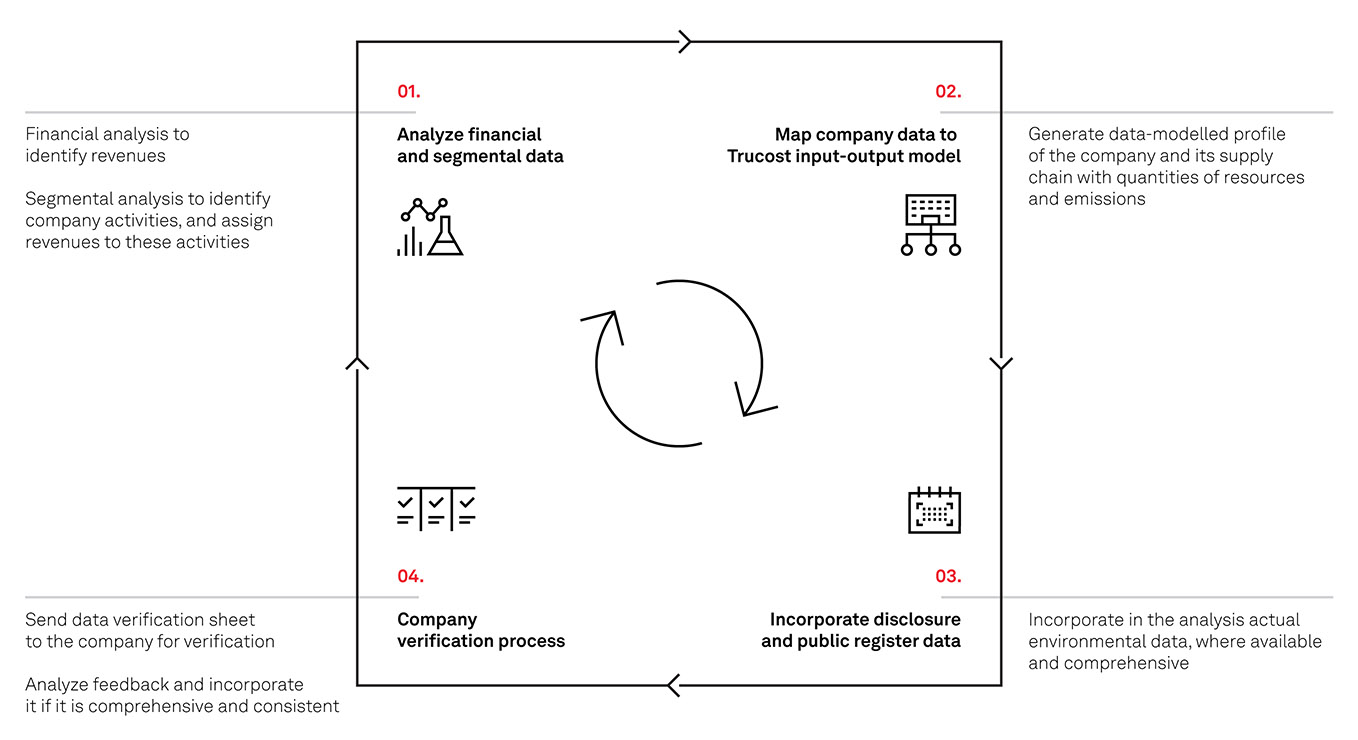

S&P Global Trucost's Research Process

S&P Global Trucost sheds light on companies’ environmental performance using a four-step research process.

About S&P Global Trucost

S&P Global Trucost is a leader in carbon and environmental data and risk analysis. S&P Global Trucost assesses risks relating to climate change, natural resource constraints, and broader environmental, social, and governance factors. More details on S&P Global Trucost’s methodology are available here.