Executive Summary

The S&P 500® is a renowned benchmark for large-cap U.S. equities. The index reflects approximately 80% coverage of investable market capitalization in the U.S. equity market and includes 500 leading companies, many of which are the world’s largest and most recognizable companies with a global reach of operations, customers and revenue sources. As of the end of 2022, USD 11.4 trillion was indexed or benchmarked to the S&P 500, with indexed assets making up approximately USD 5.7 trillion of this. As a consequence of an increasing popularity and scale of S&P 500-related products, including index funds, exchange-traded funds (ETFs) and listed derivatives such as futures and options, the typical cost and barriers to entry for S&P 500-linked investments have fallen over time.

In this paper, we examine the S&P 500 from the perspective of a Hong Kong-based investor, including:

- The relevance of the U.S. in the global economy and global equity markets;

- Comparison of the S&P 500 to the leading large-cap equity benchmark in Hong Kong;

- Complementary aspects of an S&P 500-linked investment for a broad-based Hong Kong equity portfolio; and

- The differences between the S&P 500 and other indices or active portfolios tracking U.S. equities.

The Size and Relevance of the U.S.

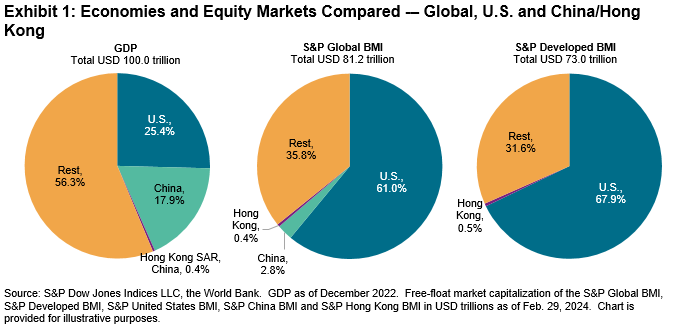

The U.S. equity market represents a significant portion of the global economy and equity opportunity set. Exhibit 1 shows the relative sizes of gross domestic product (GDP) along with equity market capitalization for the U.S., China, Hong Kong and the rest of the world. When Hong Kong equity investors make choices among countries, over 60% of their opportunity set is composed of U.S. stocks.