Introduction

The S&P 500 Equal Weight Index, launched on Jan. 8, 2003, embodies a refreshingly straightforward approach to measuring U.S. equities. Its methodology is simple: rather than weighting its constituents by market capitalization, the index assigns equal weight to all 500 companies of the S&P 500, ensuring a uniform representation of 0.2% for each. This shift from a traditional market-capitalization-weighted index fosters a more balanced approach to the large-cap U.S. equity market. To maintain this equilibrium, the index undergoes quarterly rebalancing, which helps manage weight drift and allows for the potential benefits of mean reversion in equity market valuations. This rules-based methodology has contributed to growth in assets that track the index, indicating interest from market participants and a variety of financial products associated with it. The index also aims to enhance market liquidity by distributing capital more evenly across all constituents, which may reduce concentration risk and helps ensure that liquidity is not disproportionately affected by a few mega-cap stocks.

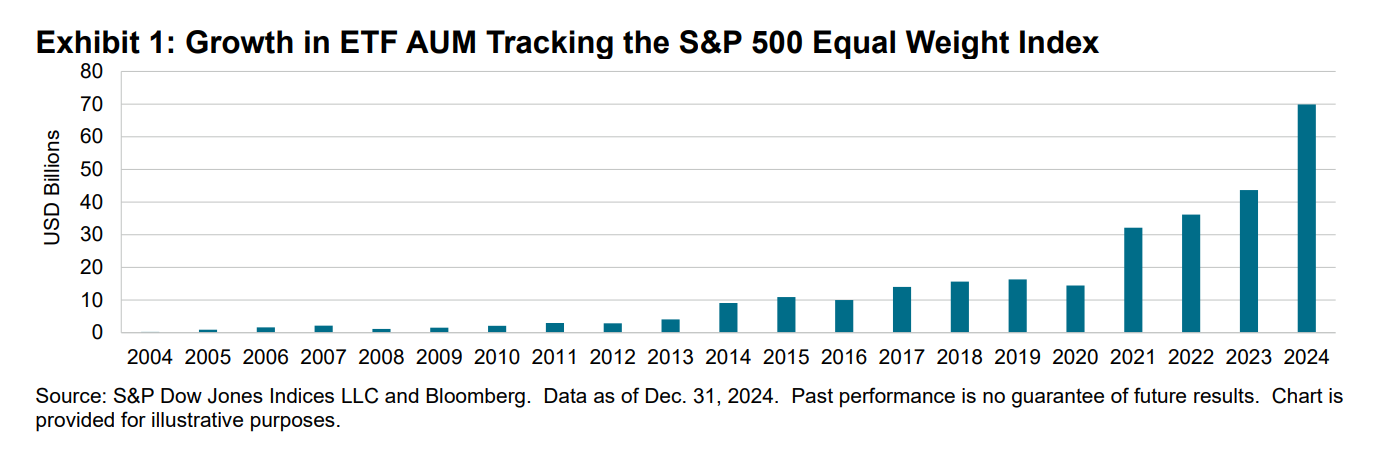

In recent years, the equal weight concept has been adopted across various markets and segments, resulting in the development of numerous products that track the index, including a range of exchange-traded funds (ETFs) and exchange-traded derivatives (ETDs). Over the last five years, ETFs linked to the S&P 500 Equal Weight Index have grown globally, with AUM reaching nearly USD 70 billion in 2024. This development reflects the growing interest in the index as a potential option for market participants seeking diversification, enhanced liquidity and an alternative investment strategy. The introduction of ETDs has further contributed to the index liquidity, reinforcing its role in the broader investment landscape.

The Relevance of Equal Weight Today

In the recent market environment, characterized by heightened concentration among a few mega-cap companies, the S&P 500 Equal Weight Index presents a strategy for hedging concentration risk. The dominance of select companies has resulted in a narrow market focus, highlighting the potential drawdowns a broad, market-cap-weighted index would be exposed to should these stocks underperform. In contrast, equal weighting assigns the same weight across all constituents, which may be relevant in periods when market valuations appear stretched.

Historically, equal weight indices have showcased long-term outperformance, boosted by their weighting to smaller-cap and value stocks, which often carry associated risk premia. The inherent small-cap tilt of equal weight strategies has historically enhanced returns, especially during periods of market correction or volatility. Moreover, the reduced concentration in the largest names has led to more resilient performance historically that has helped the index withstand market fluctuations. Given the rapid shifts in sentiment and momentum, the S&P 500 Equal Weight Index offers a strategic measure of broad-based equities that is especially relevant in the recent market landscape.