INTRODUCTION

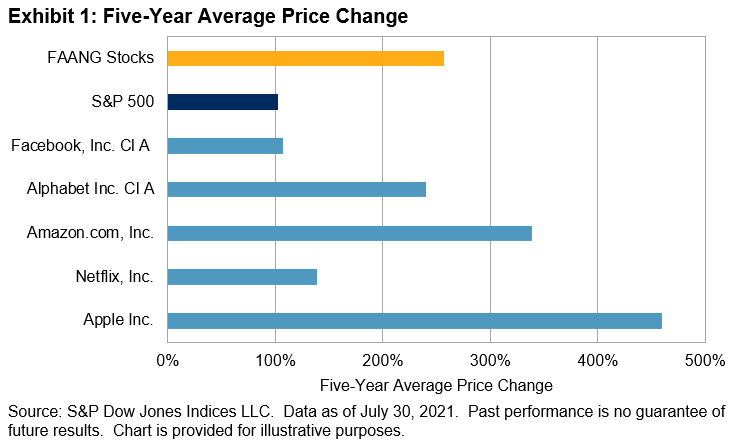

Over the past five years, the world witnessed the dramatic rise in the market capitalization of technology-driven companies like Facebook, Amazon, Apple, Netflix, and Google (now Alphabet), collectively known as the FAANG stocks. The growth rates of these stocks over the past five years have been quite remarkable, with the average price change exceeding 250% and outperforming the S&P 500® by 15.5% (see Exhibit 1).

On May 11, 2020, S&P Dow Jones Indices (S&P DJI) and B3 introduced the S&P/B3 Ingenius Index to the Brazilian market. The index seeks to measure the performance of global companies creating many of the innovative products and services that permeate today’s modern world and are transforming almost every aspect of daily life, including the way we communicate, work, entertain, and shop, and nearly everything in between.

By launching the S&P/B3 Ingenius Index, S&P DJI is providing an index that is designed to measure the performance of 15 innovative global companies trading on B3 as Brazilian Depositary Receipts (BDRs), giving local investors access to foreign securities.