Executive Summary

The iBoxx USD Liquid Emerging Markets Sovereigns & Sub-Sovereigns index tracks the performance of U.S. dollar-denominated bonds from sovereign and sub-sovereign issuers in emerging markets. The index provides a broad measure of emerging market bonds while adhering to stringent liquidity criteria. The index could serve as a basis for tradable products such as futures, total return swaps (TRS) and exchange-traded funds (ETFs).

Debt issued by sovereign and sub-sovereign issuers with a notional amount of at least USD 1 billion and at least one year to maturity from rebalance date are eligible for entry. Similarly to the benchmark, the index uses the IHS Markit Global Economic Development Classification Methodology to catalogue a country as emerging or developed. Except for the Gulf Cooperation Council (GCC) members, regions with a Global National Income (GNI) per capita higher than two times the World Bank GNI high income cut-off during the past five years are excluded. The index uses a novel country capping methodology, reviewed annually in December.

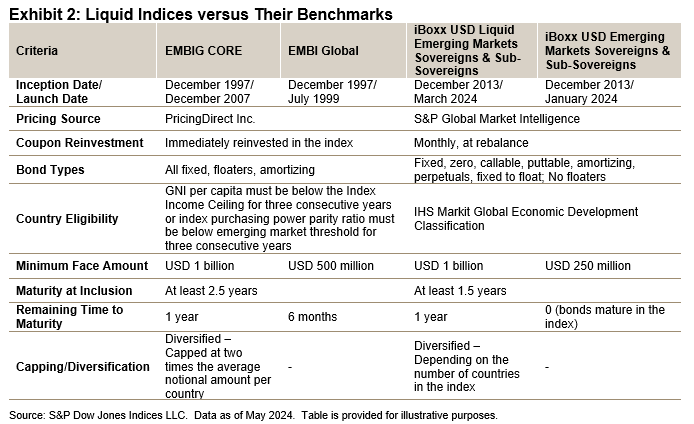

The capping is based on two variables: 1) the average country weight, defined as one divided by the number of countries in the index; and 2) weight-based capping defined as three times the average country weight, rounded to the nearest 2.5%. Exhibit 1 illustrates how the capping methodology was applied starting Dec. 31, 2023. The 7.5% capping became effective in January 2024.

The index uses bid-side pricing; however, new securities are included at the ask price. Coupons are reinvested at the end of the month and the index is rebalanced monthly, on the last business day. The index excludes floating rate bonds.

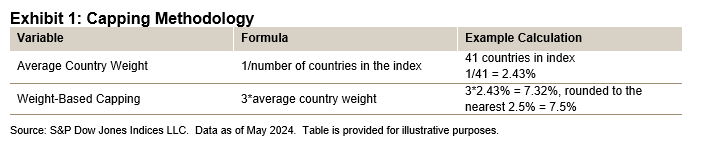

The oldest benchmark in the market is J. P. Morgan’s Emerging Markets Bond Index Global Core (EMBIG CORE), which is based on J. P. Morgan’s EMBI Global. The EMBIG CORE tracks liquid, U.S. dollar-denominated, emerging market fixed and floating rate bonds issued by sovereign and quasi-sovereign entities. The main differences between the iBoxx USD Liquid Emerging Markets Sovereigns and Sub-Sovereigns and the J. P. Morgan EMBI Global are outlined in Exhibit 2.