The S&P China Tech 50 Index highlights a unique and innovative set of high-tech companies across multiple sectors in the Chinese market.

1. Why was the S&P China Tech 50 Index introduced?

As China continues its transformation toward "new economy" sectors, technology plays an increasingly important role in the nation's economic and equity market composition. The S&P China Tech 50 Index is unique in that it is based on a transparent, well-established industry classification system (GICS®), and spans multiple industries in order to effectively capture the tech segment. Additionally, it prioritizes liquidity and capacity by limiting constituent count to 50 large, liquid companies.

2. How does the index work?

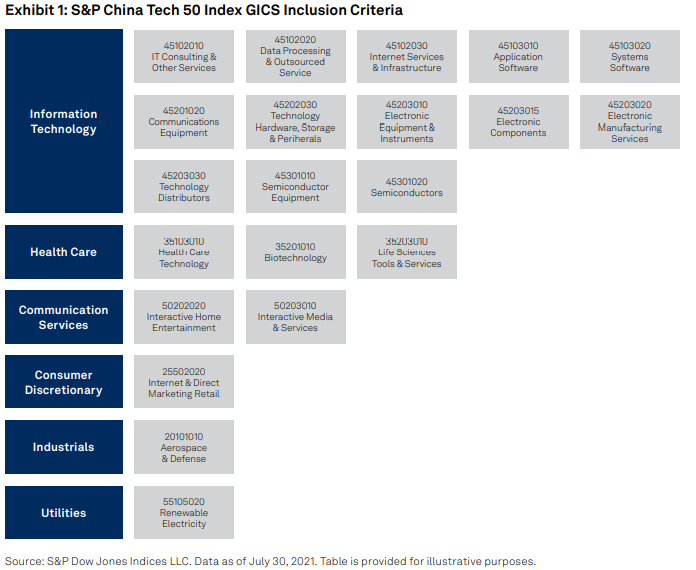

The S&P China Tech 50 Index uses a simple, rules-based process to select 50 of the largest and most liquid Chinese technology companies. The eligible universe includes all Chinese companies meeting minimum float-adjusted market cap and liquidity thresholds that are accessible via Stock Connect or trade on a foreign exchange. All companies meeting these requirements and classified under the GICS groupings in Exhibit 1 are eligible for inclusion.

The 50 largest companies (measured by total market cap) are selected and the index is weighted by float-adjusted market cap, subject to a 10% single stock cap. The index is rebalanced semiannually in March and September.