Motivated by the continuing need for transparency in how sustainability and climate-related objectives are incorporated into the index construction process, S&P Dow Jones Indices (S&P DJI) has developed and deployed its own glass-box optimization method across a wide range of sustainability-focused indices. The approach aims to provide risk-efficient solutions with targeted outcomes while improving the interpretability and explainability of the selection and weighting of constituents. This is achieved by ensuring the sustainability-related data is the key driver for each company’s relative weight change to the underlying index. The end result is a clearer relationship between each company’s resultant weight in the index and its sustainability characteristics.

1. How does S&P DJI's glass-box optimization work?

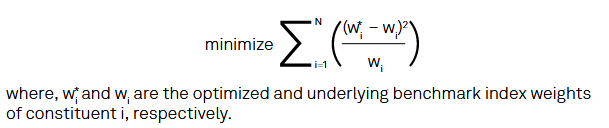

In its simplest form, the glass-box optimization method minimizes active share, subject to the condition of proportional redistribution. It does this by minimizing the sum of the squared differences in constituent weights between those in the underlying benchmark, divided by each company’s weight in the benchmark.

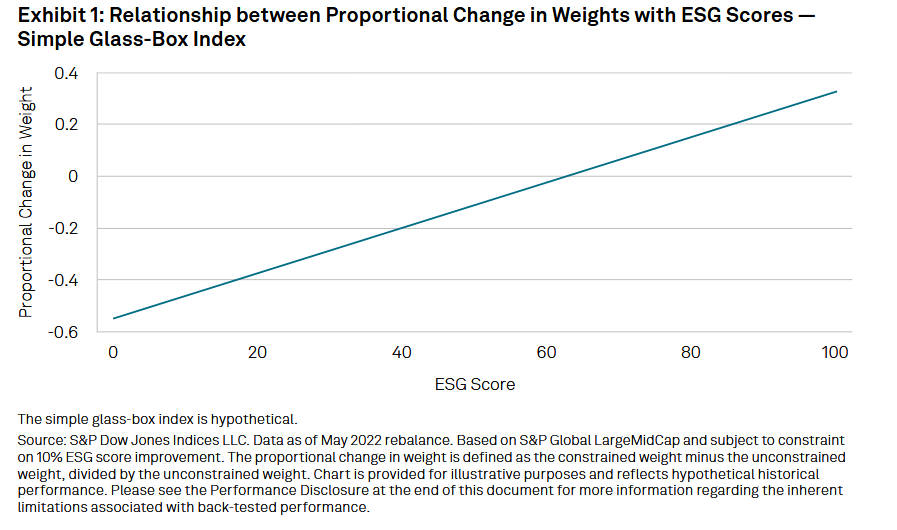

In practice, when combined with a single constraint to improve an index-level sustainability metric (e.g., ESG scores) to a predefined target, we observe that the relationship between the proportional changes in each company’s weight and the sustainability metric is perfectly correlated. In other words, only the sustainability data is driving the constituent weight changes—and so they are completely explainable.

2. Why do proportional weight changes matter?

S&P DJI’s glass-box optimization process ensures weight changes are related to the company’s underlying benchmark weight. For instance, two equally sustainable constituents—one large, one small—will be fairly rewarded within the simple glass-box-optimized index highlighted above. For example, both may increase proportionally by 1.2 times, rather than both receiving an additional two percentage points in index weight absolutely. The added benefit is that since the final index baskets are anchored to the weights of the float-adjusted market-capitalization-weighted benchmark, they may naturally inherit much of its enhanced liquidity and lower turnover.