1. Why is the U.S. market relevant to investors worldwide?

The U.S. equity market is the largest in the world, with U.S.-domiciled companies representing 60% of the index market capitalization of S&P Dow Jones Indices’ (S&P DJI’s) global equity barometer—the S&P Global BMI—at the end of March 2024. The U.S. also accounts for most of the index market capitalization in 10 of the 11 S&P Global BMI GICS sectors.

Hence, market participants that do not have a U.S. view risk overlooking a sizeable portion of the global equity opportunity set. Not only might this make it more difficult to explain the impact of narratives on global equity returns, but the distinct makeup of the U.S. equity market means that overlooking U.S. equities may impact investors’ abilities to gain strategic or tactical exposures.

2. What role can indices play in measuring equity markets?

Since Charles Dow and Edward Jones began publishing the first ever index—the Dow Jones Railroad Average—towards the end of the 19th century, indices have allowed investors to monitor the impact of trends on different market segments and to benchmark the performance of active managers.

While the first indices were equity market measures, transparent, rules-based indices have since been created for a variety of asset classes. Nowadays, indices also measure the performance of more complex strategies previously thought to be solely within the realm of active management.

Accompanying—and to a large extent, driving—the proliferation of index information, indices have come to serve as the basis for investment products, globally. The substantial adoption of index-based investment products has been driven by the increased awareness of the substantial body of evidence that shows that most active managers underperformed on an absolute and risk-adjusted basis most of the time. For example, more than 90% of U.S. Large-Cap funds based in the U.S. underperformed the S&P 500® over a 20-year period ending on Dec. 31, 2023.European Equity funds focused on large-cap U.S. equities posted similar underperformance rates: more than 90% of such active funds underperformed the S&P 500 over the 10-year period ending on Dec. 31, 2023.

3. The S&P 500 Equal Weight Index has been a popular strategy recently. What are the drivers behind this?

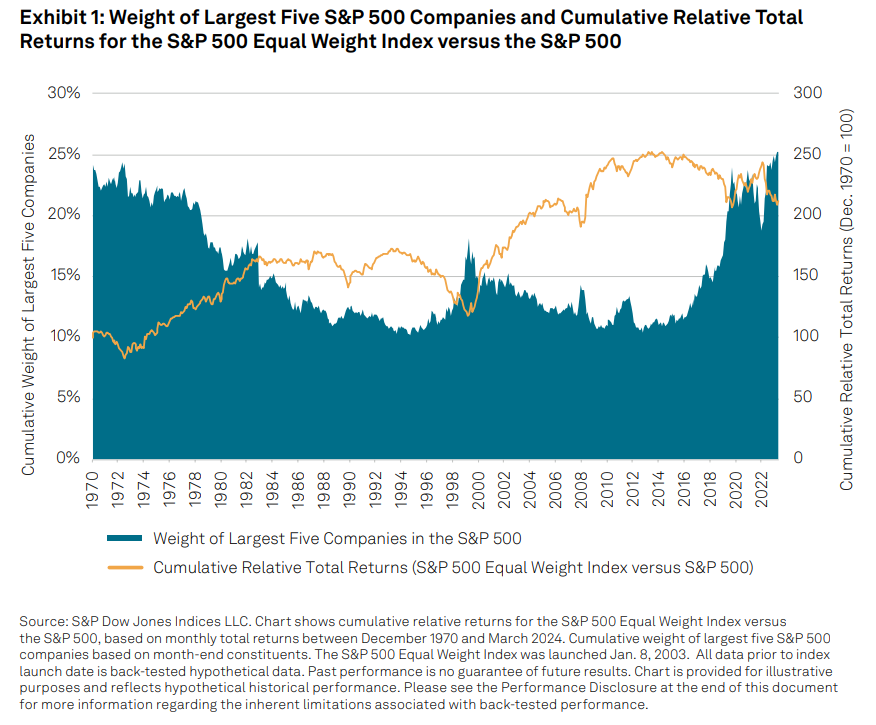

A notable trend in U.S. equities over the past year has been the outperformance of some of the largest companies as investors expressed their views on the potential impact of artificial intelligence on companies’ growth prospects. Against this backdrop, the representation of mega-cap companies in the S&P 500 reached multi-decade highs: the cumulative weight of the largest five companies in the S&P 500 was 25.3% at the end of March 2024—a level that has not been seen since December 1970.

Although elevated stock-level concentration demonstrates that the S&P 500 continues to meet its stated objective of measuring the performance of large-cap U.S. equities, many investors have turned to an equal weight approach to reduce exposure to the largest names and to express views on mean reversion in equity market concentrations.

The relevance of the S&P 500 Equal Weight Index in these considerations comes from its smaller size exposure: assigning egalitarian allocations to the S&P 500’s component companies on a quarterly basis means that the equal weight index has less weight in the largest names. This methodology helped to explain most of the S&P 500 Equal Weight Index’s relative performance versus the S&P 500 over the past year, and it provides a tangible link between changes in market concentration and the equal weight index’s relative returns.

Typically, when the largest companies (to which equal weight has less sensitivity) outperformed, concentration rose, and equal weight underperformed its cap-weighted benchmark. Conversely, outperformance among smaller companies (to which equal weight has greater exposure) led to reduced concentration and greater likelihood of equal weight outperformance.